Please use a PC Browser to access Register-Tadawul

The Bull Case For STERIS (STE) Could Change Following Margin Pressures Amid Revenue Growth And Buybacks

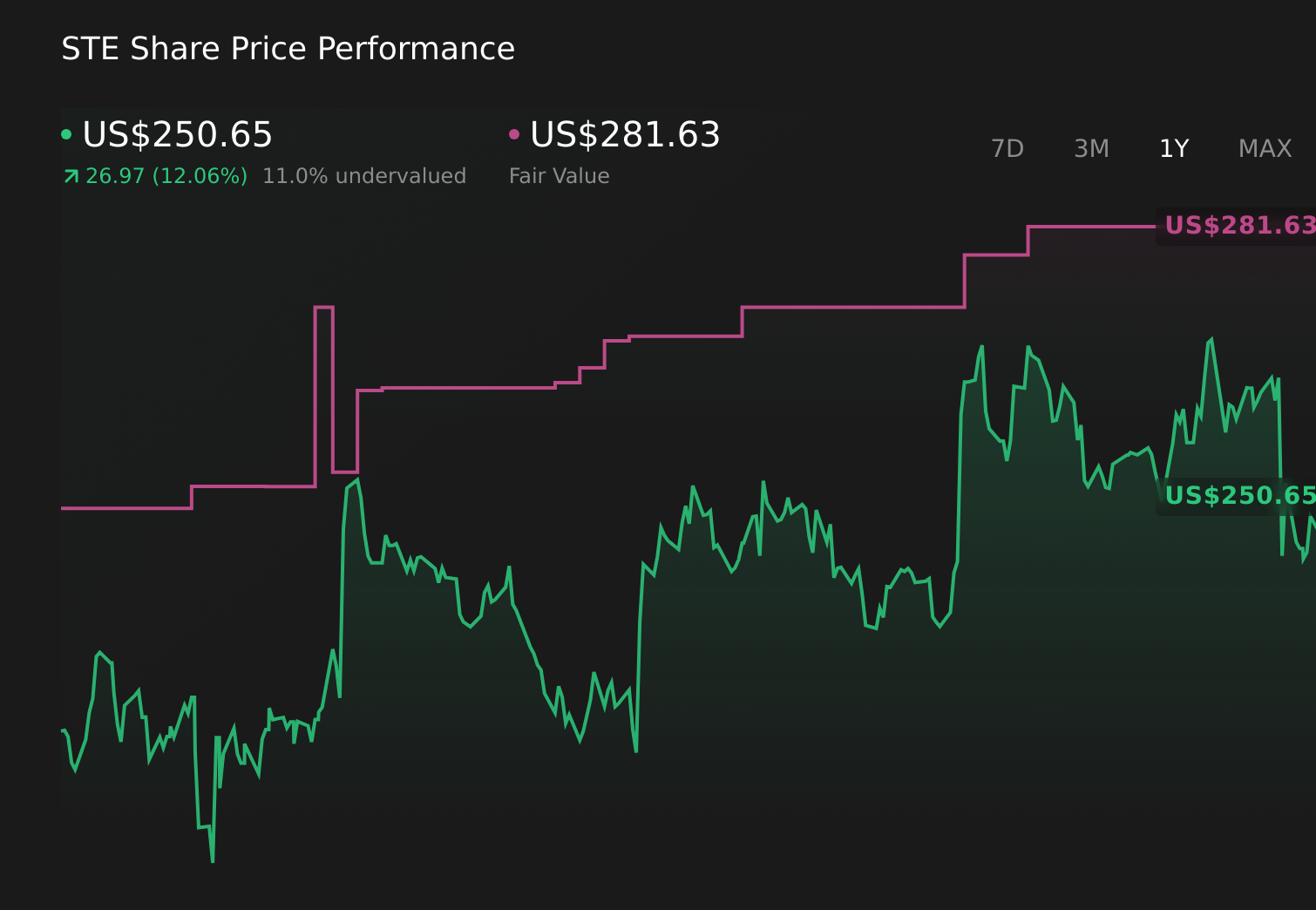

STERIS plc STE | 250.65 | -0.21% |

- In its most recent quarter ended December 31, 2025, STERIS plc reported higher sales of US$1,496.2 million and net income of US$192.9 million, alongside completing a US$350.6 million share repurchase program totaling 1,507,158 shares since May 2023.

- The combination of rising earnings per share and ongoing margin pressure from tariffs and inflation highlights a tension between growth in profitability metrics and the cost environment facing STERIS.

- We’ll now examine how STERIS’s margin pressures amid solid revenue growth and completed buybacks affect the existing investment narrative.

Outshine the giants: these 28 early-stage AI stocks could fund your retirement.

STERIS Investment Narrative Recap

To own STERIS, you need to believe that steady demand for infection prevention and sterilization can support consistent revenue growth, even when costs are rising. The latest results, with higher sales and earnings per share alongside a completed US$350.6 million buyback, do not materially change the near term tension between tariff driven margin pressure as the key risk and volume growth as the main catalyst.

The third quarter earnings release for the period ended December 31, 2025 is most relevant here, as it shows sales of US$1,496.2 million and net income of US$192.9 million growing year on year while management highlighted tariffs and inflation as headwinds. This mix of higher profitability metrics and a tougher cost environment frames how investors might weigh recent margin pressure against the company’s growing base of consumables and services revenue.

Yet investors should be aware that rising tariffs on key input metals could still...

STERIS’ narrative projects $6.8 billion revenue and $1.0 billion earnings by 2028.

Uncover how STERIS' forecasts yield a $281.62 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community cluster between US$230 and about US$281.6 per share, underlining how differently individual investors can view the same numbers. You can set those views against the current concern that higher tariffs may pressure STERIS’s margins and consider what that might mean for future earnings resilience and valuation.

Explore 3 other fair value estimates on STERIS - why the stock might be worth 7% less than the current price!

Build Your Own STERIS Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your STERIS research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free STERIS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate STERIS' overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with 28 elite penny stocks that balance risk and reward.

- The future of work is here. Discover the 30 top robotics and automation stocks leading the charge in AI-driven automation and industrial transformation.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.