Please use a PC Browser to access Register-Tadawul

The Bull Case For V2X (VVX) Could Change Following New Amazon AI Logistics Partnership – Learn Why

V2X Inc VVX | 68.59 | -3.22% |

- V2X, Inc. recently announced a partnership with Amazon to deploy smart warehousing and automation technologies, including advanced computer-vision AI, across V2X-managed warehouses serving U.S. Government customers.

- This collaboration highlights how combining Amazon’s robotics and AI capabilities with V2X’s mission support footprint could reshape logistics, readiness, and decision-making for complex government operations.

- We’ll now examine how this Amazon-enabled push into AI-driven smart warehousing and logistics may influence V2X’s broader investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is V2X's Investment Narrative?

To own V2X, you really have to believe in its ability to turn a broad U.S. Government services footprint into higher quality, data-enabled mission solutions while keeping profitability on an upward track. Recent results already show earnings bouncing back from prior years of pressure, but margins and interest cover remain thin, so near term catalysts still hinge on solid execution of large contracts like W‑TRS, DEA fleet support, and DLA JETS 2.0, plus disciplined integration of new awards. The fresh Amazon partnership fits into this by potentially strengthening V2X’s positioning on AI-first warehousing and logistics bids, although the financial impact is unlikely to be immediately material given its early stage and the absence of updated guidance. It may, however, tilt the story toward higher-value, tech-enabled work and slightly recalibrate both the upside and the execution risk profile.

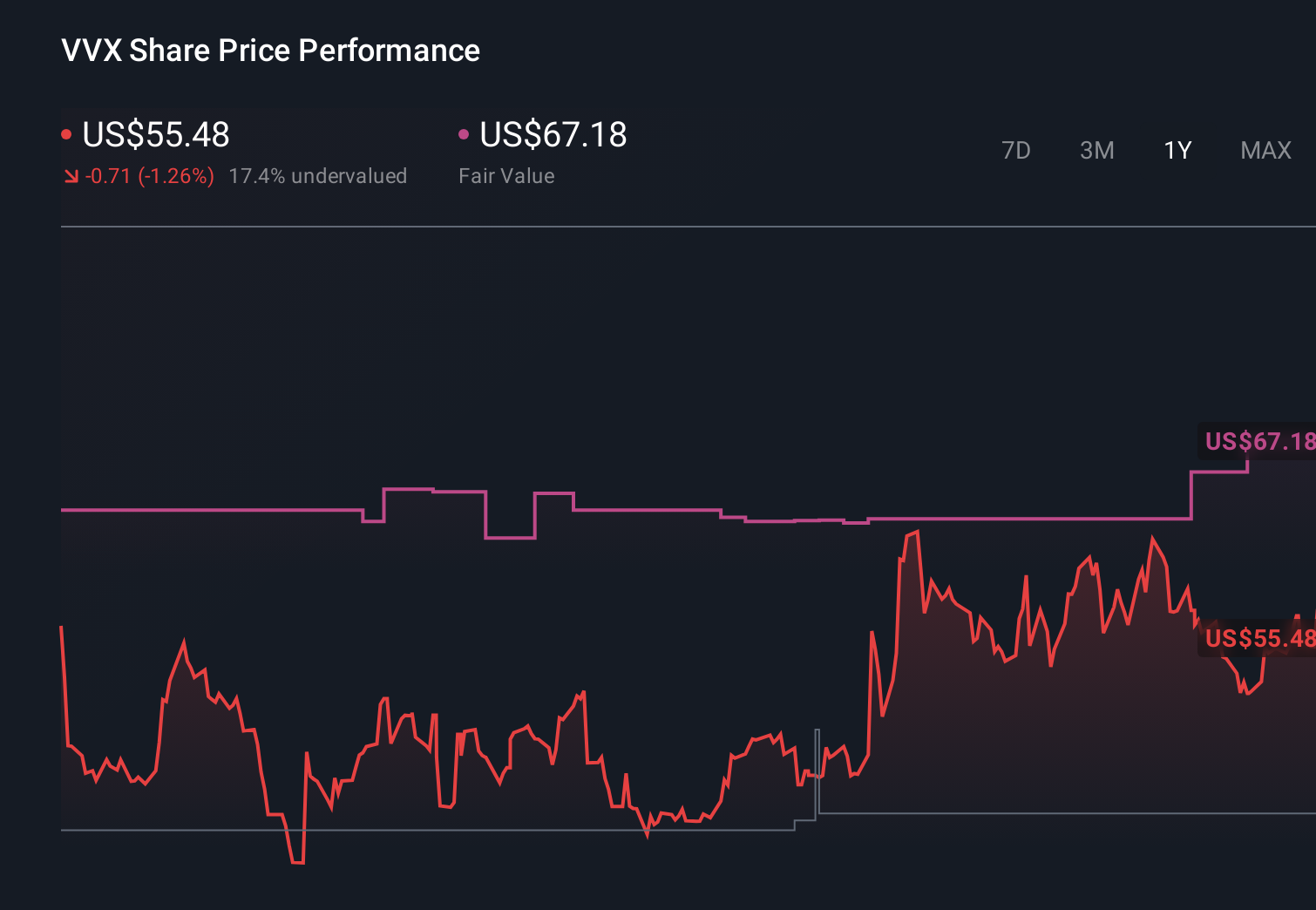

However, there is one funding-related risk here that investors should not overlook. Despite retreating, V2X's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 4 other fair value estimates on V2X - why the stock might be worth 46% less than the current price!

Build Your Own V2X Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your V2X research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free V2X research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate V2X's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 110 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.