Please use a PC Browser to access Register-Tadawul

The Bull Case For Duke Energy (DUK) Could Change Following Ambitious 2025 Carolinas Resource Plan Announcement

Duke Energy Corporation DUK | 115.59 | -0.98% |

- Duke Energy has released its 2025 Carolinas Resource Plan, outlining new investments in nuclear, natural gas, solar, and battery storage to address accelerating electricity demand and infrastructure modernization in the Carolinas.

- The plan highlights that customer bills are projected to rise by only 2.1% annually, below inflation, while expanding generation capacity through a mix of technologies and pursuing customer savings from a planned utility combination.

- We will now examine how Duke Energy’s ambitious plan to support rapid demand growth and grid modernization may shift its investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Duke Energy Investment Narrative Recap

To be a Duke Energy shareholder, you need to believe that ongoing infrastructure investment and a diverse energy portfolio can support stable growth even as demand accelerates and regulatory landscapes evolve. The 2025 Carolinas Resource Plan is significant for the investment story, but recent shelf registration and program expansions do not materially affect the most immediate catalysts or risks related to capital requirements and financing costs.

Notably, the recent $2 billion shelf registration highlights Duke Energy’s focus on securing funding for modernization and capacity projects. As Duke ramps up capital investments, access to cost-effective financing remains in the spotlight, reinforcing existing concerns about how funding needs and interest rates could pressure margins and future earnings.

Yet, investors should be aware that, if borrowing costs rise or capital markets tighten, the impact on Duke’s financial flexibility could...

Duke Energy's narrative projects $35.4 billion revenue and $6.1 billion earnings by 2028. This requires 4.7% yearly revenue growth and a $1.4 billion earnings increase from $4.7 billion today.

Uncover how Duke Energy's forecasts yield a $132.00 fair value, a 9% upside to its current price.

Exploring Other Perspectives

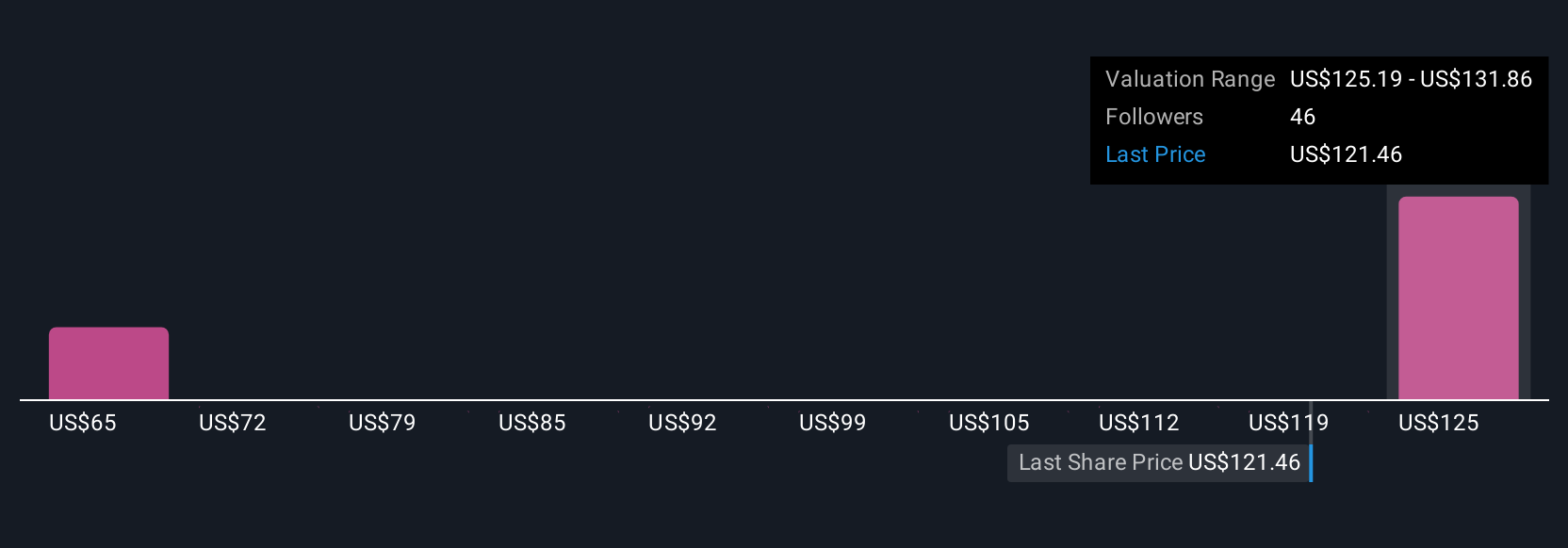

Six private investors in the Simply Wall St Community produced fair value estimates for Duke Energy ranging from US$65 to US$132 per share. Against this backdrop of differing views, the increased dependence on external capital to fund large-scale projects could shape your outlook on risk and return.

Explore 6 other fair value estimates on Duke Energy - why the stock might be worth 46% less than the current price!

Build Your Own Duke Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Duke Energy research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Duke Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Duke Energy's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.