Please use a PC Browser to access Register-Tadawul

The Bull Case for CAVA Group (CAVA) Could Change Following COO Departure and Accelerated Nationwide Expansion

CAVA Group, Inc. CAVA | 69.96 | +8.38% |

- In September 2025, CAVA Group, Inc. announced the departure of Chief Operations Officer Jennifer Somers and opened its first Detroit-area restaurant, expanding to 28 states and the District of Columbia while engaging with local communities through charitable initiatives.

- This combination of executive transition and continued nationwide expansion underscores the company’s commitment to growth, operational adaptability, and building brand presence in new markets.

- We'll assess how this leadership change during a period of accelerated store growth may influence CAVA's long-term investment outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

CAVA Group Investment Narrative Recap

Investors in CAVA Group need to believe in the ongoing appeal of Mediterranean cuisine and the company’s ability to expand nationwide without sacrificing same-restaurant sales or operational quality. The recent COO departure comes as CAVA accelerates its store openings, but this executive change is unlikely to have a material impact on the most significant near-term catalyst, continued geographic expansion and execution, though it does underscore the importance of sustaining operational excellence while rapidly scaling. The biggest risk remains that continued new store growth could eventually dilute returns if consumer demand does not keep pace.

Of the latest announcements, the opening of CAVA’s new Detroit location is most relevant, aligning with its plan to reach at least 1,000 restaurants by 2032. The launch, along with extensive local community engagement initiatives, reflects how expansion remains front and center as a driver of both visibility and sales, but also raises questions about managing complexity and ensuring each new site performs up to expectations. Yet while short-term catalysts get attention, investors should remember that...

CAVA Group's narrative projects $1.9 billion in revenue and $126.2 million in earnings by 2028. This requires 20.4% yearly revenue growth and a $14.5 million decrease in earnings from the current $140.7 million.

Uncover how CAVA Group's forecasts yield a $92.21 fair value, a 46% upside to its current price.

Exploring Other Perspectives

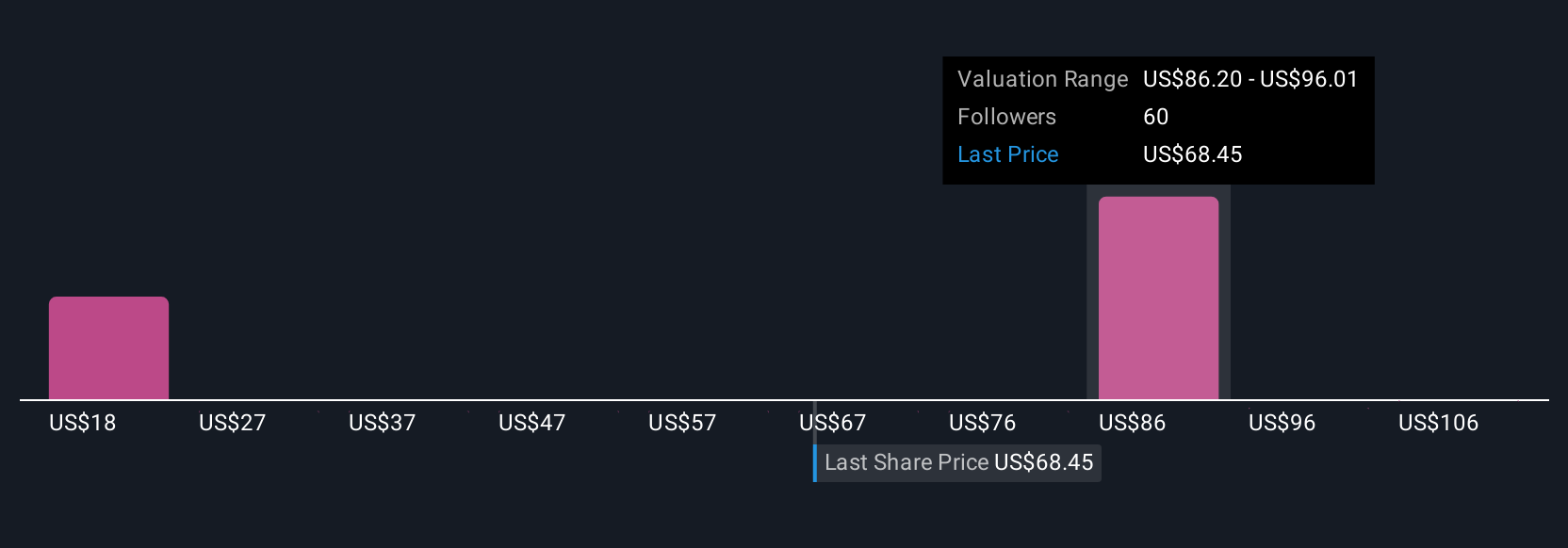

Twelve fair value estimates from the Simply Wall St Community range from US$24 to US$118.75 per share. While many see upside from rapid expansion, there is clear debate on whether ambitious growth targets are offset by the risk of market saturation; consider these varied perspectives as you form your own view.

Explore 12 other fair value estimates on CAVA Group - why the stock might be worth less than half the current price!

Build Your Own CAVA Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CAVA Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CAVA Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CAVA Group's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.