Please use a PC Browser to access Register-Tadawul

The Bull Case For Iovance Biotherapeutics (IOVA) Could Change Following Reaffirmed 2025 Guidance And TIL Scale-Up

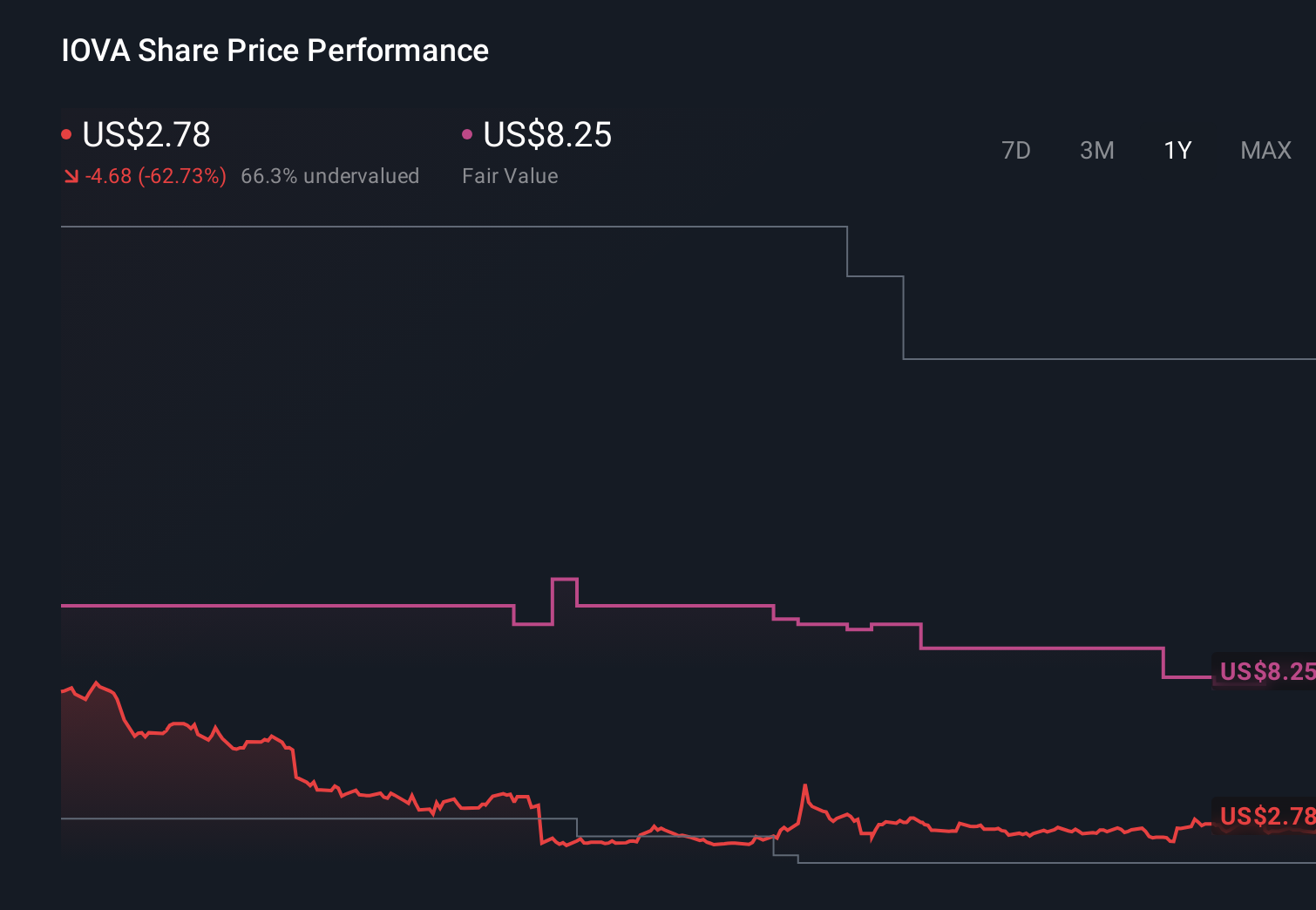

Iovance Biotherapeutics Inc IOVA | 2.87 | +0.70% |

- Iovance Biotherapeutics recently reaffirmed that it expects to meet its earlier 2025 revenue guidance of US$250 million to US$300 million, while reporting that its tumor‑infiltrating lymphocyte therapies have now been used to treat more than 1,000 patients worldwide and scaling manufacturing to support up to 5,000 patients a year.

- This combination of confirmed commercial outlook, real‑world treatment reach, and expanded capacity underscores how Iovance is building out its TIL therapy footprint across multiple markets.

- We’ll now examine how the reaffirmed 2025 revenue guidance and expanded manufacturing capacity affect Iovance’s existing investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Iovance Biotherapeutics Investment Narrative Recap

Iovance’s investment case hinges on Amtagvi gaining traction as a first commercial TIL therapy while the company works to reduce losses and broaden its solid tumor footprint. The reaffirmed 2025 revenue guidance of US$250 million to US$300 million supports the near term commercialization catalyst, but does not remove key risks around dependence on a single product, international approvals, and the high cost and complexity of its individualized TIL manufacturing.

The August 2025 conditional approval of Amtagvi in Canada, via Health Canada’s Notice of Compliance with Conditions, ties directly into this story of expanding real world reach and potential revenue diversification outside the U.S. Together with the latest update on treating over 1,000 patients globally and scaling to support up to 5,000 patients a year, it reinforces that execution on global access remains central to how these catalysts and risks will play out.

Yet despite this progress, investors should be aware that Iovance still faces elevated regulatory uncertainty around...

Iovance Biotherapeutics' narrative projects $744.8 million revenue and $35.6 million earnings by 2028. This requires 45.6% yearly revenue growth and a $425.5 million earnings increase from -$389.9 million today.

Uncover how Iovance Biotherapeutics' forecasts yield a $8.35 fair value, a 241% upside to its current price.

Exploring Other Perspectives

Twelve fair value estimates from the Simply Wall St Community span a wide US$3.65 to US$26.58 range, showing how far apart views on Iovance can be. You can set these against the reaffirmed 2025 revenue guidance and ongoing dependence on Amtagvi, which together raise important questions about how execution risks may shape future performance.

Explore 12 other fair value estimates on Iovance Biotherapeutics - why the stock might be worth over 10x more than the current price!

Build Your Own Iovance Biotherapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Iovance Biotherapeutics research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Iovance Biotherapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Iovance Biotherapeutics' overall financial health at a glance.

No Opportunity In Iovance Biotherapeutics?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 39 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.