Please use a PC Browser to access Register-Tadawul

Take Care Before Jumping Onto First Advantage Corporation (NASDAQ:FA) Even Though It's 28% Cheaper

First Advantage Corp. FA | 9.49 | -9.62% |

First Advantage Corporation (NASDAQ:FA) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 43% in that time.

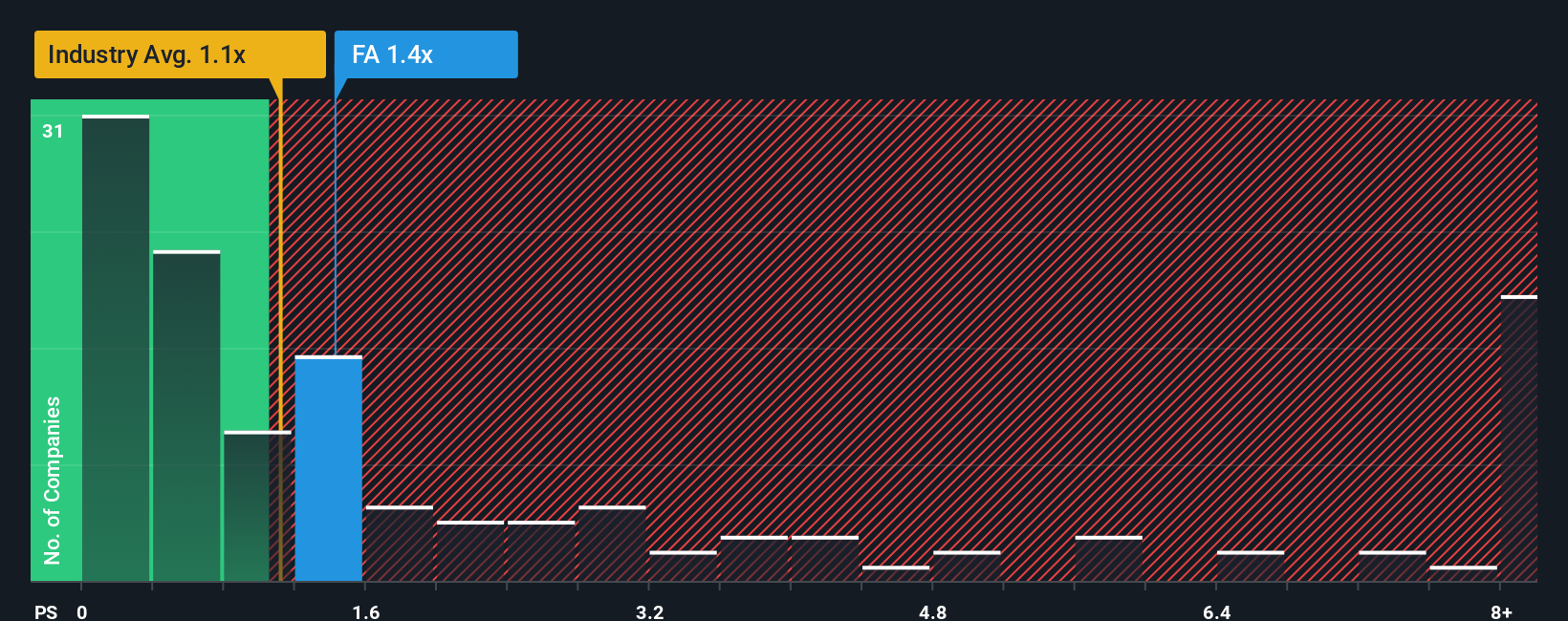

In spite of the heavy fall in price, there still wouldn't be many who think First Advantage's price-to-sales (or "P/S") ratio of 1.3x is worth a mention when the median P/S in the United States' Professional Services industry is similar at about 1.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

What Does First Advantage's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, First Advantage has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on First Advantage will help you uncover what's on the horizon.How Is First Advantage's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like First Advantage's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 93% last year. The latest three year period has also seen an excellent 80% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 9.8% as estimated by the nine analysts watching the company. That's shaping up to be materially higher than the 6.6% growth forecast for the broader industry.

With this information, we find it interesting that First Advantage is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does First Advantage's P/S Mean For Investors?

Following First Advantage's share price tumble, its P/S is just clinging on to the industry median P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite enticing revenue growth figures that outpace the industry, First Advantage's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for First Advantage with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on First Advantage, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.