Please use a PC Browser to access Register-Tadawul

The Bull Case For Oracle (ORCL) Could Change Following Major Healthcare Digitalization Push in Ireland

Oracle Corporation ORCL | 189.97 | -4.47% |

- In recent days, Oracle announced a series of major developments, including the expansion of its cloud-powered healthcare solutions across Irish maternity hospitals, new client deployments with Bloom Energy and Digital Realty supporting sustainable data center operations, and AI-driven enhancements to its supply chain management products.

- One unique aspect highlighted is Oracle Health's role in providing unified, real-time patient data across more than half of Ireland's births, directly supporting clinical workflows and collaborative care, while freeing significant nursing time for patient interaction instead of administrative work.

- We’ll examine how Oracle’s expanding healthcare digitalization initiatives showcased in Ireland may influence its longer-term investment narrative.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Oracle Investment Narrative Recap

The case for owning Oracle centers on its ability to scale cloud infrastructure, support AI demand, and diversify into industry-specific solutions. However, the most important catalyst remains the pace of cloud-powered capacity expansion, while the biggest risk continues to be execution on these ambitious infrastructure build-outs, recent announcements like healthcare digitalization in Ireland are promising, but do not materially shift the near-term equation for either factor.

Among the latest developments, Oracle’s collaboration with Bloom Energy to deploy sustainable fuel cell power at US data centers stands out. This move speaks directly to the need for reliable, efficient cloud infrastructure, a core catalyst for the company as it commits substantial capital to meet surging AI and cloud workloads, and addresses concerns over data center scalability and resilience.

In contrast, investors should be aware of the risk that Oracle’s significant capital spending relies on projected demand actually materializing...

Oracle's outlook points to $94.1 billion in revenue and $23.2 billion in earnings by 2028. This projection assumes 17.9% annual revenue growth and an earnings rise of $10.8 billion from the current $12.4 billion.

Uncover how Oracle's forecasts yield a $234.37 fair value, a 7% downside to its current price.

Exploring Other Perspectives

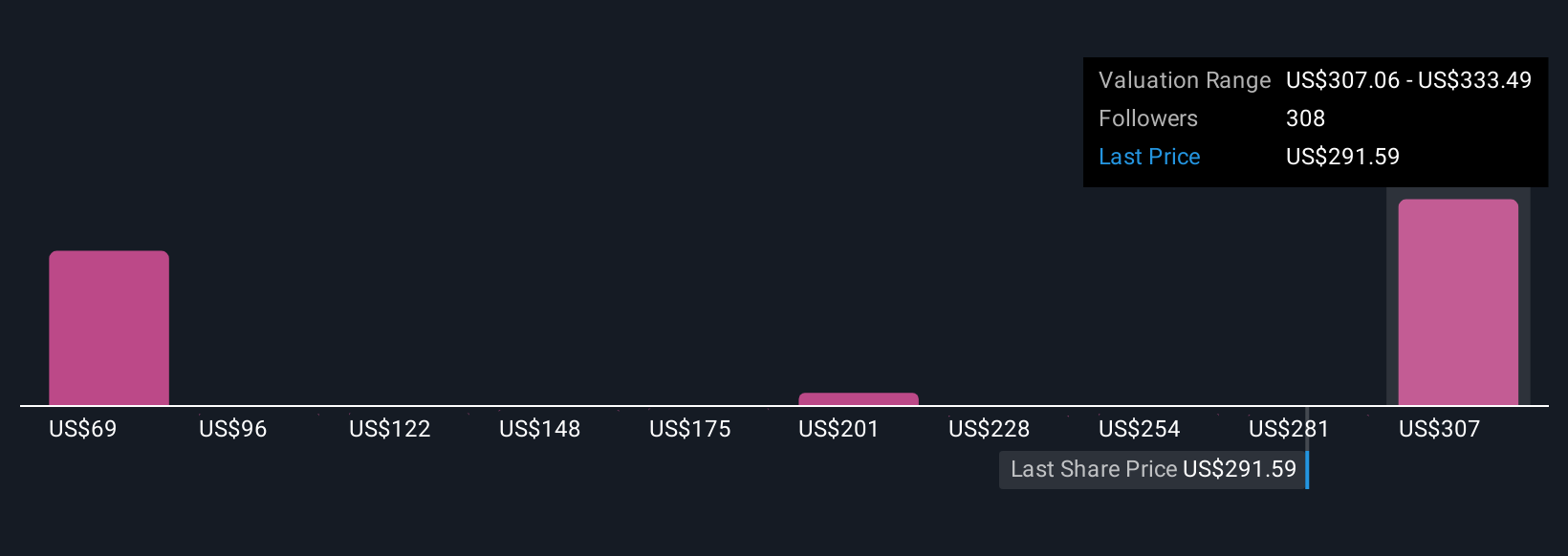

Twenty-three members of the Simply Wall St Community estimate Oracle’s fair value from US$136.51 to US$309.18. While cloud infrastructure expansion remains a key catalyst, such a wide range of opinions highlights how expectations for future growth and execution can vary, be sure to consider several viewpoints.

Explore 23 other fair value estimates on Oracle - why the stock might be worth as much as 22% more than the current price!

Build Your Own Oracle Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oracle research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Oracle research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oracle's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.