Please use a PC Browser to access Register-Tadawul

The Bull Case For Rubrik (RBRK) Could Change Following Launch of AI Agent Security Platform

Rubrik, Inc. Class A RBRK | 51.07 | +5.65% |

- In November 2025, Rubrik unveiled Rubrik Agent Rewind, a new technology aimed at monitoring, controlling, and reversing unwanted actions of enterprise AI agents, alongside integrations with Microsoft Copilot Studio and expanded protections for Microsoft 365, Azure DevOps, and GitHub users.

- The launch was supported by a creative marketing campaign featuring artist Ludacris, highlighting Rubrik’s focus on positioning itself at the forefront of AI security and operations for rapidly evolving enterprise environments.

- We’ll explore how Rubrik’s launch of AI agent security features, including Agent Rewind, may reshape its investment narrative going forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Rubrik Investment Narrative Recap

To be a shareholder in Rubrik, you need to believe in the company’s ability to become indispensable in the enterprise data security and AI operations space. The new Rubrik Agent Rewind and Copilot Studio integrations align with key catalysts, such as strengthening partnerships and advancing cyber resilience, but these launches do not directly offset the short-term challenge of achieving product-market fit in the rapidly evolving AI security segment or address persistent losses.

Among Rubrik’s recent announcements, the integration of Agent Cloud with Microsoft Copilot Studio stands out because it underscores efforts to simplify and safeguard enterprise AI agent adoption, a theme at the heart of both the latest product launch and Rubrik’s growth ambitions. With enterprises increasingly implementing automated agents, Rubrik’s expanded management and security tools speak to immediate market needs and reinforce the company’s positioning to capture emerging demand.

However, investors should also note that, by contrast, early-stage adoption risk in the AI and cloud strategy is front and center, especially as...

Rubrik's narrative projects $2.0 billion revenue and $257.3 million earnings by 2028. This requires 26.2% yearly revenue growth and a $782.1 million increase in earnings from the current $-524.8 million.

Uncover how Rubrik's forecasts yield a $115.20 fair value, a 66% upside to its current price.

Exploring Other Perspectives

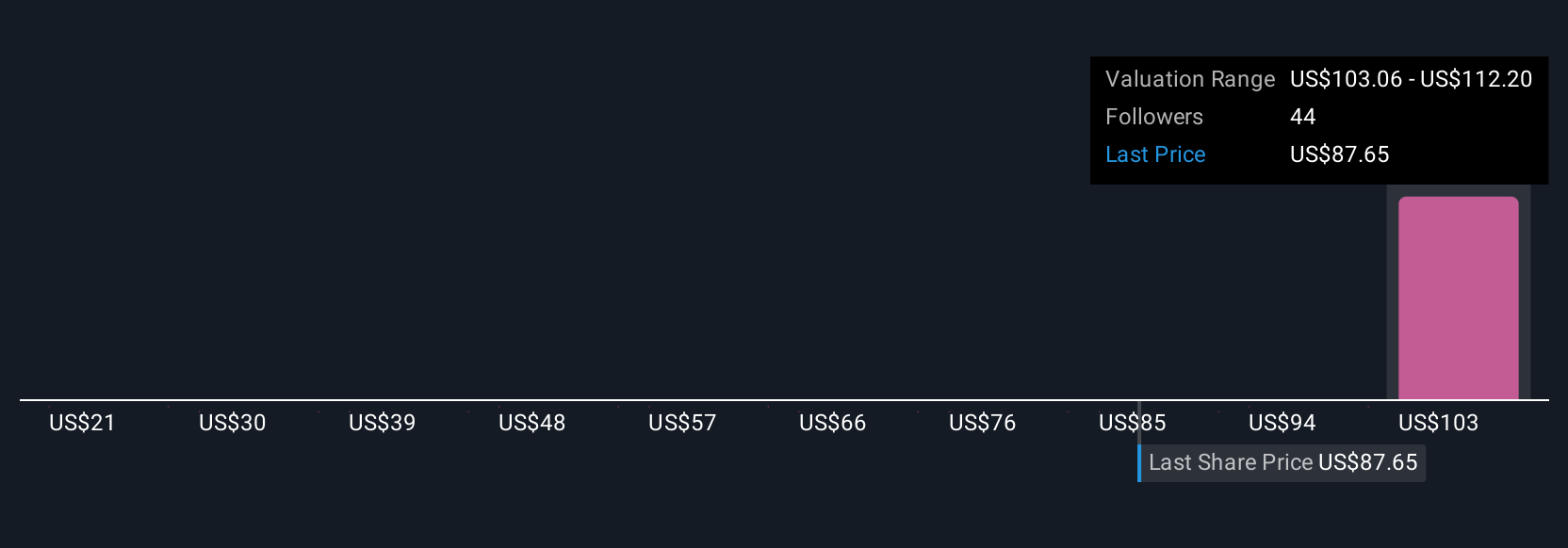

Simply Wall St Community users estimate Rubrik’s fair value anywhere from US$20.80 to US$115.20, based on 11 unique perspectives. This broad spectrum comes as Rubrik pushes deeper into AI security where early adoption risk remains an important factor for company performance.

Explore 11 other fair value estimates on Rubrik - why the stock might be worth as much as 66% more than the current price!

Build Your Own Rubrik Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rubrik research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Rubrik research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rubrik's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.