Please use a PC Browser to access Register-Tadawul

Teradata (TDC) Valuation Check As New CISO Hire Supports Cloud And AI Security Expansion

Teradata Corporation TDC | 30.91 | -3.77% |

Why Teradata’s New CISO Matters for Stock Watchers

Teradata (TDC) has appointed Ken Ricketts as Senior Vice President and Chief Information Security Officer, placing a seasoned cloud and AI security leader at the center of its enterprise-wide security program.

For investors tracking how Teradata supports its data and AI platforms, this move highlights management focus on risk, compliance, and secure product development at a time when cybersecurity is a core consideration for enterprise customers.

Teradata’s latest share price of $29.91 comes after a 39.83% 90 day share price return. Its 1 year total shareholder return of a 7.03% decline contrasts with an 11.98% gain over five years, suggesting recent momentum has picked up after a weaker stretch.

If this security focused move has you thinking about where data and AI trends might go next, it could be worth scanning high growth tech and AI stocks for other potential ideas in the space.

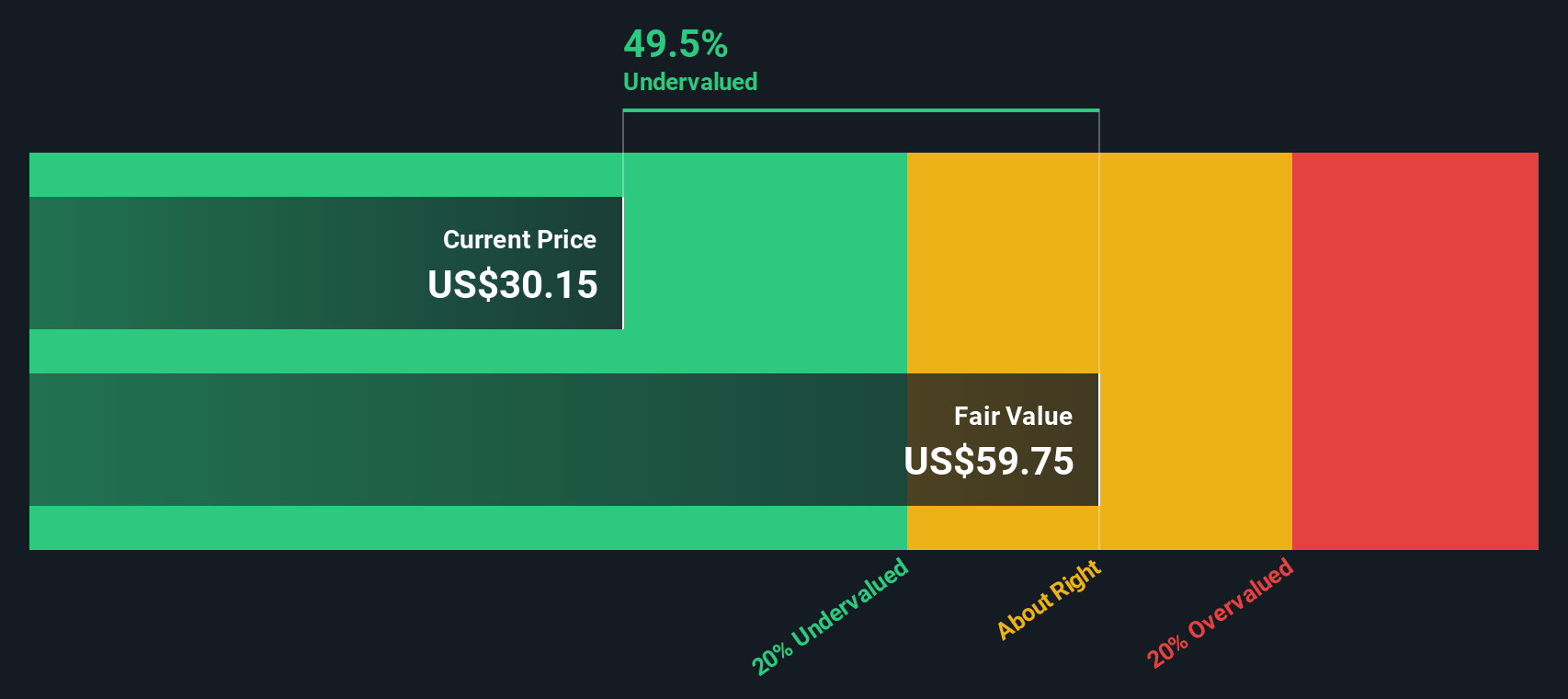

With Teradata trading at $29.91, a 39.83% 90 day share price return, and an intrinsic value estimate that suggests a sizable discount, the key question is simple: is this a fresh opportunity, or is the market already pricing in future growth?

Price-to-Earnings of 23.6x: Is it justified?

On a P/E of 23.6x against a last close of $29.91, Teradata screens as cheaper than both its peer set and the wider US software group.

The P/E ratio compares the current share price to earnings per share and is a common shorthand for what the market is willing to pay for each dollar of profit. For a data and analytics software company like Teradata, investors often watch this closely because it hints at how much future earnings are being priced in.

Here, Teradata is described as trading at good value compared to peers and the industry. Its 23.6x P/E is lower than the peer average of 25.7x and well below the US software industry average of 30.1x. It also sits under an estimated fair P/E of 26.3x. This suggests the current multiple is below a level the market could potentially move toward if sentiment and earnings expectations stay aligned with that fair ratio view.

Result: Price-to-Earnings of 23.6x (UNDERVALUED)

However, recent 1 year and 3 year total returns are in decline. Along with a discount to the current analyst price target, this shows that sentiment can still shift quickly.

Another View: What the SWS DCF Model Says

Teradata might look inexpensive on a 23.6x P/E, but our DCF model paints an even starker picture, with a future cash flow value estimate of US$80.64 versus the current US$29.91 share price. That gap suggests a very wide margin. Which signal do you trust more?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Teradata for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 881 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Teradata Narrative

If you see the data differently or prefer to test your own assumptions, you can build a full Teradata thesis yourself in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Teradata.

Looking for more investment ideas?

If Teradata has caught your attention, do not stop here, the same tools can help you spot other opportunities that might suit your style and goals.

- Target potential growth stories early by checking out these 3523 penny stocks with strong financials and see which smaller names already show solid financial footing.

- Capture the momentum in artificial intelligence by scanning these 24 AI penny stocks for companies building tools, infrastructure, or applications tied to this theme.

- Hunt for pricing gaps using these 881 undervalued stocks based on cash flows to spot businesses where cash flow estimates point to a possible discount in the current share price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.