Please use a PC Browser to access Register-Tadawul

The Bull Case For Floor & Decor (FND) Could Change Following Report of Weak Sales and Cash Flow Trends

Floor & Decor Holdings, Inc. Class A FND | 61.16 | -2.78% |

- Recent independent analysis points to continued declines in same-store sales and shrinking free cash flow margins at Floor & Decor Holdings, largely attributed to increased costs from new store openings.

- The report also highlights that the company’s five-year average return on invested capital lags behind top consumer retail peers, raising concerns about Floor & Decor’s ability to efficiently execute its growth strategy.

- We'll explore how softening demand and profitability challenges may now influence the company's long-term investment case.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Floor & Decor Holdings Investment Narrative Recap

To be a shareholder in Floor & Decor Holdings, belief in the company's aggressive store expansion unlocking future growth and operating leverage is essential, even as recent analysis points to same-store sales declines and margin pressure. While the news of continued weak demand and pressured free cash flow may reinforce near-term risks, the most important short-term catalyst remains the company’s ability to execute expansion profitably; given that, these developments make concerns about returns on new investment even more pressing for investors.

Among the latest company announcements, a series of new warehouse openings across multiple states stands out in the context of rising costs and margin pressure. The continued rollout of additional stores demonstrates Floor & Decor’s push for scale, but also amplifies the stakes as underperformance in new locations could further strain company profitability.

In contrast, what may matter most for investors right now is the risk of expense deleverage if new store ramp-ups lag expectations...

Floor & Decor Holdings is projected to deliver $6.0 billion in revenue and $296.9 million in earnings by 2028. This outlook is based on a 9.0% annual revenue growth rate and represents an $85.7 million earnings increase from current earnings of $211.2 million.

Uncover how Floor & Decor Holdings' forecasts yield a $82.23 fair value, a 14% upside to its current price.

Exploring Other Perspectives

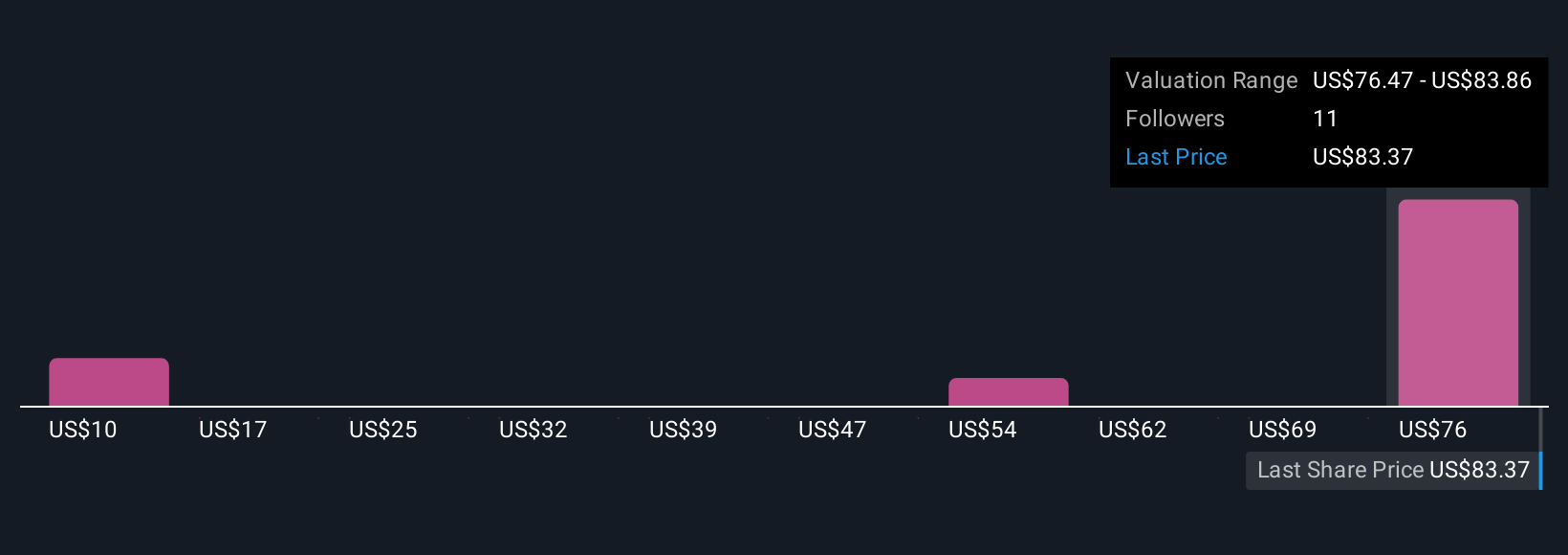

Five individual fair value estimates from the Simply Wall St Community span a broad US$9.83 to US$82.23 per share. With such diversity, and given store expansion risks amid softening demand, there are several viewpoints for you to consider.

Explore 5 other fair value estimates on Floor & Decor Holdings - why the stock might be worth as much as 14% more than the current price!

Build Your Own Floor & Decor Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Floor & Decor Holdings research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Floor & Decor Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Floor & Decor Holdings' overall financial health at a glance.

No Opportunity In Floor & Decor Holdings?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.