Please use a PC Browser to access Register-Tadawul

Tesla (NasdaqGS:TSLA) Faces Lawsuit Over Misleading Full Self-Driving Claims

Tesla Motors, Inc. TSLA | 458.96 | +2.70% |

Tesla (NasdaqGS:TSLA) experienced a 22% price increase last week, amidst significant developments both in its legal affairs and business partnerships. The personal injury lawsuit filed against the company regarding its Full Self-Driving technology raised questions about Tesla's marketing practices, potentially impacting investor perception. Simultaneously, the partnership expanding Tesla's Supercharger network access to Kia EVs could have positively influenced investor sentiment, aligning with the broader market's positive momentum of a 5% rise over the week. These diverse factors navigated Tesla's trajectory amidst a challenging market climate, partially driven by mixed economic data and broader tech sector fluctuations.

Last week's 22% surge in Tesla's stock price amid legal and partnership developments aligns with broader opportunities and challenges for the company. The legal scrutiny over Tesla's Full Self-Driving technology might outweigh short-term gains from the Kia collaboration if regulatory concerns persist, influencing investor outlook. Meanwhile, Tesla's strategic moves into autonomous vehicles and energy sectors are key to its narrative. The successful execution of these new revenue streams could mitigate potential negative impacts from legal uncertainties, supporting long-term revenue and earnings growth.

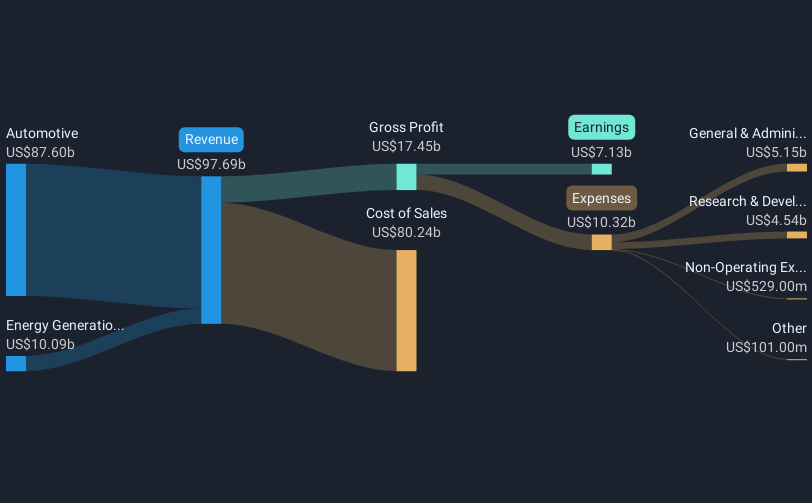

Over the past five years, Tesla's total shareholder return, including share price appreciation and dividends, has been very large at 470.22%. This performance underscores the company's ability to deliver substantial returns, contrasting with its recent one-year performance where it outpaced the US Auto industry by 45.7%. However, recent fiscal challenges evidenced by a decline in net profit margins—from 14.7% last year to the current 6.4%—highlight the market's concerns as reflected in the current share price of US$237.97, which sits 23.1% below the consensus analyst price target of US$309.49.

The announcement of the partnership with Kia could potentially enhance Tesla's revenue forecasts by increasing access to its Supercharger network, whereas the lawsuit could create headwinds if it leads to stricter regulations or reshaping marketing practices, affecting bottom-line projections. As Tesla continues to expand its capabilities in autonomous tech and energy solutions, these developments will be crucial in determining whether future earnings rise to the predicted US$13.4 billion by April 2028.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.