Please use a PC Browser to access Register-Tadawul

The Bull Case For Element Solutions (ESI) Could Change Following Q3 Beat And EFC Gases Acquisition - Learn Why

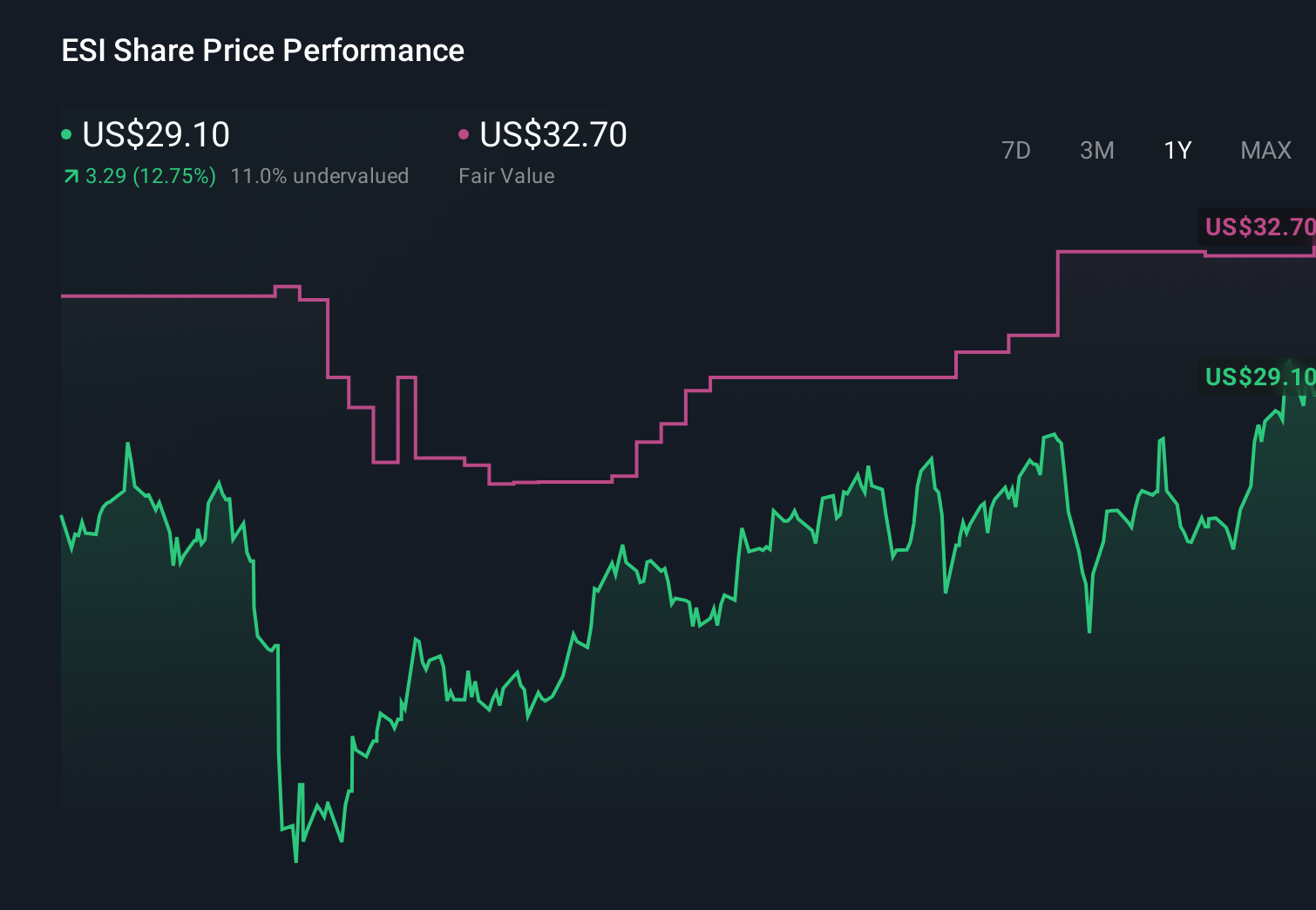

Element Solutions Inc ESI | 29.10 | -2.38% |

- Element Solutions recently reported Q3 2025 earnings that came in ahead of forecasts and completed its acquisition of EFC Gases & Advanced Materials, bolstering its position in specialty chemicals for advanced technologies.

- This combination of stronger-than-expected results and an expanded footprint in semiconductor-related materials has reinforced investor attention on the company’s role in high-performance electronics manufacturing.

- Next, we’ll examine how Element Solutions’ EFC Gases & Advanced Materials acquisition shapes its investment narrative within high-growth electronics and semiconductor end-markets.

Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Element Solutions' Investment Narrative?

For Element Solutions, the big-picture belief is that specialty chemistry remains essential to increasingly complex electronics and semiconductor production, and that the company can convert that relevance into steady, if not spectacular, growth. The recent Q3 2025 beat and the completed EFC Gases & Advanced Materials deal slot directly into that story, sharpening near term catalysts around integration progress, cross-selling into semiconductor customers and any signs that higher value materials can support margins that had been drifting lower. The stock’s push to a new 52 week high and higher analyst targets suggest the market is already baking in part of this optimism, which raises the bar for future quarters. At the same time, rich valuation multiples, insider selling and earnings that have relied on one off items leave less room for disappointment if integration or demand trends underwhelm.

However, investors should weigh how richer valuations interact with softer margins and insider selling. Despite retreating, Element Solutions' shares might still be trading 28% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 2 other fair value estimates on Element Solutions - why the stock might be worth as much as 38% more than the current price!

Build Your Own Element Solutions Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Element Solutions research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Element Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Element Solutions' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 109 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.