Please use a PC Browser to access Register-Tadawul

The Bull Case For Sable Offshore (SOC) Could Change Following Court’s Denial of Cease Order Stay - Learn Why

Sable Offshore SOC | 6.16 | +9.22% |

- On July 9, 2025, the Santa Barbara County Superior Court denied Sable Offshore Corp.’s motion to stay a Cease and Desist Order from the California Coastal Commission regarding coastal zone maintenance, as Sable simultaneously filed a Notice of Appeal to continue contesting operational restrictions.

- This legal challenge unfolds as Sable maintains production and prepares for potential pipeline restarts, underscoring the company’s commitment to ongoing operations amid regulatory uncertainty.

- We’ll explore how Sable’s determination to continue operations during its legal appeal shapes its evolving investment narrative.

What Is Sable Offshore's Investment Narrative?

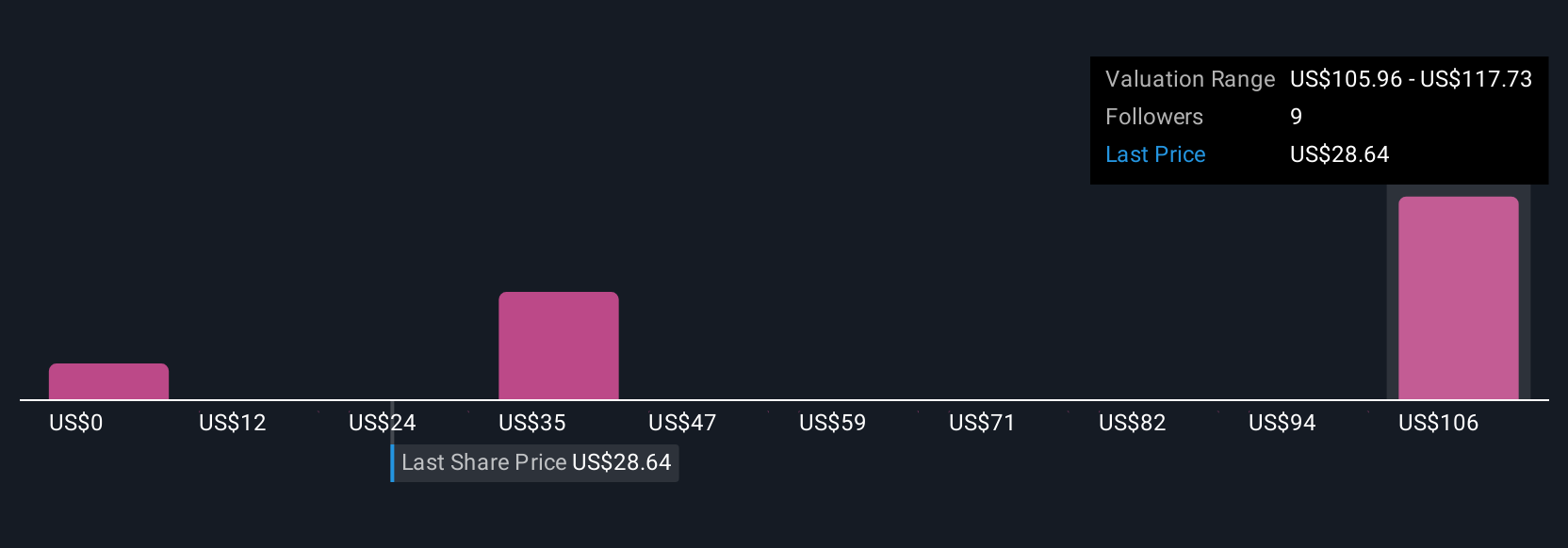

Holding Sable Offshore stock right now hinges on a belief in the company’s ability to overcome regulatory setbacks and ramp up production, particularly as it targets first oil sales following the anticipated Las Flores Pipeline restart. The recent Santa Barbara Superior Court ruling, denying Sable’s motion to stay a Cease and Desist Order, highlights the biggest immediate risk: persistent legal and regulatory headwinds that could disrupt operations or delay key catalysts. While Sable is still operating and has appealed the decision, this ongoing legal uncertainty matters for the short-term timeline and predictability of upcoming production increases, previously flagged as a major catalyst. Despite rising production guidance and robust revenue growth forecasts, the lack of stable revenue and history of substantial losses reinforce the precariousness of this turnaround. The court’s latest move does not appear to have triggered material negative price moves, but it may leave investors balancing opportunity and risk more acutely as timing for pipeline restart could shift.

But risks tied to regulatory rulings could still surprise investors, keep an eye on further court actions.

Exploring Other Perspectives

Build Your Own Sable Offshore Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sable Offshore research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Sable Offshore research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sable Offshore's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.