Please use a PC Browser to access Register-Tadawul

Tariffs, Trump, Tumult: How To Trade This Volatility ($VIX) Surge

ALBILAD GOLD ETF 9405.SA | 21.95 | -0.09% |

iShares MSCI Min Vol USA ETF USMV | 94.63 | -0.02% |

S&P 500 Low Volatility Powershares SPLV | 71.60 | +0.59% |

Short S&P 500 Proshares SH | 36.53 | +1.14% |

Proshares Trust Ii Ultra Vix Sht Trm Futr Etf 2017(Post Spt UVXY | 42.28 | +0.17% |

The stock market just got a fresh jolt of turbulence, and traders are buckling up for more. Monday's rollercoaster session saw the S&P 500 index wipe out a staggering $1.5 trillion in value as trade war fears reignited.

ETFs tracking the index closed lower: the SPDR S&P 500 ETF (NYSE:SPY) closed lower by 1.75% while the Vanguard S&P 500 ETF (NYSE:VOO) and the iShares Core S&P 500 ETF (NYSE:IVV) were down 1.72% on Monday close.

Related: Markets Tank After Trump Confirms More Tariffs: Here’s What Wall Street Is Saying

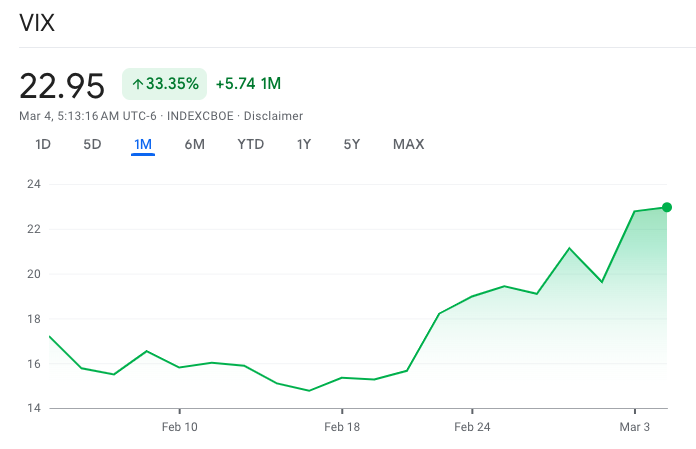

With tariffs on Canada, Mexico and China ramping up, volatility is officially back in business. The VIX has surged over 33% over the past month:

Chart source: Google Finance

But for investors, chaos breeds opportunity – if you know how to play it.

1. The VIX Is Screaming – Use It

The Cboe Volatility Index ($VIX) is Wall Street's fear gauge, and when it spikes, traders take notice. With uncertainty surging, options-based strategies become lucrative.

Investors can hedge against further market swings with the ProShares Ultra VIX Short-Term Futures ETF (BATS:UVXY) or the iPath Series B S&P 500 VIX Short-Term Futures ETN (BATS:VXX).

But beware—these are short-term tools, not long-term holds.

2. Play Defense With Broad Market ETFs

When markets get rocky, smart money often rotates into low-volatility and defensive plays.

The Invesco S&P 500 Low Volatility ETF (NYSE:SPLV) offers exposure to less turbulent stocks, while the iShares MSCI USA Minimum Volatility ETF (BATS:USMV) helps cushion the downside.

For those who expect more fireworks but want to stay long equities, the SPY remains a solid way to ride out the storm.

3. Don't Fight The Tape – Trade Trends

With uncertainty swirling, trend-following strategies gain an edge. Investors looking for short-term gains might consider the ProShares Short S&P 500 ETF (NYSE:SH) for bearish exposure or the ProShares UltraPro Short S&P 500 ETF (NYSE:SPXU) for amplified downside bets.

Meanwhile, gold, often a safe-haven asset, is seeing renewed interest through ETFs like SPDR Gold Shares (NYSE:GLD).

With Trump hinting at more "big" announcements by Wednesday night, expect the volatility train to keep rolling. The question isn't whether markets will move – it's whether you're ready to trade the storm.

Read Next:

- Leon Cooperman Says He Likes Cash, Calls Trump’s Deficit Cutting ‘Contractionary’

Image via Shutterstock