Please use a PC Browser to access Register-Tadawul

The Bull Case For Corcept Therapeutics (CORT) Could Change Following FDA Acceptance of Relacorilant Application – Learn Why

Corcept Therapeutics CORT | 87.99 | +0.99% |

- Corcept Therapeutics recently announced that the FDA has accepted its New Drug Application for relacorilant as a potential treatment for patients with platinum-resistant ovarian cancer, assigning a PDUFA date of July 11, 2026.

- This regulatory milestone is based on positive Phase 2 and 3 trial data showing improved survival rates without added safety risks, and highlights relacorilant’s potential to address an unmet need in a difficult-to-treat cancer population.

- We'll explore how the FDA's regulatory acceptance of relacorilant for ovarian cancer may influence Corcept’s future product diversification narrative.

Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Corcept Therapeutics Investment Narrative Recap

To be a Corcept Therapeutics shareholder, you need to believe that new approvals can offset current revenue concentration and margin pressure from Korlym’s declining exclusivity. The FDA’s acceptance of relacorilant’s application in ovarian cancer highlights progress for future diversification, but the most important near-term catalyst remains the earlier potential approval of relacorilant for hypercortisolism, with regulatory delays or setbacks continuing to pose the biggest risk to Corcept’s revenue outlook.

Of the recent announcements, the FDA acceptance of the New Drug Application for relacorilant in platinum-resistant ovarian cancer stands out, as it reinforces the pipeline’s clinical progress. This milestone follows the company’s NDA submission in July 2025, underlining the importance of regulatory momentum in advancing Corcept’s catalyst narrative.

In contrast, investors should be aware that heavy reliance on Korlym revenue and the risk of further margin compression from generic competition remain...

Corcept Therapeutics' outlook projects $2.0 billion in revenue and $743.0 million in earnings by 2028. This requires 40.7% annual revenue growth and a $611.0 million increase in earnings from the current $132.0 million.

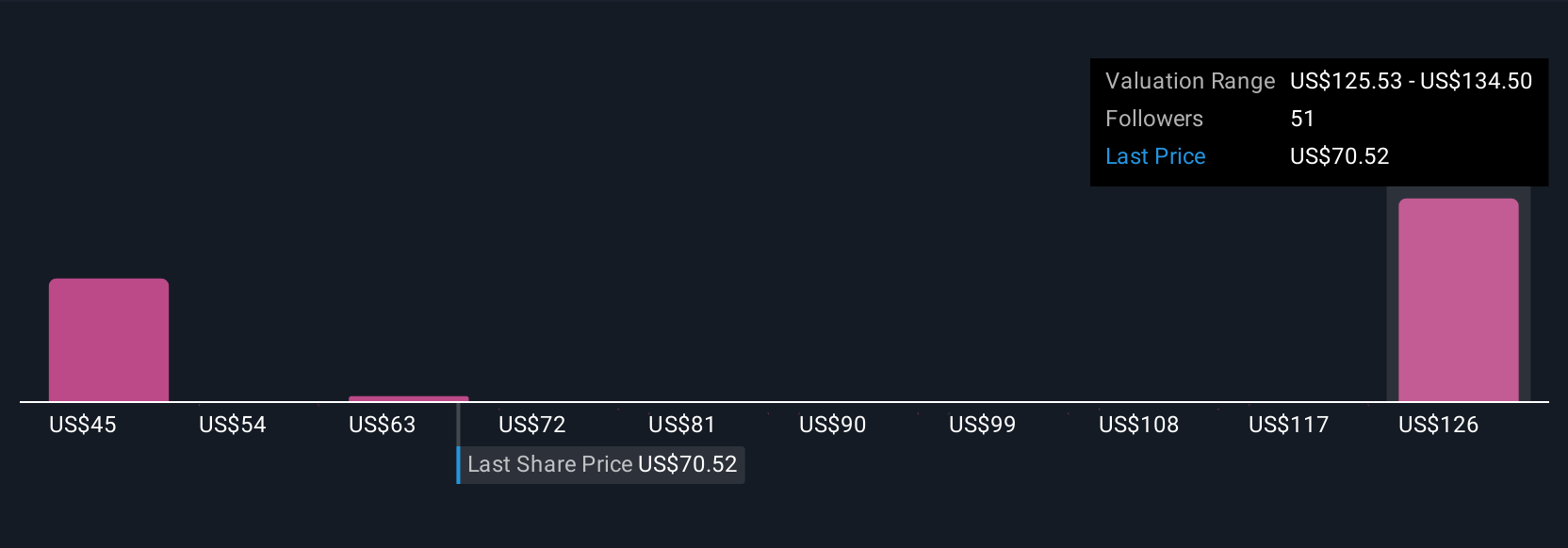

Uncover how Corcept Therapeutics' forecasts yield a $134.50 fair value, a 85% upside to its current price.

Exploring Other Perspectives

Twelve members of the Simply Wall St Community place Corcept’s fair value anywhere from US$44.83 to US$177.43 per share. As regulatory milestones approach, payer pressure and generic competition may affect how these perspectives translate into the company’s future performance.

Explore 12 other fair value estimates on Corcept Therapeutics - why the stock might be worth 38% less than the current price!

Build Your Own Corcept Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Corcept Therapeutics research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Corcept Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Corcept Therapeutics' overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.