Please use a PC Browser to access Register-Tadawul

TaskUs (TASK): Is the Stock Undervalued Based on Recent Valuation Signals?

TaskUs, Inc. TASK | 12.22 | -2.32% |

TaskUs (TASK) shares have seen some movement lately, prompting investors to reassess the company’s recent performance in the context of ongoing shifts in the outsourcing and business services sector. The stock’s price action warrants a closer look at its fundamentals.

TaskUs has seen a shift in momentum lately, with a 4.6% share price gain over the past week helping offset recent declines. However, the stock still sits well below levels from a month ago. The overall picture remains mixed. The one-year total shareholder return of 17.2% hints at underlying strength, even as longer-term holders are yet to recover past losses.

If you’re interested in discovering what other fast-moving opportunities might be out there, now’s a great time to check out fast growing stocks with high insider ownership.

With mixed returns and analysts still seeing upside ahead, is TaskUs trading at a bargain worth grabbing? Or has the market already factored in all of the company’s future growth?

Most Popular Narrative: 16% Undervalued

With TaskUs’s fair value set at $16.63 by the most popular narrative, the last close of $13.96 looks like a discount that could catch investors’ attention. Something in TaskUs’s outlook has led market-watchers to assign a price target notably above today’s market valuation.

TaskUs is investing heavily in AI services and technologies, including Agentic AI and generative AI services. These investments are anticipated to drive record-breaking revenue growth in 2025. AI services are expected to become the fastest-growing service line, which could enhance overall revenue.

Curious about what powers this optimistic valuation? The real intrigue lies in the narrative’s bold forecasts and the ambitious assumptions about TaskUs’s ability to outpace rivals. Want to see what specific financial leaps and growth drivers are behind this premium fair value? Dig in to uncover the surprising projections that set the bar for TaskUs’s future.

Result: Fair Value of $16.63 (UNDERVALUED)

However, ongoing pressure on net margins from higher operating costs and reliance on a major client could significantly alter TaskUs’s growth trajectory.

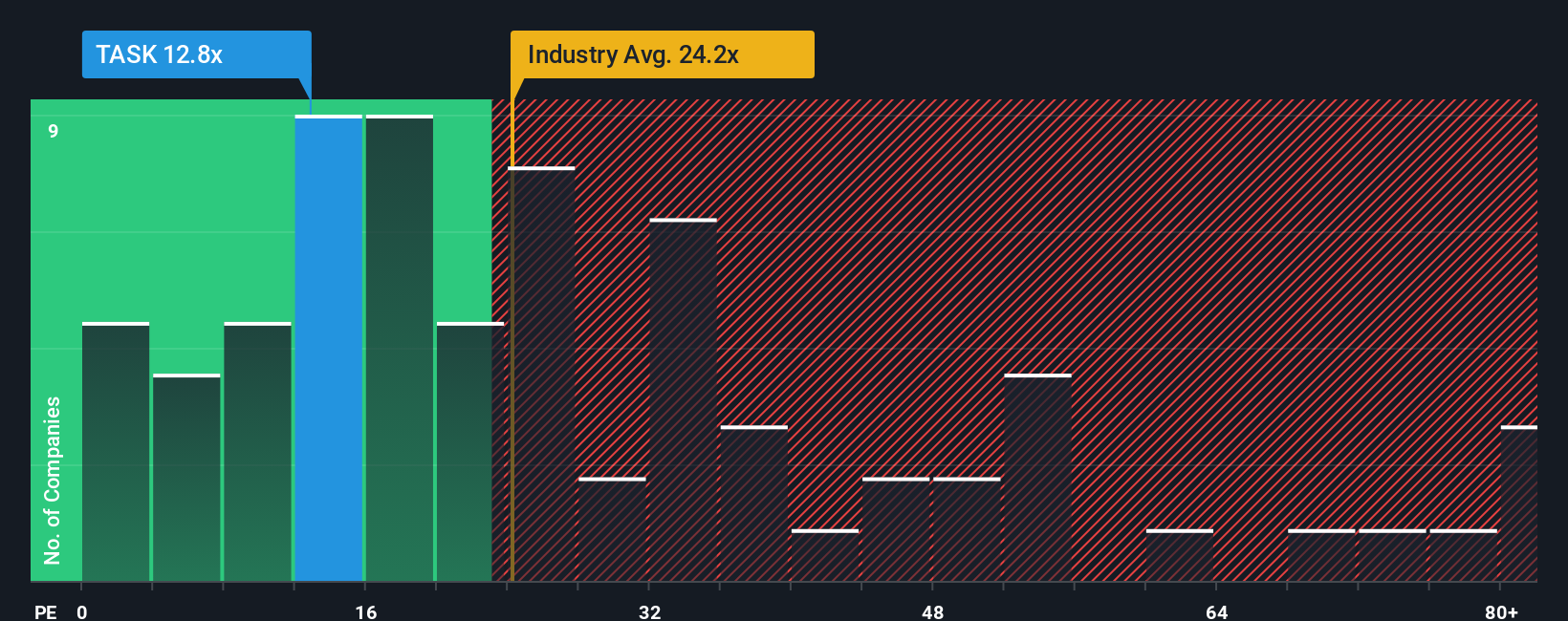

Another View: Price Ratios Point to Good Value

Taking a fresh look using price-to-earnings ratios, TaskUs trades at 20 times earnings. This is not only below the sector average of 25.9 times, but also compares favorably to peers at 36.6 times and sits beneath the fair ratio of 28.5 times. That gap could signal a value opportunity, unless the market is pricing in real risks others are ignoring. So, what might tip the balance?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TaskUs for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TaskUs Narrative

If you see the story unfolding differently or want to dig deeper into the numbers yourself, you can craft your own perspective in just a few minutes, and Do it your way.

A great starting point for your TaskUs research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t settle for ordinary returns. Expand your portfolio with proven opportunities using the Simply Wall Street Screener. Ambitious investors seize advantages that others overlook every day.

- Unlock passive income streams when you start tracking these 17 dividend stocks with yields > 3% offering above-average yields in today’s challenging rate environment.

- Fuel your growth ambitions by targeting companies capitalizing on artificial intelligence revolutions. See which businesses are propelling gains with these 27 AI penny stocks now.

- Supercharge your value hunt by tapping into these 875 undervalued stocks based on cash flows built on strong cash flows and fundamentals just waiting to be recognized by the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.