Please use a PC Browser to access Register-Tadawul

The Price Is Right For Reddit, Inc. (NYSE:RDDT) Even After Diving 25%

Reddit, Inc. Class A RDDT | 150.17 | +2.76% |

Reddit, Inc. (NYSE:RDDT) shares have had a horrible month, losing 25% after a relatively good period beforehand. The recent drop has obliterated the annual return, with the share price now down 9.7% over that longer period.

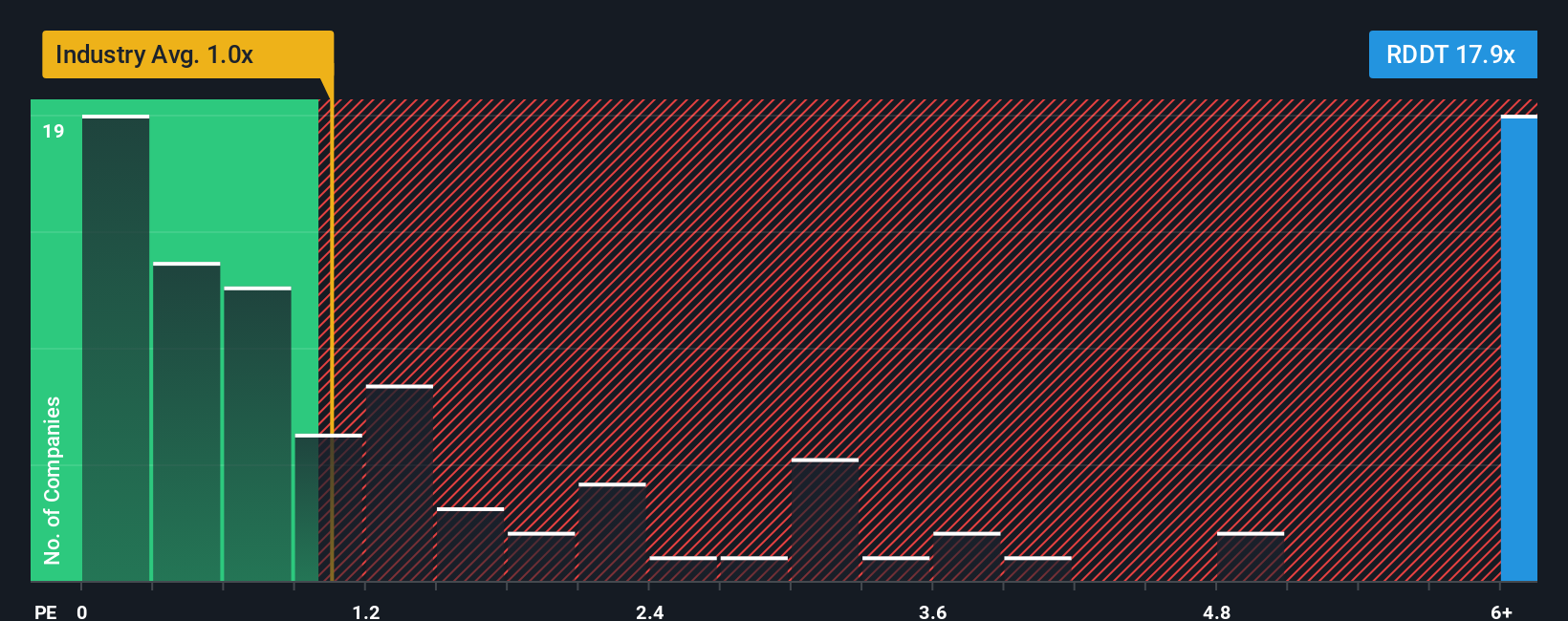

Although its price has dipped substantially, given around half the companies in the United States' Interactive Media and Services industry have price-to-sales ratios (or "P/S") below 1x, you may still consider Reddit as a stock to avoid entirely with its 17.9x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

How Has Reddit Performed Recently?

With revenue growth that's superior to most other companies of late, Reddit has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Reddit's future stacks up against the industry? In that case, our free report is a great place to start.How Is Reddit's Revenue Growth Trending?

Reddit's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered an exceptional 70% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 196% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 35% per year as estimated by the analysts watching the company. With the industry only predicted to deliver 15% each year, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Reddit's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Even after such a strong price drop, Reddit's P/S still exceeds the industry median significantly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Reddit maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Interactive Media and Services industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Reddit with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.