Synopsys (NasdaqGS:SNPS) Updates 2025 Guidance Despite Q1 Revenue Dip to US$1,455M and Earnings Drop to US$296M

Synopsys, Inc. SNPS | 0.00 |

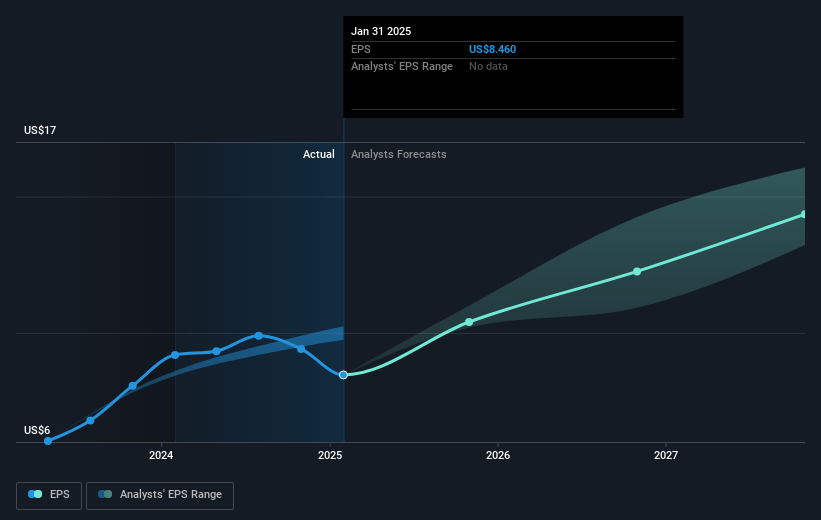

Synopsys (NasdaqGS:SNPS) recently announced a decline in both revenue and net income for the first quarter of 2025, with earnings per share reduced compared to the previous year. Simultaneously, the company issued upbeat guidance for the upcoming quarter and fiscal year. Despite this optimism, the stock experienced a 6% decline over the past week. This price movement may reflect investor reactions to the mixed earnings results against the backdrop of broader market conditions. During this period, major U.S. stock indexes exhibited mixed performance, influenced by tariff news and Nvidia's earnings. The Dow Jones rose, while the Nasdaq Composite fell, impacting tech stocks. The declining performance of chip stocks, which included other semiconductor companies in addition to Nvidia, likely had a ripple effect. With the market dropping 3.6% over the week, Synopsys' performance aligns with tech sector trends, marked by investor caution amid economic uncertainties.

While Synopsys shares have recently experienced a dip, the past five years have shown a very large total return of 220.43%. This robust performance reflects notable milestones that the company achieved in that time. The launch of innovations like the DSO.ai™ chip design application and the RTL Architect™ significantly enhanced design processes, marking important steps in product evolution. Additionally, strategic collaborations were formed, such as the partnership with SiFive, Inc. for cloud-based SoC designs in 2020, underlining Synopsys' strong industry alignment.

More recently, Synopsys has focused on expanding its product offerings with technologies like the Ultra Ethernet IP, emphasizing their growth trajectory. Financially, the company's share buyback in December 2024, repurchasing 4.14% of its shares, reflects a commitment to creating value for shareholders. Despite underperforming the US market and the software industry over the past year, the company's sustained advancements continue to play a critical role in its longer-term success.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Recommend

- Sahm Platform 03/11 08:27

Insights Ahead: Shopify's Quarterly Earnings

Benzinga News 03/11 14:01Profits Soar, Jobs Vanish: How AI Created A Tale Of Two Economies

Benzinga News 03/11 14:11JP Morgan Downgrades Jamf Holding to Neutral, Raises Price Target to $13

Benzinga News 03/11 18:53Palantir CEO Alex Karp Says We Are Every Day Making This Company Better For This Nation And Allied Countries

Benzinga News 03/11 22:47NCR Atleos And Kuwait Finance House Introduce Conversational AI Avatar To Revolutionize Customer Interactions

Benzinga News 04/11 06:47Shopify Sees Q4 Sales $3.515B-$3.599B vs $3.471B Est

Benzinga News 04/11 12:10CleanSpark Mines 612 Bitcoin In October 2025, Reaches 50 EH/s Operational Hashrate And Holds 13,033 BTC

Benzinga News 04/11 13:38