Please use a PC Browser to access Register-Tadawul

Teradata (TDC): Evaluating Valuation Following Launch of AgentBuilder AI Suite

Teradata Corporation TDC | 31.30 | -1.60% |

Teradata (TDC) just made waves with the launch of AgentBuilder, a new suite designed to help organizations move from tinkering with AI agents to actually putting them to work at scale. For anyone following the company, this product could be a meaningful move. It brings together open-source innovations, context-driven analytics, and ready-made agents for real business use. These features may appeal to both existing and new customers thinking about how AI fits into their day-to-day operations.

Following this announcement, investors have taken notice. While Teradata’s shares have seen a modest lift of 1% over the past week and roughly 5% in the past month, the longer-term view is more sobering. The stock is still down nearly 28% for the year. That means momentum could be shifting, or it might just be a temporary pop after an extended slide. Still, efforts like AgentBuilder show the company is responding to a changing market with tangible updates.

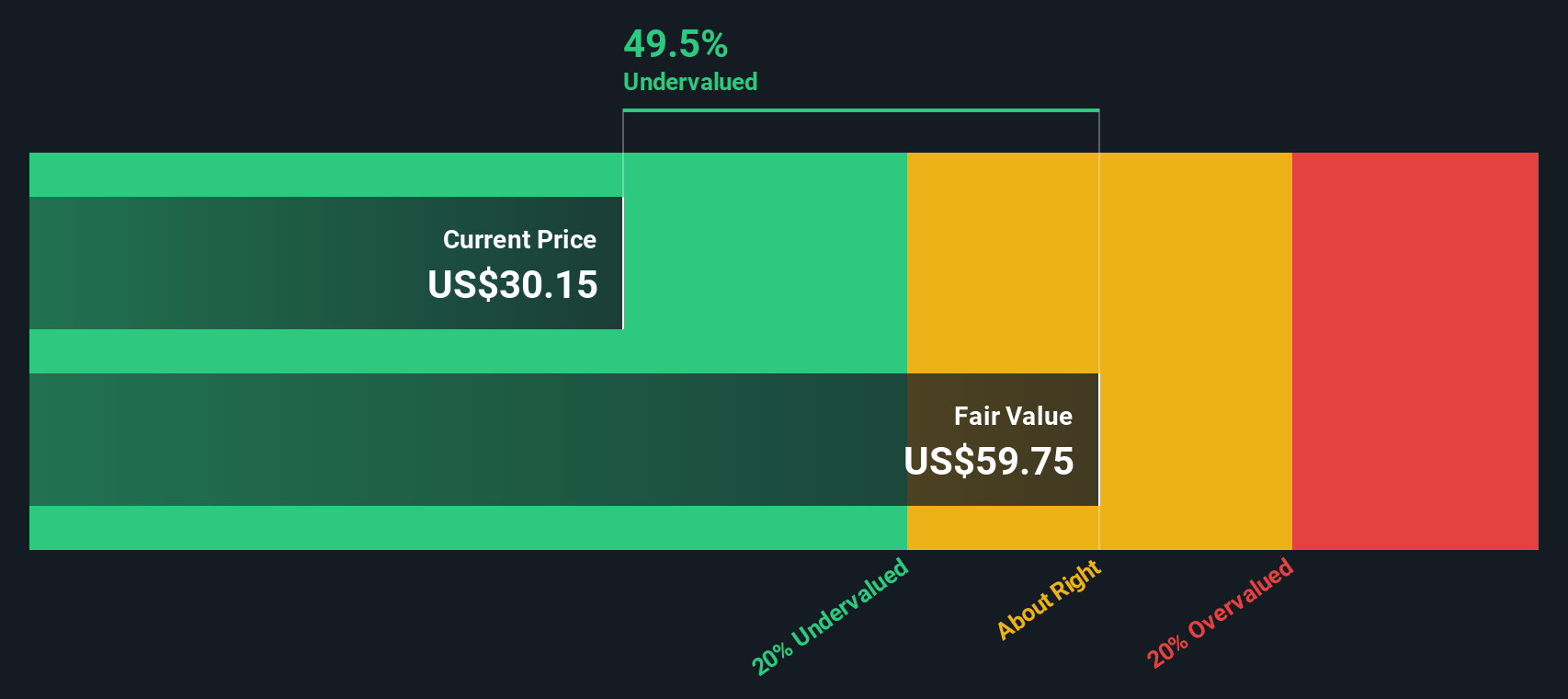

So after a year marked by big swings and today’s AI reveal, is Teradata suddenly undervalued, or did markets already price in this next wave of growth?

Most Popular Narrative: 9.2% Undervalued

According to the most widely followed narrative, Teradata appears undervalued by just over 9% based on forward-looking expectations for its business fundamentals.

The accelerating adoption of AI and GenAI initiatives among large enterprises is driving a surge in demand for robust data management and analytics infrastructure. This is positioning Teradata's hybrid platform to capture new, high-value workloads and to support sustained recurring revenue growth and platform usage.

What is really fueling this bullish outlook? The narrative is built on bold projections involving future earnings power, margins, and share count, all pointing to a valuation above today’s price. Want to see how a mix of margin shifts, industry trends, and a sizable jump in future profitability add up to this target? The quantitative drivers behind that fair value could change your perspective on Teradata’s next chapter.

Result: Fair Value of $24.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing revenue headwinds and heightened competition from cloud-native providers could quickly challenge the current optimism surrounding Teradata’s valuation outlook.

Find out about the key risks to this Teradata narrative.Another View: Discounted Cash Flow Model

While the most-watched narrative points to undervaluation based on future company earnings, our DCF model presents a similar picture from a completely different perspective, suggesting shares could be significantly undervalued. But is that enough to change the story?

Build Your Own Teradata Narrative

If you see things differently or want a hands-on look at the numbers, you can quickly shape your own narrative in just a few minutes. Do it your way

A great starting point for your Teradata research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

You could be one smart move away from spotting your next winning stock. Don’t let the market’s best opportunities pass you by. See what’s gaining real momentum today:

- Uncover the potential of small, fast-growth companies shaking up the market by checking out our penny stocks with strong financials: penny stocks with strong financials.

- Capitalize on the rise of artificial intelligence by targeting tomorrow’s industry leaders with our selection of top AI penny stocks: AI penny stocks.

- Take advantage of companies that may be trading below their true worth by tapping into undervalued stocks based on cash flows: undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.