Please use a PC Browser to access Register-Tadawul

The Bull Case For iQIYI (IQ) Could Change Following Its First Profitable Quarter Amid High Short-Term Liabilities

IQIYI, INC. IQ | 1.95 | -4.41% |

- iQIYI recently achieved profitability after five years of losses, now earning a 3.8% return on capital employed while keeping its capital base unchanged.

- Despite this turnaround, nearly half of iQIYI's assets are tied up in current liabilities, reflecting ongoing short-term financial risk.

- We'll explore how iQIYI's move to profitability, despite its high current liabilities, influences its broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

iQIYI Investment Narrative Recap

For iQIYI shareholders, the central investment story has centered on belief in the platform’s ability to convert content-driven engagement into reliable and growing profitability, despite pronounced swings in revenue and high exposure to near-term financial obligations. The recent news of achieving a 3.8% return on capital is encouraging, but this doesn’t materially shift the near-term challenge: revenue remains under pressure and high current liabilities still represent the most significant risk to the business model’s stability.

Recent executive board changes announced in August 2025 stand out, as the company brought in two new directors following resignations. While not directly tied to the profitability milestone, having new leadership in the boardroom could influence oversight and decision-making around financial risks and growth strategy, especially given the ongoing need to balance innovation with cost control.

However, while profitability grabs headlines, investors should also be mindful of how much of iQIYI’s capital remains subject to short-term creditor funding, as rising liabilities could...

iQIYI's outlook forecasts CN¥29.2 billion in revenue and CN¥1.3 billion in earnings by 2028. This assumes 1.8% annual revenue growth and a CN¥1.2 billion increase in earnings from the current CN¥88.5 million.

Uncover how iQIYI's forecasts yield a $2.44 fair value, a 7% downside to its current price.

Exploring Other Perspectives

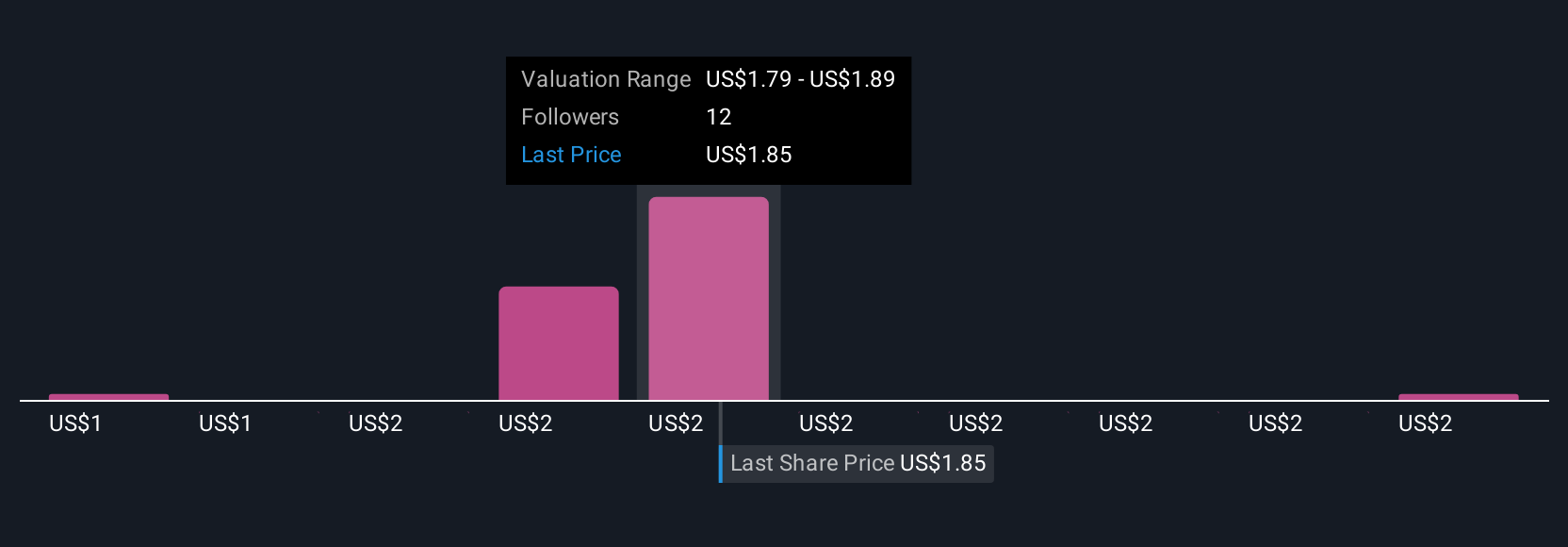

Five members of the Simply Wall St Community shared their fair value views for iQIYI, ranging from CN¥0.89 to CN¥3.34 per share. Continued revenue declines in recent earnings underscore why some market participants scrutinize financial risks and the stability of future returns, highlighting the need to consider multiple perspectives.

Explore 5 other fair value estimates on iQIYI - why the stock might be worth as much as 28% more than the current price!

Build Your Own iQIYI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your iQIYI research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free iQIYI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate iQIYI's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.