The 8.3% return this week takes ADMA Biologics' (NASDAQ:ADMA) shareholders three-year gains to 964%

ADMA Biologics, Inc. ADMA | 0.00 |

Generally speaking, investors are inspired to be stock pickers by the potential to find the big winners. You won't get it right every time, but when you do, the returns can be truly splendid. One such superstar is ADMA Biologics, Inc. (NASDAQ:ADMA), which saw its share price soar 964% in three years. Also pleasing for shareholders was the 17% gain in the last three months. But this could be related to the strong market, which is up 7.2% in the last three months. We love happy stories like this one. The company should be really proud of that performance!

Since the stock has added US$396m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

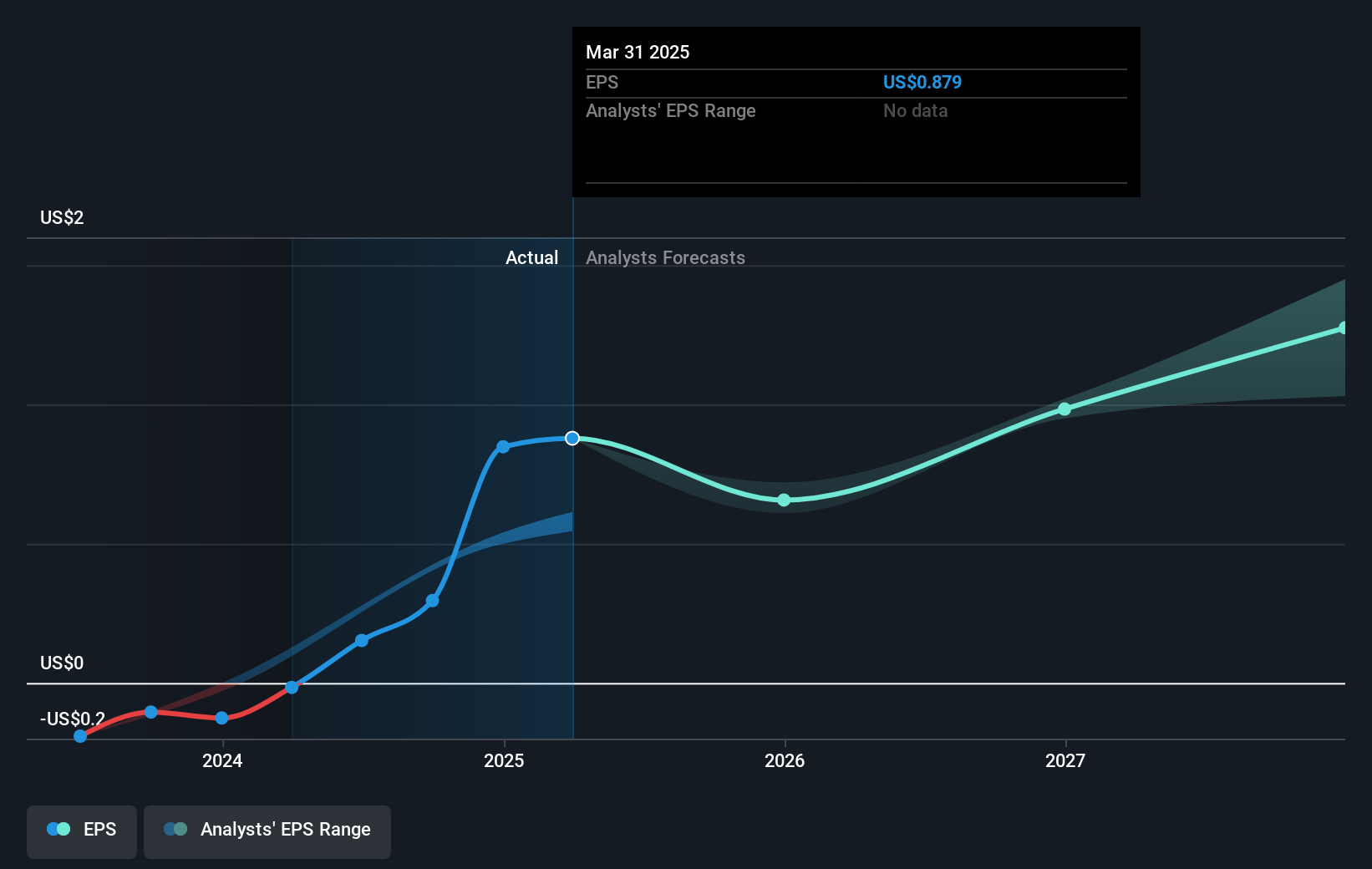

During three years of share price growth, ADMA Biologics moved from a loss to profitability. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It is of course excellent to see how ADMA Biologics has grown profits over the years, but the future is more important for shareholders.

A Different Perspective

It's good to see that ADMA Biologics has rewarded shareholders with a total shareholder return of 100% in the last twelve months. That's better than the annualised return of 49% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand ADMA Biologics better, we need to consider many other factors. Consider risks, for instance.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Recommend

- Reuters 07/11 21:19

Deal Dispatch: From A Founder Comeback To Billion-Dollar Bids, This Week In M&A And Bankruptcy

Benzinga News 07/11 21:22Is ADMA Biologics a Hidden Gem After Recent FDA Approval and 35% Share Drop?

Simply Wall St 08/11 06:35BRIEF-Novo Nordisk Says Will Not Increase Its Proposal To Acquire Metsera, Inc.

Reuters 08/11 08:21Can Eledon Pharmaceuticals’ (ELDN) Mixed Kidney Trial Results Reshape Its Competitive Edge in Transplant Care?

Simply Wall St 08/11 10:39TG Therapeutics (TGTX): Exploring Valuation After Raised Guidance and Strong Q3 Financial Results

Simply Wall St 08/11 13:22Why ADMA Biologics (ADMA) Is Up After FDA Clears Yield-Enhanced Production and Revenue Guidance Boost

Simply Wall St 09/11 23:26Assessing Nektar Therapeutics (NKTR) Valuation After Recent Surge in Share Price

Simply Wall St Today 01:23