Please use a PC Browser to access Register-Tadawul

The Bull Case For Target (TGT) Could Change Following Major Circle Week Expansion and Self-Checkout Rollout

Target Corporation TGT | 97.09 | +0.12% |

- Target recently unveiled its largest Circle Week event to date, offering deep discounts, exclusive product drops, and enhanced perks for members, while launching accessible self-checkout technology and adding thousands of new products and delivery options nationwide to strengthen its holiday shopping appeal.

- This comprehensive approach marks a significant push to drive sales, bolster loyalty engagement, and improve customer accessibility amid a challenging retail landscape.

- We'll explore how the nationwide rollout of accessible self-checkout technology could influence Target's investment narrative and future growth prospects.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Target Investment Narrative Recap

To own shares in Target today, you need confidence that ongoing investments in technology, store experience, and exclusive products can reverse recent declines in earnings and reposition the company as a retail leader. The rollout of accessible self-checkout aligns with this strategy, but is unlikely to materially change the key near-term catalyst, success in the upcoming holiday sales push, while competitive pricing and margin pressures remain the biggest risks to watch.

Among Target's recent announcements, the expanded Circle Week event and exclusive product launches stand out for their influence on near-term customer engagement. With deeper discounts and enhanced loyalty perks rolling out just as self-checkout technology launches, Target is clearly focused on lifting store traffic and holiday revenue amid soft consumer demand.

By contrast, intensifying price competition and persistent margin pressures pose risks investors should be aware of, especially as cost control efforts...

Target's narrative projects $110.5 billion revenue and $3.7 billion earnings by 2028. This requires 1.4% yearly revenue growth and a $0.5 billion decrease in earnings from $4.2 billion today.

Uncover how Target's forecasts yield a $103.69 fair value, a 18% upside to its current price.

Exploring Other Perspectives

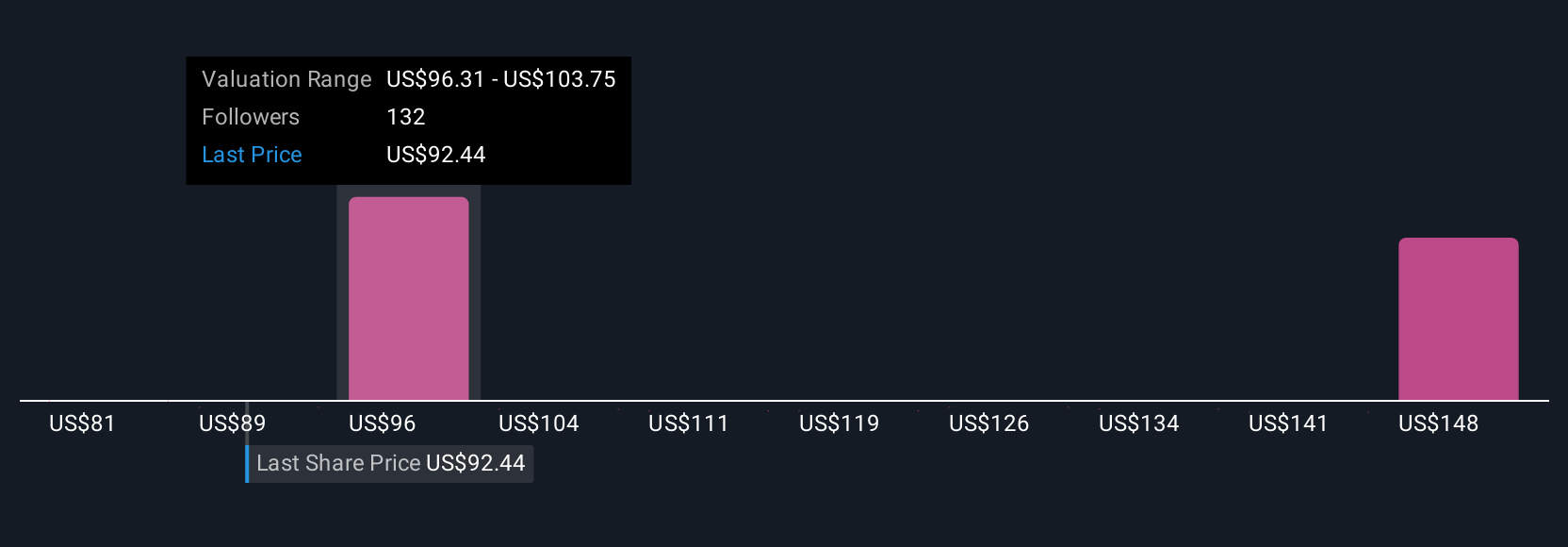

Twenty-five members of the Simply Wall St Community place Target’s fair value between US$80.46 and US$156.50. While many see room for upside, the breadth of opinions illustrates how concerns about margin compression and competitive pricing shape views on Target’s future performance.

Explore 25 other fair value estimates on Target - why the stock might be worth as much as 78% more than the current price!

Build Your Own Target Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Target research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Target research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Target's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 31 stocks are leading the charge.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.