Please use a PC Browser to access Register-Tadawul

The Bull Case For Zymeworks (ZYME) Could Change Following Early Phase 1 Data Reveal for ZW191

Zymeworks Inc. ZYME | 25.48 | +2.17% |

- Zymeworks announced the acceptance of a poster presentation on early Phase 1 results for its FR-targeting antibody-drug conjugate, ZW191, at the AACR-NCI-EORTC Conference held in Boston from October 22–26, 2025.

- This development spotlights Zymeworks' ongoing innovation in targeted cancer therapies, as ZW191 is designed to deliver a proprietary payload to tumors expressing folate receptor alpha, common in certain ovarian and lung cancers.

- We'll examine how anticipation for Phase 1 ZW191 results may influence Zymeworks' long-term pipeline and partnership outlook.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Zymeworks Investment Narrative Recap

Owning shares in Zymeworks means believing in the company's ability to advance novel biotherapeutics and capitalize on milestones and royalties from partnerships, while managing the risks of early-stage pipeline concentration. The acceptance of preliminary Phase 1 ZW191 results for a major conference raises investor attention, but the short-term catalyst, milestone and royalty progress from partnered assets, remains the central focus. At this stage, the ZW191 update does not materially change the most important catalyst or the risk profile of pipeline clinical setbacks.

A particularly relevant recent announcement is the discontinuation of ZW171 development, which highlights the inherent clinical risks faced by the company's early-stage assets. This underscores why every early clinical milestone, including the ZW191 poster, draws scrutiny from investors tracking the pipeline's ability to produce future revenue streams and reduce dependence on partnership success.

By contrast, investors should also be aware of the heightened impact that any clinical or regulatory failure in the early-stage pipeline could have on future revenue and margin prospects...

Zymeworks is expected to reach $150.9 million in revenue and $24.2 million in earnings by 2028. This projection assumes annual revenue growth of 7.1%, with earnings set to increase by $97.9 million from the current -$73.7 million.

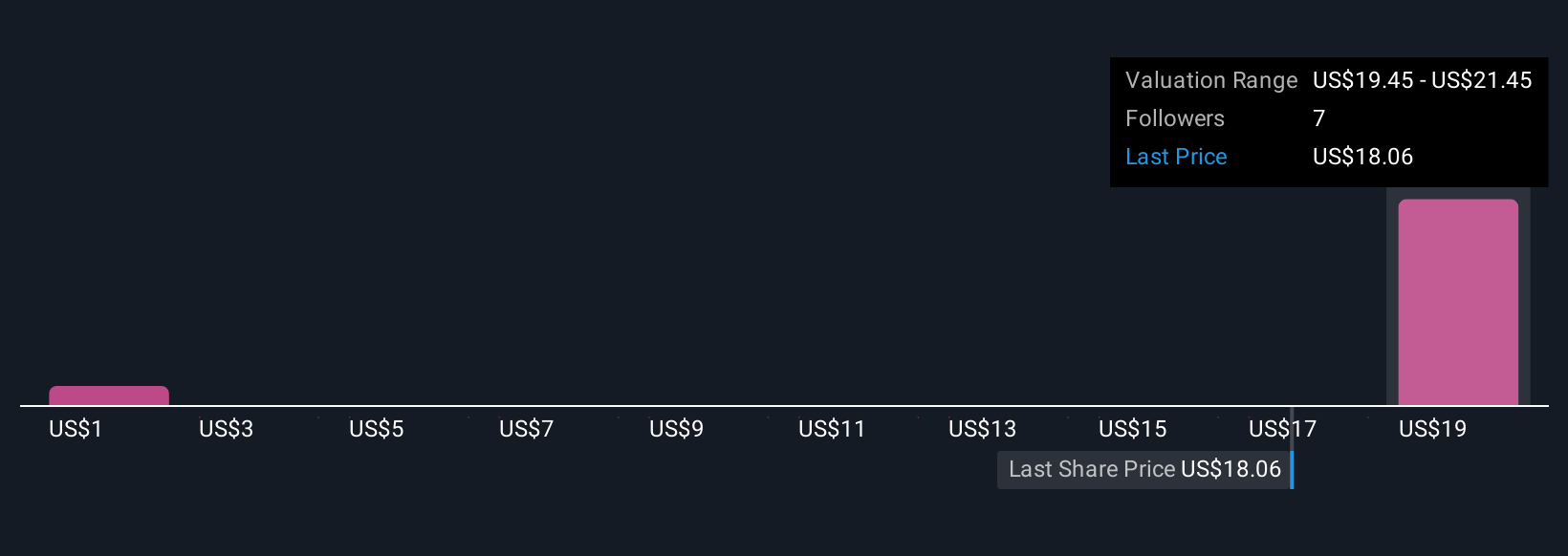

Uncover how Zymeworks' forecasts yield a $21.45 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members’ fair value estimates for Zymeworks stock range from US$1.43 to US$21.45, based on just two individual analyses. Keep in mind, pipeline concentration risk means setbacks in early-stage programs could reshape how the broader market views sustainable growth.

Explore 2 other fair value estimates on Zymeworks - why the stock might be worth as much as 17% more than the current price!

Build Your Own Zymeworks Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zymeworks research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Zymeworks research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zymeworks' overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.