Please use a PC Browser to access Register-Tadawul

TeraWulf Rewires From Bitcoin To AI Infrastructure As Analysts Reassess

TeraWulf Inc. WULF | 15.47 15.57 | +0.59% +0.65% Pre |

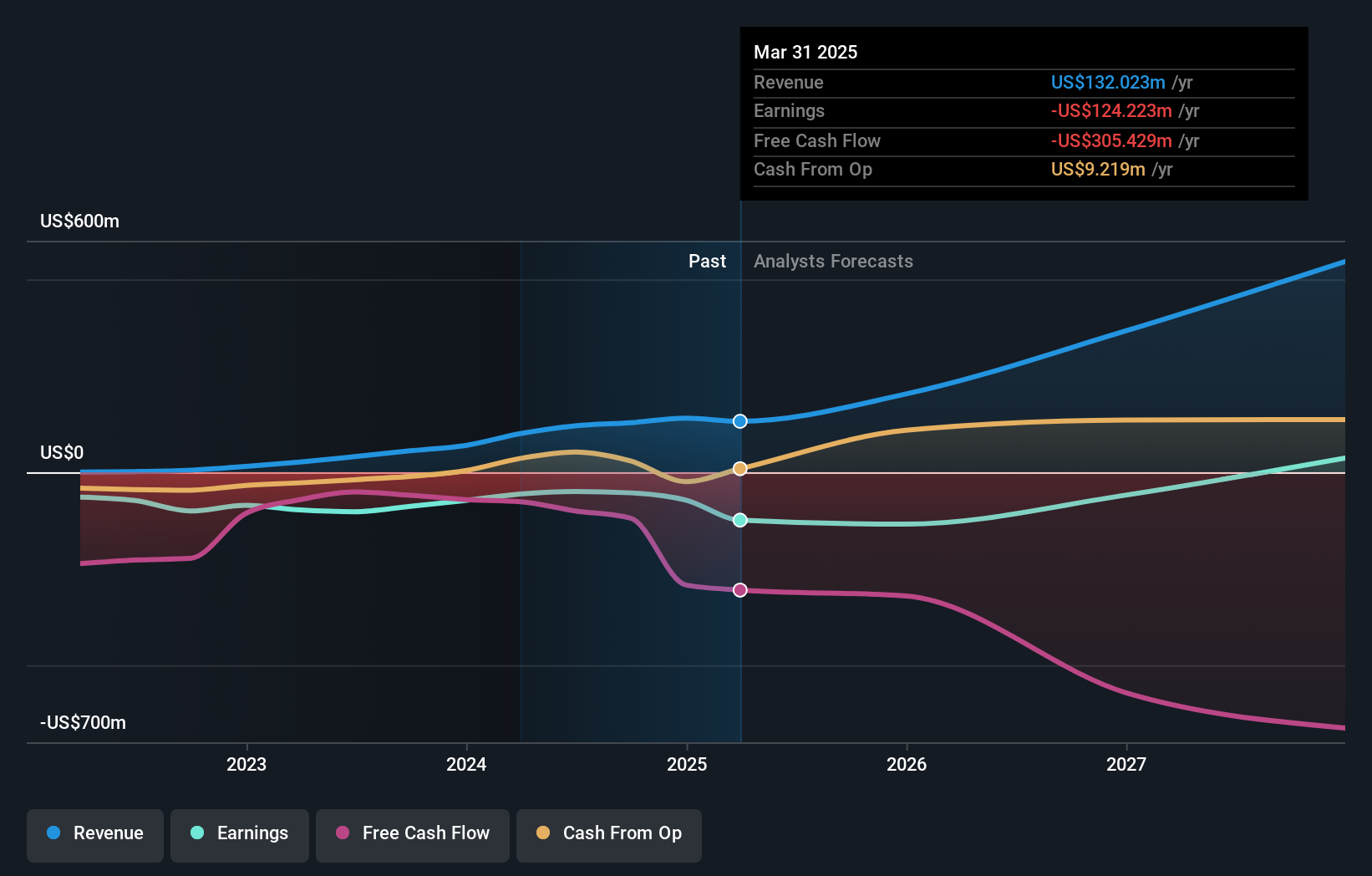

- TeraWulf (NasdaqCM:WULF) is shifting its core focus from Bitcoin mining to building AI focused infrastructure.

- The company has sold its Bitcoin holdings and is acquiring new industrial sites intended to roughly double its power capacity.

- Management has lifted earnings expectations, with several major analysts updating their views on the stock.

TeraWulf begins this transition with a share price of $16.26 and a very large 3 year return of about 25x, plus a 233.9% gain over the past year. Even over the past month the stock is up 17.4%, despite a 2.3% decline in the last week. This suggests investors have already reacted to parts of the new plan.

For you as a potential or existing shareholder, the key question is whether a move toward AI infrastructure changes how you think about TeraWulf’s risk and opportunity profile. The pivot away from holding Bitcoin and toward power heavy sites for AI workloads sets up a very different business mix. It is worth watching how execution, capital needs, and customer traction develop from here.

Stay updated on the most important news stories for TeraWulf by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on TeraWulf.

Quick Assessment

- ✅ Price vs Analyst Target: At $16.26, TeraWulf trades about 31% below the consensus analyst target of $23.56.

- ⚖️ Simply Wall St Valuation: Our DCF view is currently unknown, so you may want to treat valuation as an open question rather than a clear positive or negative.

- ✅ Recent Momentum: The 30 day return of roughly 17.4% shows investors have already reacted strongly to the AI infrastructure shift.

There is only one way to know the right time to buy, sell or hold TeraWulf. Head to Simply Wall St's company report for the latest analysis of TeraWulf's Fair Value..

Key Considerations

- 📊 The move away from Bitcoin holdings toward AI focused infrastructure changes TeraWulf from a pure crypto story into a power and data center capacity story.

- 📊 Keep an eye on how new industrial sites ramp, power capacity added versus contracted AI workloads, and any updates to earnings expectations relative to the current $16.26 price and $23.56 target.

- ⚠️ The company has less than one year of cash runway, so execution on this new plan and access to funding are crucial to watch.

Dig Deeper

For the full picture including more risks and rewards, check out the complete TeraWulf analysis. Alternatively, you can check out the community page for TeraWulf to see how other investors believe this latest news will impact the company's narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.