Please use a PC Browser to access Register-Tadawul

The Bull Case For Cboe Global Markets (CBOE) Could Change Following Launch of Long-Term Crypto Futures

CBOE Holdings, Inc. CBOE | 253.02 | +0.76% |

- Cboe Global Markets recently announced plans to launch Cboe Continuous futures on its U.S.-regulated exchange, featuring long-duration, cash-settled bitcoin and ether contracts designed to simplify digital asset trading and risk management.

- This product suite aims to reduce the need for position rolling, offering traders a streamlined way to gain long-term digital asset exposure within a transparent, regulated framework.

- We'll explore how the upcoming launch of long-term digital asset futures could further enhance Cboe's competitive position and product offering.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Cboe Global Markets Investment Narrative Recap

Owning shares in Cboe Global Markets is a bet on the continued growth of electronic and derivatives trading, and the firm's ability to expand its product suite across traditional and digital assets. The recent announcement of Cboe Continuous futures presents a potential product catalyst that could strengthen its competitive edge, but it does not materially impact the short-term concentration risk tied to the S&P index options partnership, which remains a key focus for investors.

Among the latest developments, the SEC’s approval for Cboe to list and trade commodity-based trust shares is particularly relevant. This regulatory progress streamlines the path for new crypto-linked products, complementing Cboe’s upcoming long-duration digital asset futures and supporting its efforts to grow market share in evolving asset classes.

Yet, it’s important to keep in mind that even as Cboe expands its digital offering, the potential impact of industry-wide shifts toward decentralized finance remains...

Cboe Global Markets' outlook anticipates $2.6 billion in revenue and $1.1 billion in earnings by 2028. This projection assumes a 16.9% annual revenue decline and an earnings increase of about $204 million from current earnings of $896.3 million.

Uncover how Cboe Global Markets' forecasts yield a $247.47 fair value, a 5% upside to its current price.

Exploring Other Perspectives

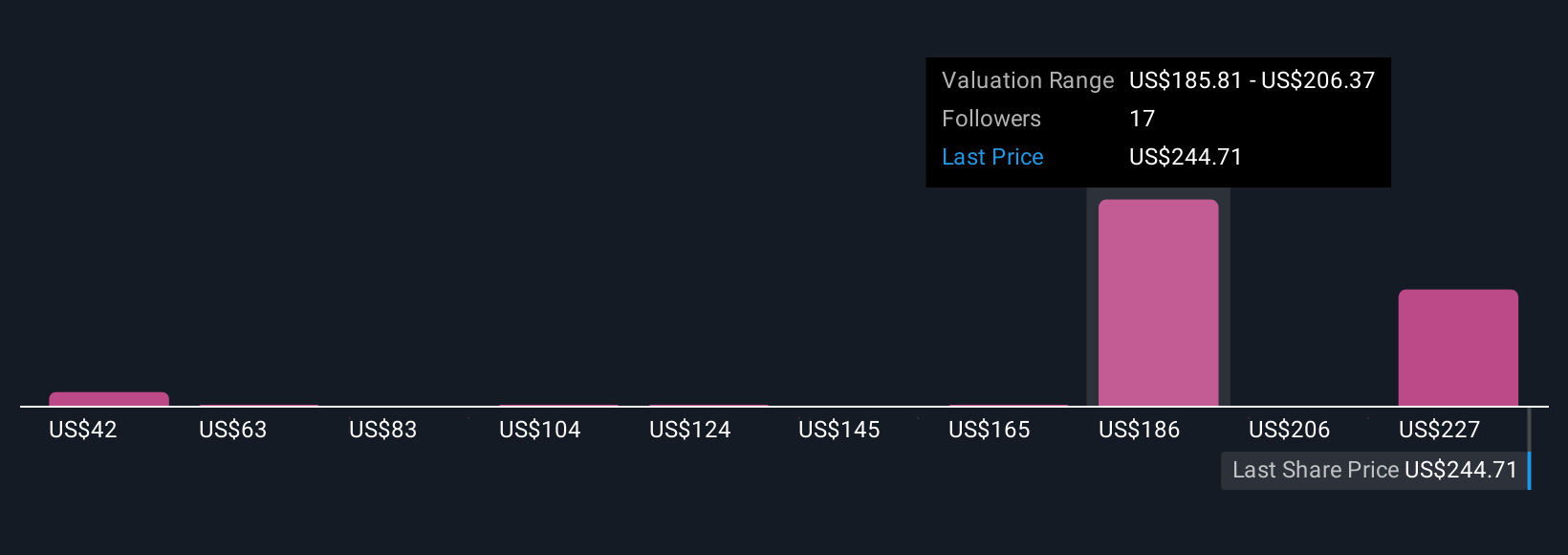

Ten members of the Simply Wall St Community provided fair value estimates for Cboe ranging from US$41.96 to US$247.47. While opinions vary widely, ongoing sector changes like the rise of digital asset trading continue to influence the company’s future prospects, explore how others are viewing these opportunities and risks.

Explore 10 other fair value estimates on Cboe Global Markets - why the stock might be worth as much as $247.47!

Build Your Own Cboe Global Markets Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cboe Global Markets research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cboe Global Markets research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cboe Global Markets' overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 30 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.