Please use a PC Browser to access Register-Tadawul

The Bull Case For Mid-America Apartment Communities (MAA) Could Change Following Weaker Earnings And A US$53 Million Settlement

Mid-America Apartment Communities, Inc. MAA | 133.47 | -1.18% |

- Mid-America Apartment Communities has reported past fourth-quarter and full-year 2025 results showing slightly higher sales of US$555.56 million for the quarter and US$2.21 billion for the year, but meaningfully lower net income of US$57.57 million and US$446.91 million respectively versus the prior year.

- Alongside earnings, the company entered into a past US$53 million class action settlement agreement and outlined 2026 diluted EPS guidance of US$4.11 to US$4.47, while also completing a US$27.23 million share repurchase tranche.

- Next, we’ll examine how the combination of weaker earnings and the US$53 million class action settlement shapes Mid-America’s investment narrative.

Explore 22 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Mid-America Apartment Communities' Investment Narrative?

To own Mid-America Apartment Communities today, you have to believe in the long-term appeal of Sun Belt multifamily housing while accepting that earnings are under pressure. The latest quarter underlined that tension: revenue inched higher, but net income and EPS fell, and management’s 2026 diluted EPS guidance signals only modest progress from 2025 levels. The new US$53 million class action settlement adds another moving piece. On its own, the payment looks manageable against more than US$2.21 billion of annual sales, and the company does not expect material operational changes from the related commitments. But it does sit on top of already weaker profitability, relatively high valuation multiples and underwhelming recent share returns, which together sharpen the focus on execution and balance sheet resilience over the next year or so.

Yet there is one legal and earnings-related pressure point here that investors should not ignore.

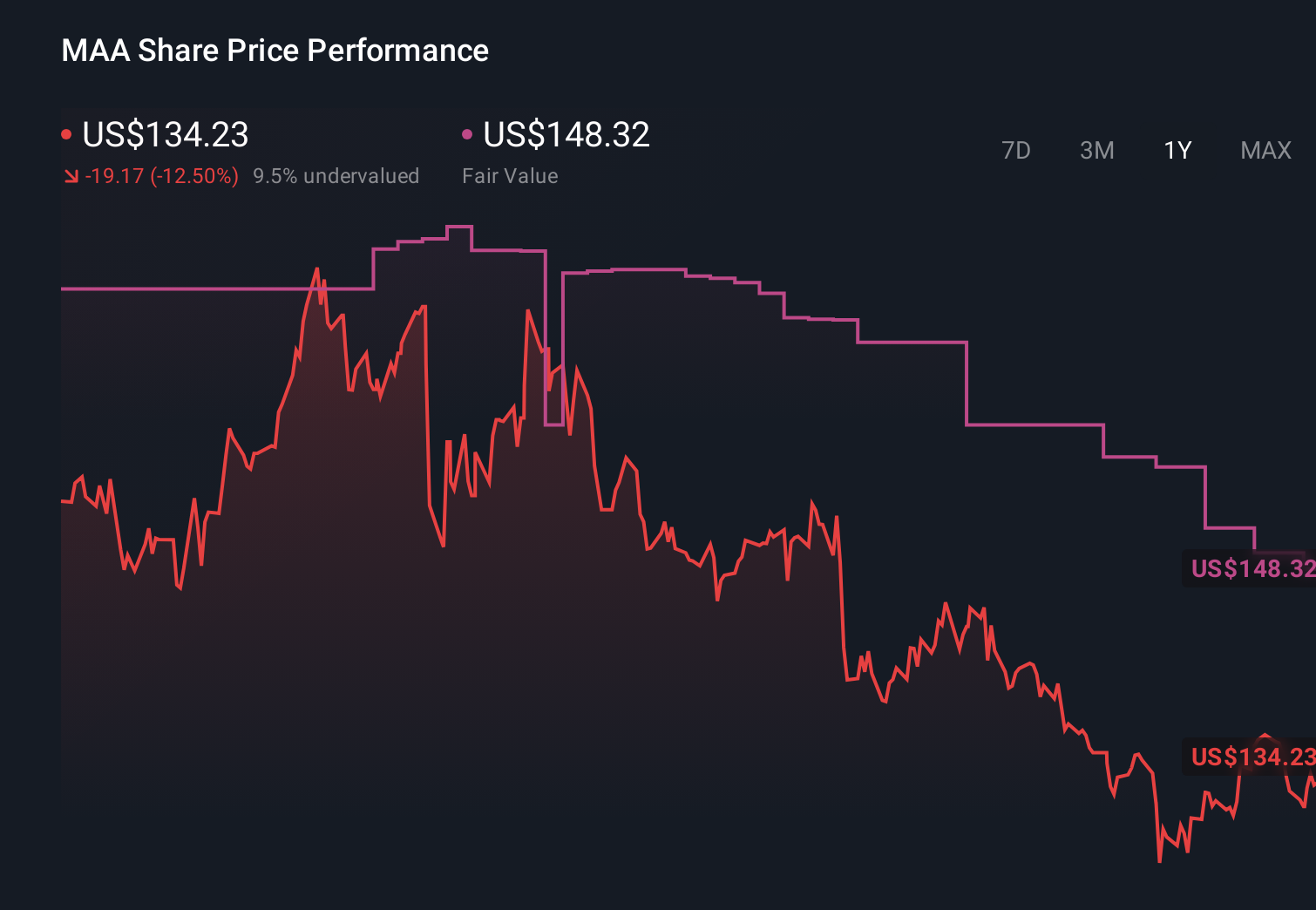

Despite retreating, Mid-America Apartment Communities' shares might still be trading 33% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Five Simply Wall St Community fair value estimates for Mid-America Apartment Communities span roughly US$90 to just under US$200, underscoring how far apart views can be. Against that spread, the recent earnings weakness, settlement cost and already high earnings multiple give you important context for thinking about which of those valuations, if any, feels realistic. You are seeing how different investors can anchor on very different scenarios for the same business, so it is worth exploring several of these viewpoints before deciding where you stand.

Explore 5 other fair value estimates on Mid-America Apartment Communities - why the stock might be worth 32% less than the current price!

Build Your Own Mid-America Apartment Communities Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mid-America Apartment Communities research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Mid-America Apartment Communities research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mid-America Apartment Communities' overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've uncovered the 14 dividend fortresses yielding 5%+ that don't just survive market storms, but thrive in them.

- The future of work is here. Discover the 28 top robotics and automation stocks leading the charge in AI-driven automation and industrial transformation.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 28 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.