Please use a PC Browser to access Register-Tadawul

The Bull Case For Adtalem Global Education (ATGE) Could Change Following Google Cloud Partnership for AI Healthcare Training – Learn Why

Adtalem Global Education Inc. ATGE | 92.88 | -0.24% |

- Adtalem Global Education recently announced the launch of a comprehensive AI credentials program for healthcare professionals, in partnership with Google Cloud, designed to deliver hands-on experience with advanced AI tools across its institutions and partner health systems starting in 2026.

- This initiative aims to close the AI knowledge gap for clinicians, equipping more than 91,000 students and working professionals with practical, in-demand skills for a rapidly evolving healthcare landscape.

- Let’s explore how this partnership with Google Cloud elevates Adtalem’s investment narrative through its focus on advanced clinical workforce training.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Adtalem Global Education's Investment Narrative?

If you’re looking at Adtalem Global Education, the investment story now has a new dimension. The just-announced partnership with Google Cloud, aimed at creating an AI credentials program for healthcare professionals, could put Adtalem at the front of the pack in clinical workforce training. While recent earnings growth and revenue forecasts were already supportive of an upbeat outlook, this initiative may amplify the company’s short-term catalysts, especially by reinforcing its leadership in tackling the healthcare AI knowledge gap. It might help offset headwinds like being dropped from Russell indices and concerns around sector-specific funding pressures. Still, given that the AI program won’t launch until 2026, its immediate impact on financial performance is likely limited; instead, it enhances Adtalem’s medium-term prospects and positions it favorably if healthcare workforce trends strengthen. But the funding uncertainty for healthcare students remains a critical consideration investors should keep in mind.

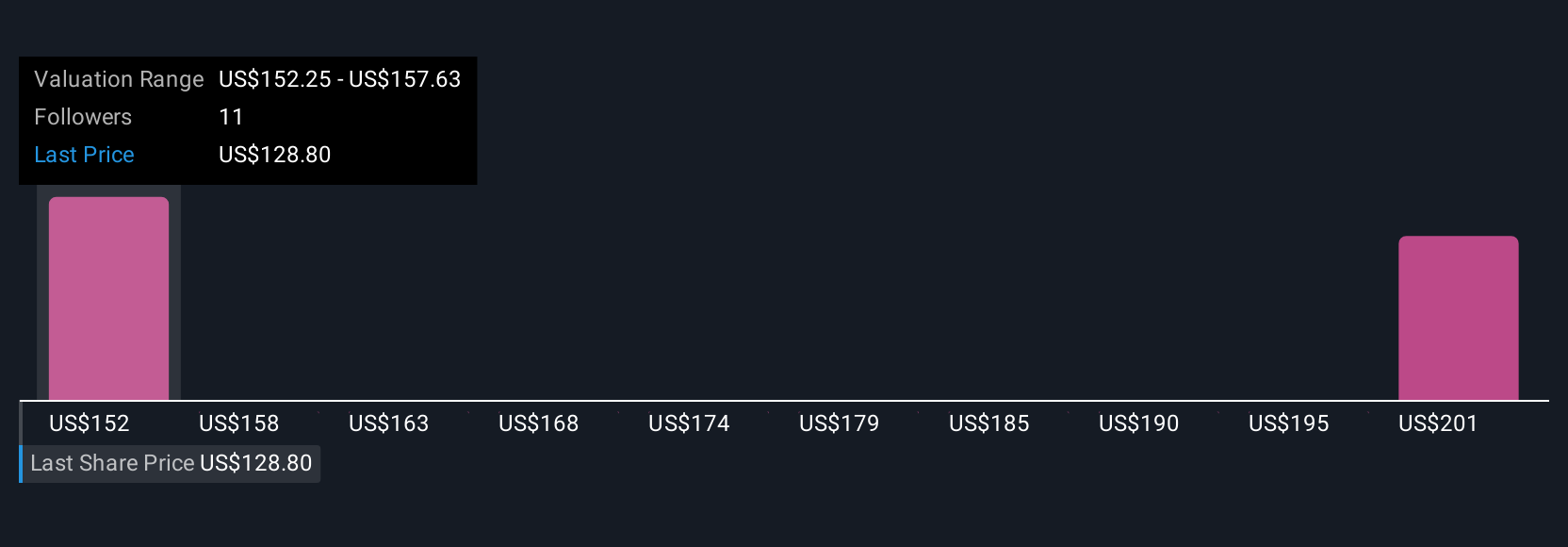

Adtalem Global Education's shares have been on the rise but are still potentially undervalued by 28%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on Adtalem Global Education - why the stock might be worth just $171.50!

Build Your Own Adtalem Global Education Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Adtalem Global Education research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Adtalem Global Education research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Adtalem Global Education's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.