Please use a PC Browser to access Register-Tadawul

T-Mobile US (NasdaqGS:TMUS) Powers NYMobile's 5G MVNO With Exclusive Number Customization

T-Mobile TMUS | 195.16 | -0.09% |

T-Mobile US (NasdaqGS:TMUS) recently experienced a 9.53% rise in its share price over the last quarter, a notable uptick potentially influenced by several key developments. A significant announcement was the multi-year agreement with New York Mobile, which leverages T-Mobile's 5G infrastructure to introduce a premium MVNO service. This emphasizes customer identity and customizability, setting a strong market position. Additionally, T-Mobile's technological advancements, such as the debut of an automated ball-strike system during MLB spring training games using its private 5G network, highlight its innovative edge. The company's robust financial performance, marked by increased revenue and net income, further bolstered investor confidence. In a broader context, technology stocks saw a rally prompted by recent inflation data, which might have indirectly supported T-Mobile's positive momentum. Meanwhile, the overall market has eased by 3.7% in the past week, contrasting with the company's upward trajectory during this period.

Over the past five years, T-Mobile US has achieved a total shareholder return of 235.61%, a substantial increase. Key factors influencing this growth include the company’s strategic focus on expanding its 5G network capabilities and innovative partnerships. Notably, in March 2021, T-Mobile invested over US$9.3 billion in the FCC's C-Band auction, enhancing mid-band spectrum for superior 5G service. This move aligned with their reputation for robust infrastructure development.

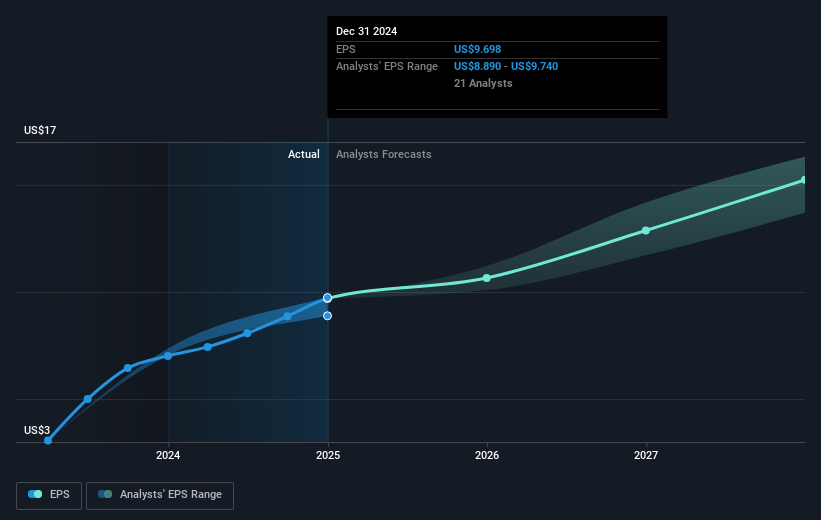

Additionally, T-Mobile's focus on shareholder value is underscored by consistent dividend payouts, such as the recent dividend of US$0.88 per share declared in March 2025. Another critical development was T-Mobile's addition to the S&P 100 index in March 2021, reflecting broad market confidence. Despite a high Price-To-Earnings Ratio, T-Mobile has maintained accelerated earnings growth, exceeding industry rates, contributing to its long-term rise. This financial performance contrasts with the company's underperformance relative to the Wireless Telecom industry over the past year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.