Please use a PC Browser to access Register-Tadawul

The Timken Company's (NYSE:TKR) Shares Not Telling The Full Story

Timken Company TKR | 84.14 | -1.90% |

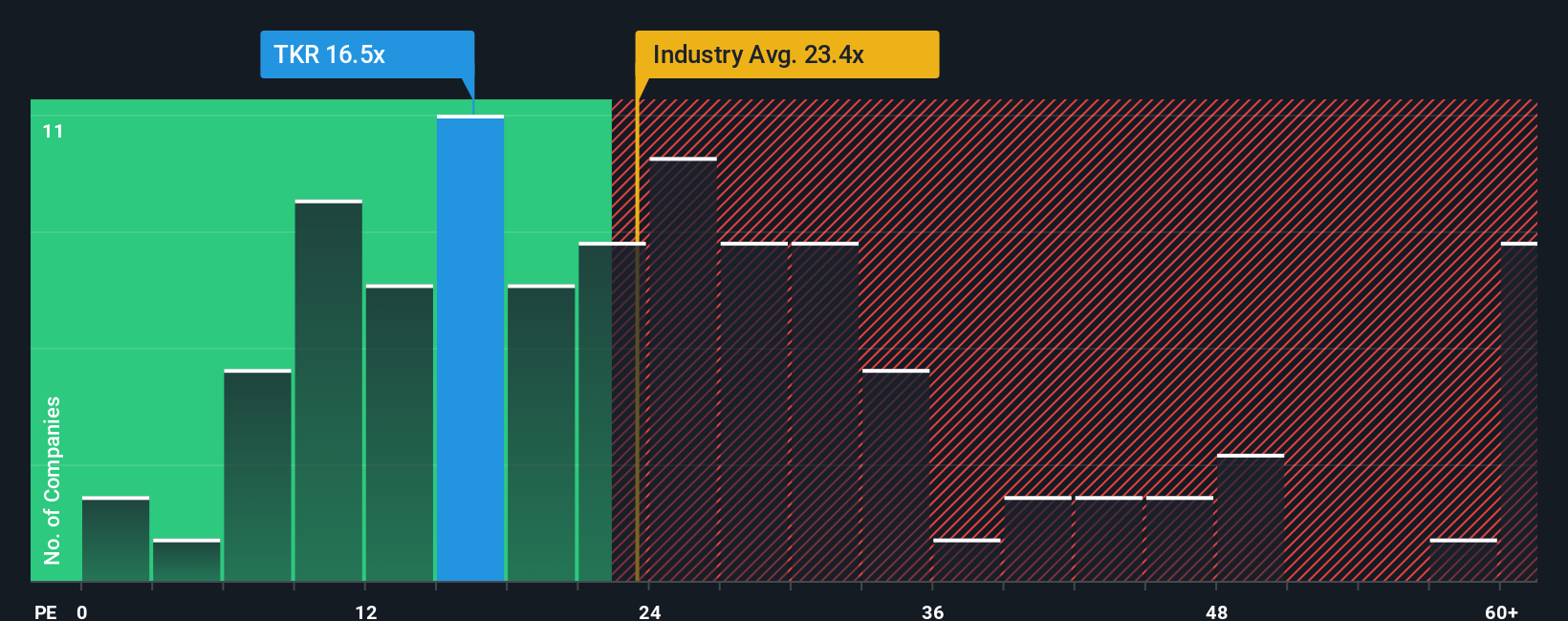

The Timken Company's (NYSE:TKR) price-to-earnings (or "P/E") ratio of 16.5x might make it look like a buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 19x and even P/E's above 34x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Timken hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Timken would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 5.3% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 10% each year as estimated by the eleven analysts watching the company. That's shaping up to be similar to the 10% per year growth forecast for the broader market.

With this information, we find it odd that Timken is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On Timken's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Timken's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

You always need to take note of risks, for example - Timken has 1 warning sign we think you should be aware of.

If these risks are making you reconsider your opinion on Timken, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.