Please use a PC Browser to access Register-Tadawul

The Trade Desk Shares Spike 15% After Hours — Here's Why The Stock Is Trending Tonight

ANSYS, Inc. ANSS | 374.30 374.30 | Delist 0.00% Pre |

Citigroup Inc. C | 111.28 111.90 | -1.35% +0.56% Pre |

The Trade Desk TTD | 36.64 36.56 | +1.24% -0.22% Pre |

Trade Desk Inc. (NASDAQ:TTD) is trending on Tuesday, following the announcement of its inclusion in the S&P 500 index.

Check out how TTD stock is trading here.

What Happened: The Trade Desk’s stock price soared by 14.68% to $86.50 in after-hours trading on Monday, following the S&P 500 inclusion announcement. This development comes after the S&P Dow Jones Indices revealed that The Trade Desk would replace ANSYS Inc. (NASDAQ:ANSS) in the S&P 500, effective from the market open on July 18.

The stock of Trade Desk- a demand-side platform has been on a steady rise, with a previous close of $75.38. The company’s shares have been trading between $75.30 and $77.77, with a market cap of $37.07 billion.

See Also: This Is ‘One Of The Hottest Stocks In The Universe,’ Jim Cramer Says

Why It Matters: The Trade Desk’s inclusion in the S&P 500 index is a milestone for the company. This move is expected to attract more investors and increase the company’s visibility in the market.

Earlier in the month, Citigroup Inc. (NYSE:C) maintained a buy rating on The Trade Desk and raised its price target to $90. This was followed by a bearish move by financial giants, as revealed by Benzinga’s analysis of options history for Trade Desk TTD, which showed 44% of traders were bullish, while 48% showed bearish tendencies.

On the day of the S&P 500 inclusion announcement, The Trade Desk was among the top stocks that gained the attention of retail traders and investors.

Price in Action: According to Benzinga Pro data, Trade Desk stock closed at $75.43, down 0.07% on the day, before surging 14.68% to $86.50 during after-hours trading.

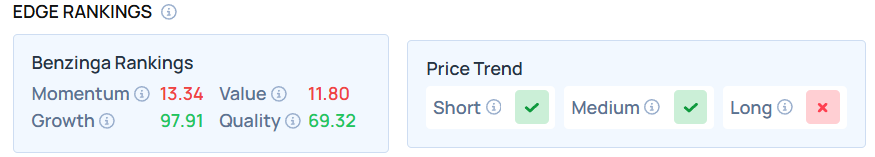

Benzinga’s Edge Stock Rankings highlight TTD has a standout Growth score of 97.91. Track the performance of other players in this segment.

Read Next:

- Cathie Wood Doubles Down On Tesla Amid Elon Musk’s Feud With Trump, Sells $3 Million Worth Of Coinbase Stock – Grayscale Bitcoin Mini Trust (BTC) Common units of fractional undivided beneficial intere

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo Courtesy: Lek_charoen on Shutterstock.com