Please use a PC Browser to access Register-Tadawul

The Bull Case for OceanFirst Financial (OCFC) Could Change Following Regional Bank Loan Quality Disclosures

OceanFirst Financial Corp. OCFC | 20.14 20.14 | -0.93% 0.00% Pre |

- Recently, disclosures from Zions Bancorp and Western Alliance Bancorp revealed a US$50 million charge-off and concerns about borrower collateral, intensifying market scrutiny toward regional banks' loan quality.

- This has sparked broader concerns that banks similar to OceanFirst Financial may face increased risks of credit losses and tighter profitability.

- We'll explore how heightened caution around loan quality disclosures may alter OceanFirst Financial’s investment narrative and future outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

OceanFirst Financial Investment Narrative Recap

To be a shareholder in OceanFirst Financial, you need confidence that the bank’s commercial expansion and new deposit-raising teams will drive enough growth to offset higher costs and uneven regional loan demand. The recent spike in industry concern around large loan charge-offs and weak collateral, as seen at peer banks, puts a spotlight on credit risk management as a short-term catalyst and top risk. For now, there is no evidence that these specific issues have materially impacted OceanFirst’s current loan book, but the scrutiny could affect market sentiment and future performance.

Among recent company developments, OceanFirst’s solid Q2 net interest income increase stands out, despite year-over-year pressure on net income. This performance, driven by its ongoing efforts in commercial lending and deposit growth, remains closely tied to the market’s focus on credit quality, especially important following sector-wide caution prompted by peers’ disclosures.

By contrast, investors should be aware of how an unexpected rise in commercial credit losses could quickly reshape OceanFirst’s…

OceanFirst Financial's outlook anticipates $536.1 million in revenue and $124.4 million in earnings by 2028, implying annual revenue growth of 12.5% and an increase in earnings of $42.7 million from the current $81.7 million.

Uncover how OceanFirst Financial's forecasts yield a $20.29 fair value, a 15% upside to its current price.

Exploring Other Perspectives

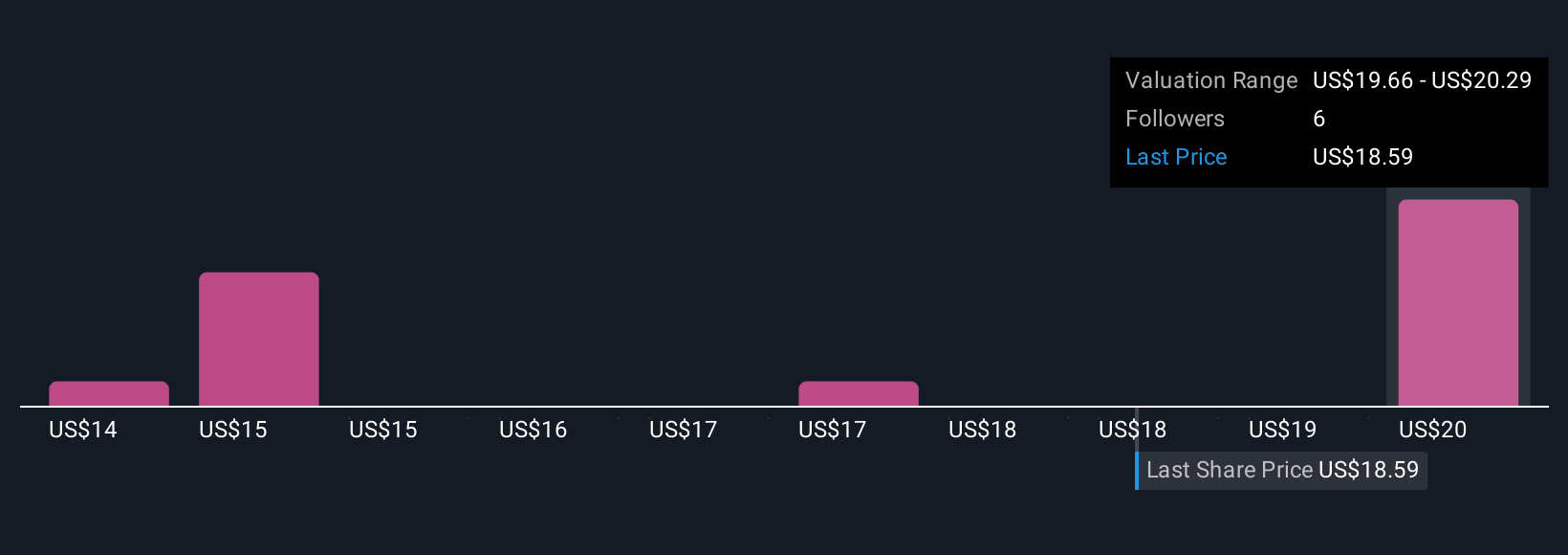

Four Simply Wall St Community fair value estimates for OceanFirst Financial range from US$14.00 to US$20.29 per share, reflecting a wide breadth of opinions. Investors differ sharply on valuation, especially as credit risk and peer sector charge-offs may weigh on future outcomes, explore these diverse perspectives to inform your own view.

Explore 4 other fair value estimates on OceanFirst Financial - why the stock might be worth as much as 15% more than the current price!

Build Your Own OceanFirst Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OceanFirst Financial research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free OceanFirst Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OceanFirst Financial's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.