Please use a PC Browser to access Register-Tadawul

Tenet Healthcare (THC): Evaluating Valuation After Segment Consolidation and Upbeat Analyst Coverage

Tenet Healthcare Corporation THC | 199.19 | -0.21% |

Tenet Healthcare (THC) has been grabbing the spotlight lately, thanks to some strategic moves and upbeat analyst commentary. The company recently announced it is consolidating its Conifer segment with its Hospital segment, a shift aimed at streamlining operations and providing clearer reporting. In addition, positive sentiment from maintained earnings estimates and strong earnings growth expectations is drawing investor curiosity as new coverage continues to highlight Tenet's evolving story.

This wave of interest builds on a stretch of strong performance for Tenet Healthcare. Over the past year, shares have surged 24 percent, with momentum accelerating to a 16 percent gain in the past three months and an over 61 percent advance since the start of the year. Recurring mentions in analyst blogs and news roundups, as well as the company's moves to tighten its operational focus, have investors weighing both short-term surges and the bigger valuation picture.

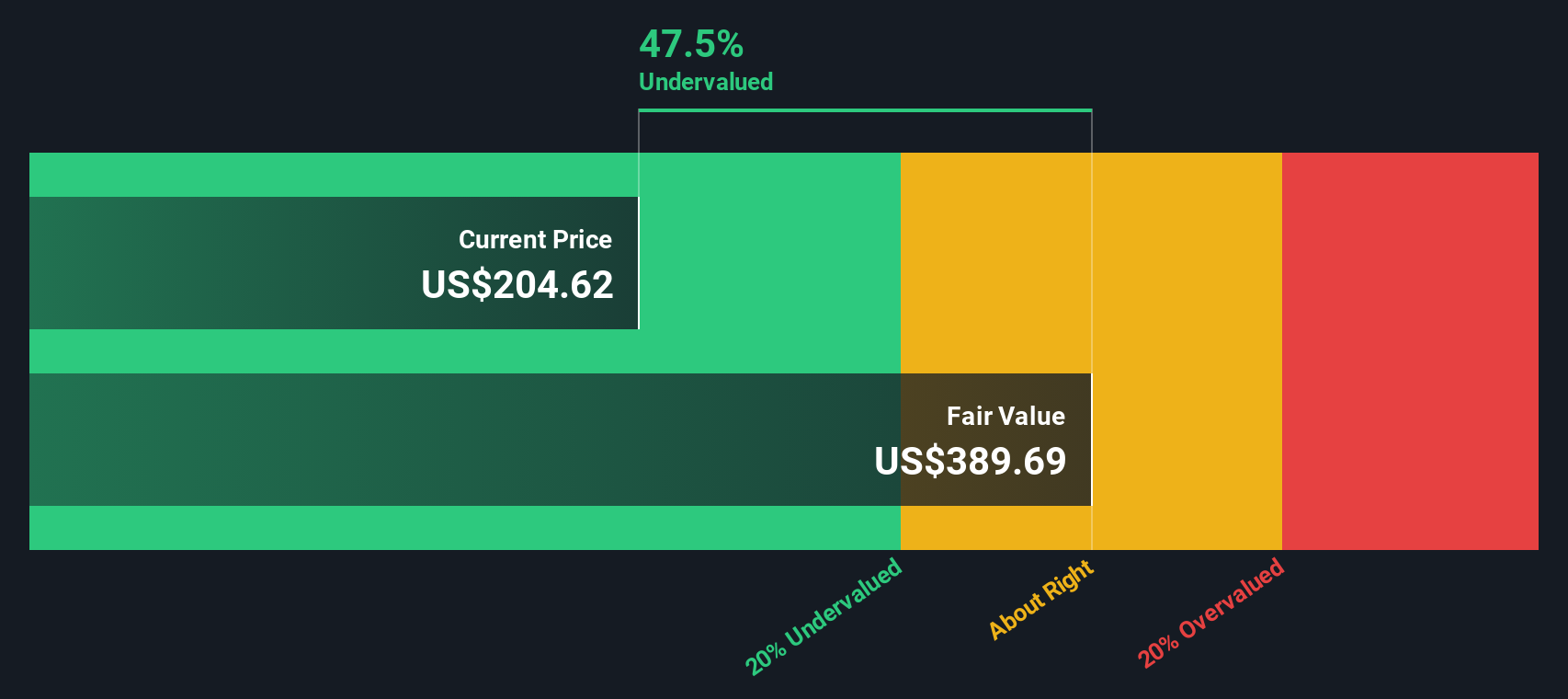

The question remains, with the company trading at a discount compared to peers and optimism about future cash flows, is Tenet Healthcare a bargain or is the market already factoring in all the good news?

Most Popular Narrative: Fairly Valued

The most widely followed narrative suggests Tenet Healthcare is trading right around its estimated fair value, with analysts agreeing the current price is in line with fundamental expectations.

"Strong free cash flow generation, driven by portfolio optimization (divestiture of underperforming assets), reduced debt leverage, and disciplined capital deployment (including share repurchases and strategic M&A), increases financial flexibility to invest in future growth initiatives, directly benefiting earnings per share and long-term shareholder value."

Curious about the math behind this valuation? The narrative is built on bold growth assumptions, shifting margins, and a future profit multiple that could surprise even the most seasoned investors. Wondering what revenue and earnings projections are powering this view, or what big bets analysts are making on Tenet's financial future? The answers are deeper in the full narrative. Uncover the figures driving the consensus fair value.

Result: Fair Value of $199.48 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, potential cuts to healthcare subsidies and pressure on hospital admissions could quickly challenge the current outlook and valuation for Tenet Healthcare.

Find out about the key risks to this Tenet Healthcare narrative.Another View: What Does Our DCF Model Say?

Looking at Tenet Healthcare through our SWS DCF model shows a very different picture. It suggests the company may be undervalued compared to the result from market-based multiples. Could the market be missing something, or is the DCF too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Tenet Healthcare Narrative

If you see the story differently or want to dive deeper into the numbers yourself, you can shape your own narrative in just a few minutes. Do it your way

A great starting point for your Tenet Healthcare research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investing Ideas?

Don’t settle for just one opportunity. Broaden your potential by acting now. You could catch tomorrow’s best stocks before the crowd even notices.

- Uncover emerging companies shaking up the tech world with innovative solutions by checking out penny stocks with strong financials.

- Tap into the explosive promise of artificial intelligence as breakthroughs redefine healthcare and more through healthcare AI stocks.

- Capture high-yield opportunities with strong income histories at your fingertips by starting your search at dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.