Please use a PC Browser to access Register-Tadawul

The Bull Case For Associated Banc-Corp (ASB) Could Change Following Q2 Earnings Beat and Insider Sales – Learn Why

Associated Banc-Corp ASB | 27.10 | -0.15% |

- In recent days, Associated Banc-Corp reported second-quarter 2025 earnings that exceeded Wall Street expectations and included sales of 3,342 shares by EVP Patrick Edward Ahern and 2,000 shares by EVP Matthew R. Braeger.

- The combination of executive share sales and an earnings beat highlights both leadership activity and analyst optimism around the company's continued strong revenue performance.

- We'll explore how the better-than-expected earnings report and insider selling affect Associated Banc-Corp's investment narrative and growth outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Associated Banc-Corp Investment Narrative Recap

Shareholders in Associated Banc-Corp typically believe in the bank’s ability to drive profitability through its commercial lending expansion and disciplined cost management. The latest earnings beat is a reassuring sign for those watching short-term progress, while executive share sales bring some outside attention but do not appear to materially affect the immediate outlook or alter the biggest risk, the bank’s ongoing exposure to regional lending and funding stability amid evolving market trends.

Of recent announcements, the company’s reaffirmed 2025 guidance for 14% to 15% net interest income growth directly supports the catalyst of expanding high-yield commercial lending. This guidance conveys management’s continued confidence in revenue momentum, matching analyst expectations that positive operating leverage remains the focus even as market competition and funding dynamics intensify.

Yet, in contrast to solid quarterly results, investors should not overlook how sector-specific loan exposures still create vulnerability if Midwest economic activity slows or...

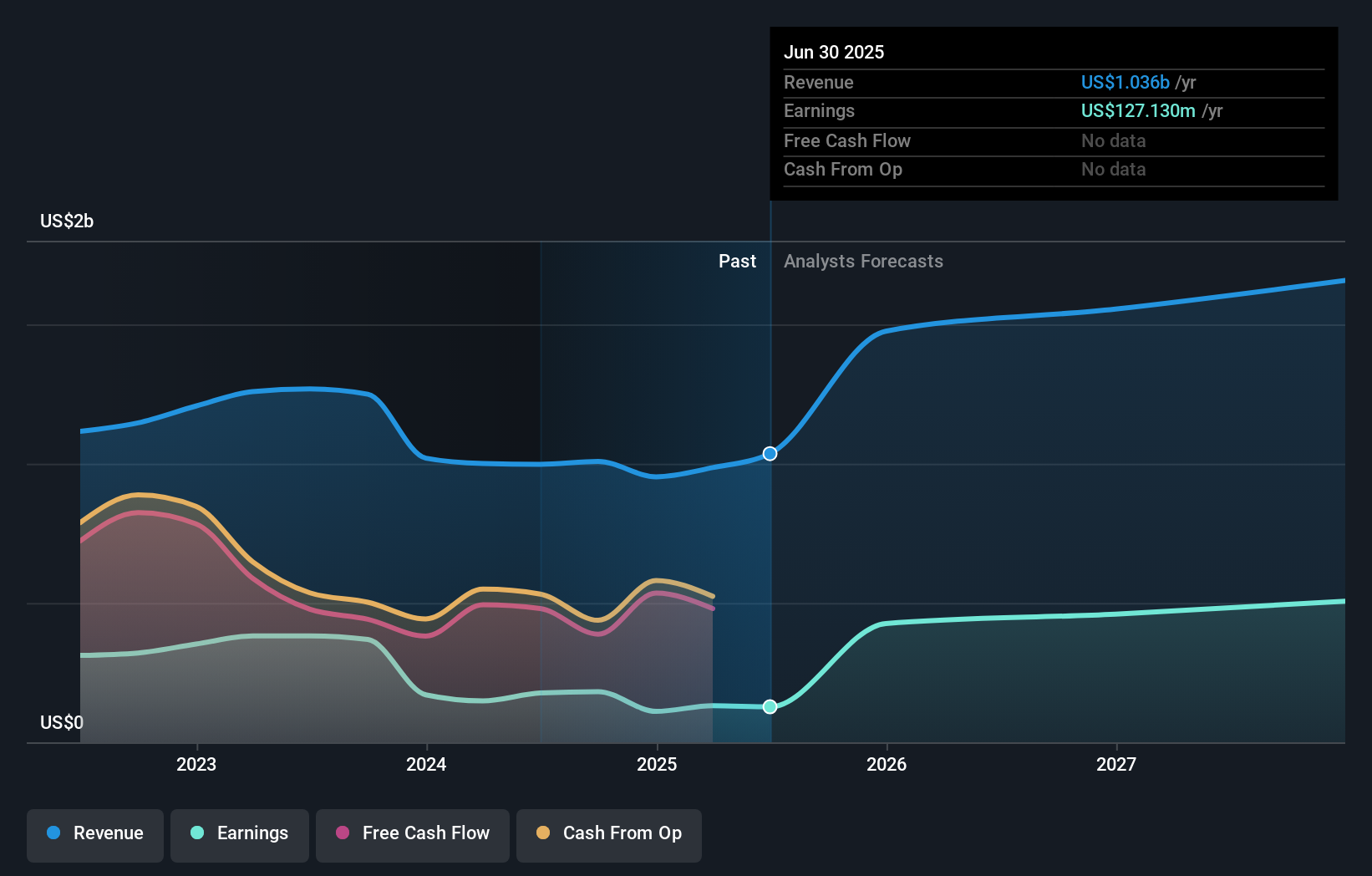

Associated Banc-Corp's narrative projects $1.9 billion revenue and $720.3 million earnings by 2028. This requires 23.4% yearly revenue growth and a $593.2 million earnings increase from $127.1 million.

Uncover how Associated Banc-Corp's forecasts yield a $28.60 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community users placed fair value for Associated Banc-Corp between US$28.60 and US$40.79 based on two distinct analyses. As broad commercial lending growth powers revenue, this wide range invites you to compare how individual forecasts interpret the company’s future earnings path.

Explore 2 other fair value estimates on Associated Banc-Corp - why the stock might be worth just $28.60!

Build Your Own Associated Banc-Corp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Associated Banc-Corp research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Associated Banc-Corp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Associated Banc-Corp's overall financial health at a glance.

No Opportunity In Associated Banc-Corp?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.