Please use a PC Browser to access Register-Tadawul

The Bull Case For Iovance Biotherapeutics (IOVA) Could Change Following New Amtagvi Real-World Data - Learn Why

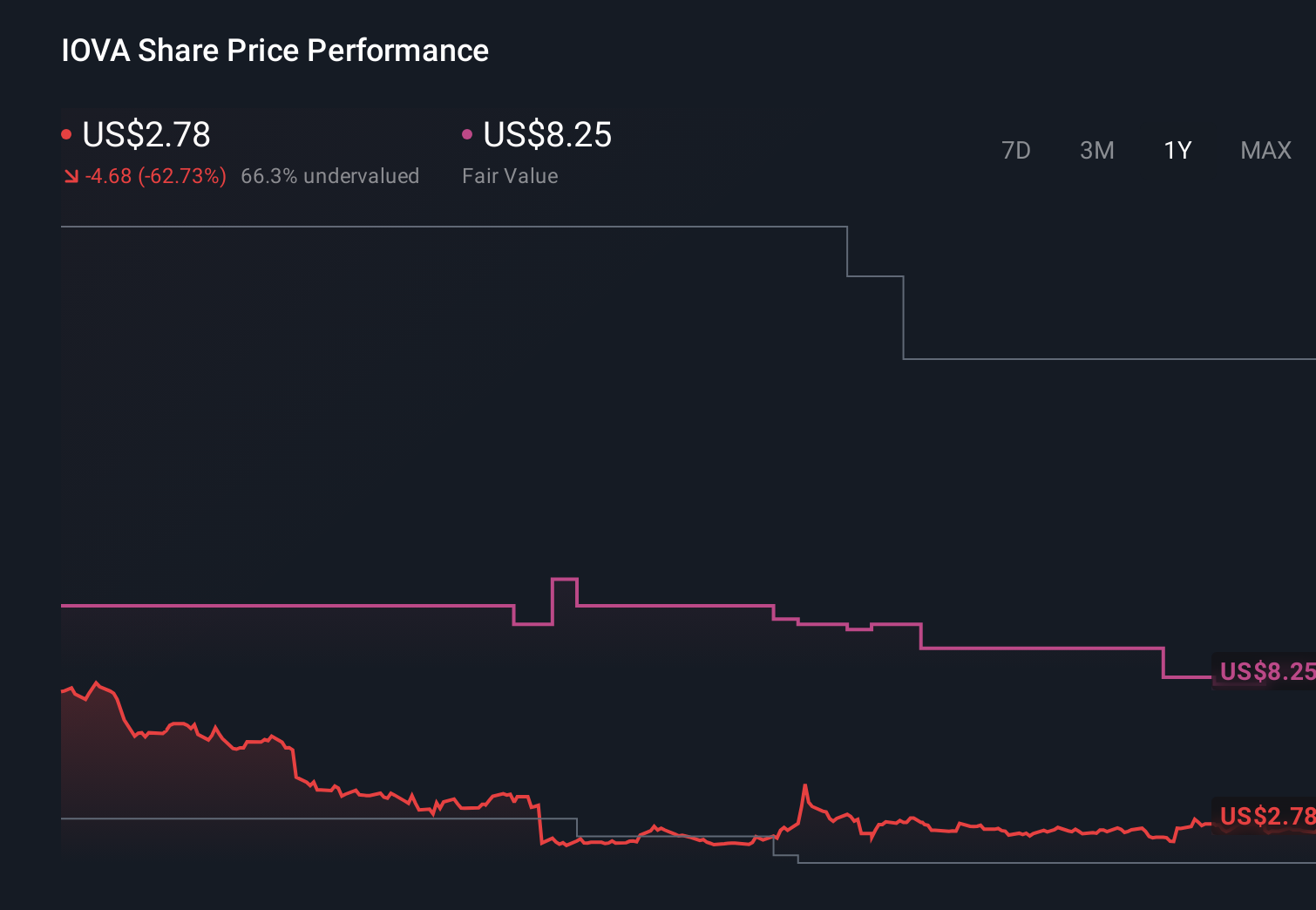

Iovance Biotherapeutics Inc IOVA | 2.87 | +0.70% |

- In early February 2026, Iovance Biotherapeutics reported real-world data for its commercial Amtagvi (lifileucel) therapy in advanced melanoma, showing what it called a best-in-class profile with unprecedented response rates, while reiterating extensive regulatory, manufacturing, and commercialization risks in its latest disclosures.

- The company’s detailed risk discussion highlights how fragile this apparent clinical success could be, with uncertainties around ex-U.S. approvals, manufacturing scale-up, evolving standards of care, and the ability of Amtagvi and Proleukin sales to cover high operating costs.

- We’ll now examine how these stronger real-world response rates for Amtagvi might reshape Iovance’s existing investment narrative around growth and risk.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Iovance Biotherapeutics Investment Narrative Recap

To own Iovance, you have to believe Amtagvi can become a durable commercial TIL franchise before cash constraints and competition bite too hard. The new real‑world melanoma data, with higher response rates than the original trial, could strengthen the near term commercial ramp, but it does not remove the most immediate risk around regulatory setbacks and the company’s ability to scale complex manufacturing while still being a loss‑making, cash‑hungry business.

Among recent announcements, the February 2025 guidance reaffirmation for 2025 revenue of US$250 million to US$300 million stands out. That outlook, set before the latest real‑world data, already assumed meaningful Amtagvi and Proleukin uptake across academic centers and community practices. If the stronger response rates support broader adoption, that guidance and the implied growth trajectory could become an important reference point for how much upside or execution risk investors see from here.

Yet behind the encouraging response data, investors should be aware of how fragile the story looks if international approvals remain delayed and pricing comes under pressure...

Iovance Biotherapeutics' narrative projects $744.8 million revenue and $35.6 million earnings by 2028. This requires 45.6% yearly revenue growth and about a $425 million earnings increase from -$389.9 million today.

Uncover how Iovance Biotherapeutics' forecasts yield a $8.35 fair value, a 221% upside to its current price.

Exploring Other Perspectives

Some of the lowest ranked analysts were assuming revenue would reach about US$524 million by 2028, yet they still saw high costs and complex commercialization as powerful headwinds, reminding you that even with today’s strong response data, opinions on Iovance’s risk reward profile can vary widely and may shift again as new information emerges.

Explore 12 other fair value estimates on Iovance Biotherapeutics - why the stock might be worth just $3.65!

Build Your Own Iovance Biotherapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Iovance Biotherapeutics research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Iovance Biotherapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Iovance Biotherapeutics' overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find 51 companies with promising cash flow potential yet trading below their fair value.

- Capitalize on the AI infrastructure supercycle with our selection of the 33 best 'picks and shovels' of the AI gold rush converting record-breaking demand into massive cash flow.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 31 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.