Please use a PC Browser to access Register-Tadawul

Talen Energy (TLN) Valuation in Focus After S&P Index Inclusion and BofA's Upgraded Analysis

Talen Energy Corp TLN | 345.00 | +6.27% |

Here's something that tends to put every investor on alert: Talen Energy (TLN) just secured a spot in the S&P 400 and the S&P Composite 1500, a milestone that routinely sparks new interest from funds and institutions. Events like these aren’t just ceremonial; they have the potential to shift the flow of money toward a company. Adding to this, BofA Securities reaffirmed its positive outlook on Talen and switched to a discounted cash flow valuation in response to recent developments, making it clear why this story is attracting attention.

This combination of index inclusion and analyst optimism has been significant. Over the past year, Talen Energy’s stock more than doubled, suggesting that momentum has been notably strong and could be gaining further. This appears to be more than a short-term trend, as the past three months alone showed a surge of over 56%. At the same time, recent news about sector headwinds and growth in U.S. electrification highlights the disruptive changes occurring within clean energy stocks.

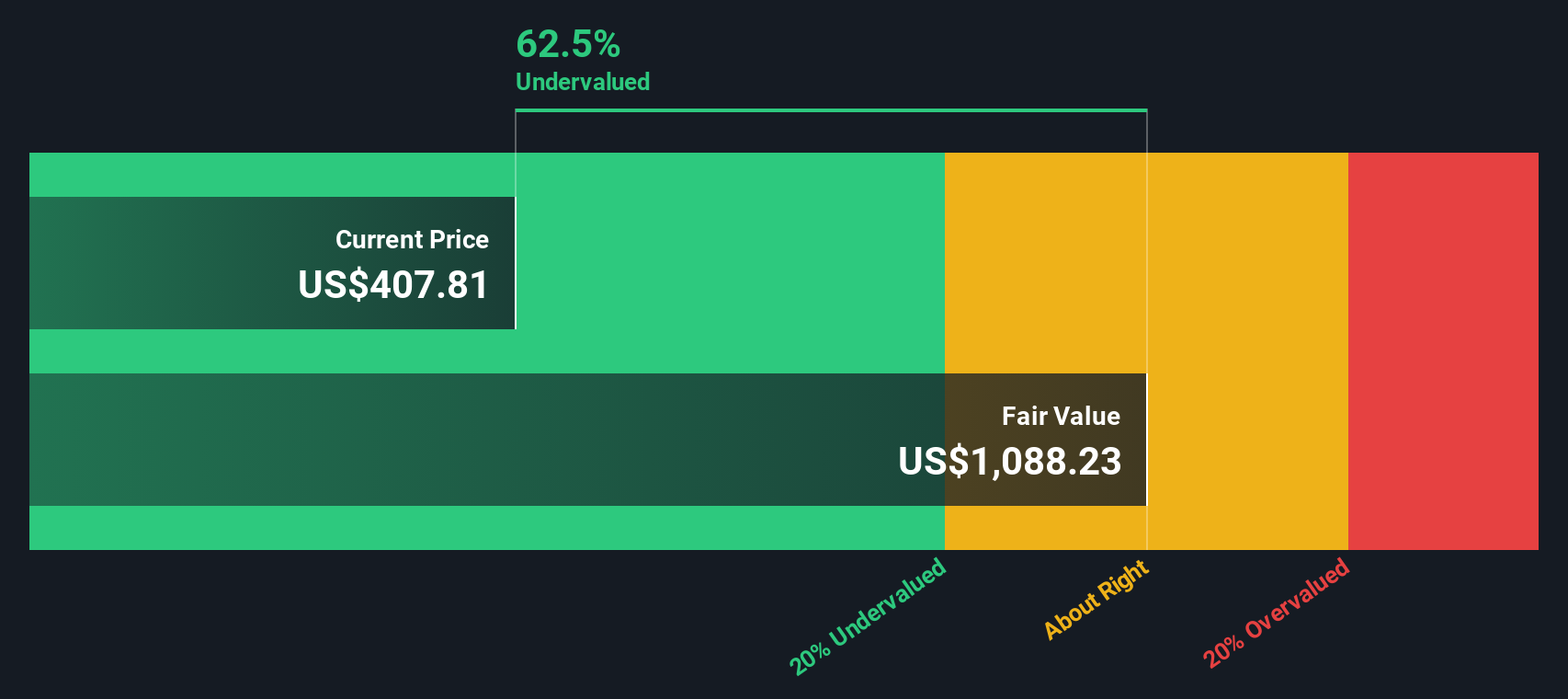

After all this action, the question remains: is Talen Energy still trading at a discount, or has the market already priced in the next wave of growth?

Most Popular Narrative: 4.3% Undervalued

According to community narrative, Talen Energy is seen as trading just below its fair value. Analysts are factoring in robust future earnings and stable, long-term cash flows as key drivers of this assessment. The margin for upside is modest, but the blend of catalysts and projections keeps valuation discussions lively.

"Rapidly growing U.S. electricity demand, particularly from data centers and AI-driven digital infrastructure, is tightening power markets in Talen's core regions. This is leading to higher forward spark spreads, improved capacity pricing, and long-term tailwinds for wholesale power revenues and EBITDA."

Curious about what’s fueling this near-fair value price call? There is a bold earnings growth story here, built on ambitious assumptions and expectations around profit margins, revenue growth, and industry transformation. Want to discover which financial leaps and market shifts are embedded in this outlook? You’ll need to dig into the full narrative to see what justifies these forward-looking numbers.

Result: Fair Value of $398.66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, including Talen’s reliance on fossil fuels and significant debt. Both factors could threaten long-term growth and margins if conditions change.

Find out about the key risks to this Talen Energy narrative.Another View: SWS DCF Model Says There’s More to the Story

Looking from another angle, our DCF model paints a much more bullish picture for Talen Energy. This suggests the market may be missing significant underlying value. Why do the two methods disagree, and what does it mean?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Talen Energy Narrative

If you’re interested in digging deeper or think the current forecasts don’t tell the full story, you can easily develop your own in just a few minutes. Do it your way.

A great starting point for your Talen Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Position yourself ahead of the curve by searching beyond the usual tickers. The Simply Wall Street Screener uncovers stocks handpicked for standout financials, exciting innovations, and future potential. Don’t miss your chance to target new growth. Explore these themes now before others catch on:

- Uncover strong up-and-comers with penny stocks boasting robust financials using the penny stocks with strong financials.

- Capture tomorrow’s winners by spotting undervalued gems based on cash flows through our undervalued stocks based on cash flows.

- Ride the next wave of medical innovation by targeting advancements in AI healthcare with the healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.