Please use a PC Browser to access Register-Tadawul

The RealReal, Inc.'s (NASDAQ:REAL) Share Price Is Still Matching Investor Opinion Despite 29% Slump

TheRealReal REAL | 11.11 | -0.45% |

The RealReal, Inc. (NASDAQ:REAL) shareholders won't be pleased to see that the share price has had a very rough month, dropping 29% and undoing the prior period's positive performance. Looking at the bigger picture, even after this poor month the stock is up 51% in the last year.

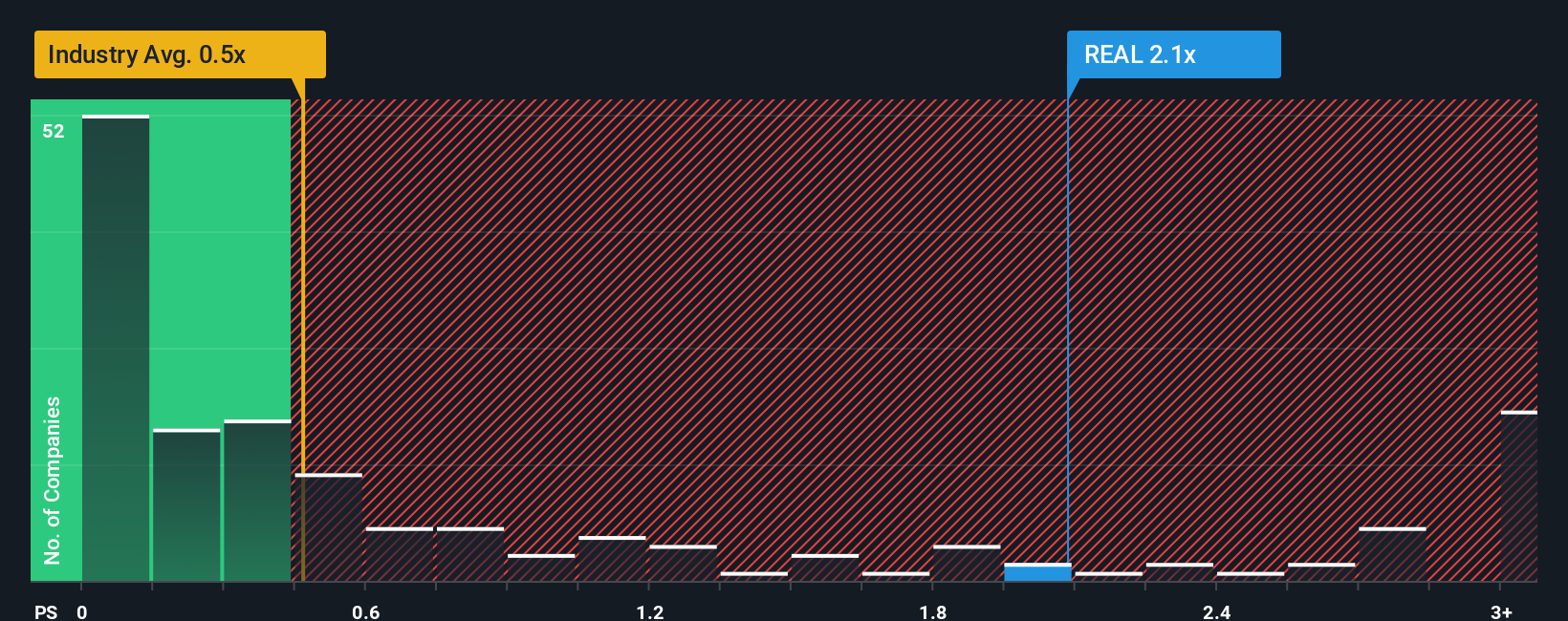

In spite of the heavy fall in price, given close to half the companies operating in the United States' Specialty Retail industry have price-to-sales ratios (or "P/S") below 0.5x, you may still consider RealReal as a stock to potentially avoid with its 2.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

How RealReal Has Been Performing

With revenue growth that's superior to most other companies of late, RealReal has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think RealReal's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For RealReal?

The only time you'd be truly comfortable seeing a P/S as high as RealReal's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a decent 14% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 13% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 12% as estimated by the nine analysts watching the company. That's shaping up to be materially higher than the 7.7% growth forecast for the broader industry.

In light of this, it's understandable that RealReal's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On RealReal's P/S

There's still some elevation in RealReal's P/S, even if the same can't be said for its share price recently. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that RealReal maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Specialty Retail industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.