Please use a PC Browser to access Register-Tadawul

There's No Escaping Biofrontera Inc.'s (NASDAQ:BFRI) Muted Revenues Despite A 42% Share Price Rise

Biofrontera Inc. BFRI | 0.89 | -4.22% |

Those holding Biofrontera Inc. (NASDAQ:BFRI) shares would be relieved that the share price has rebounded 42% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 7.4% in the last twelve months.

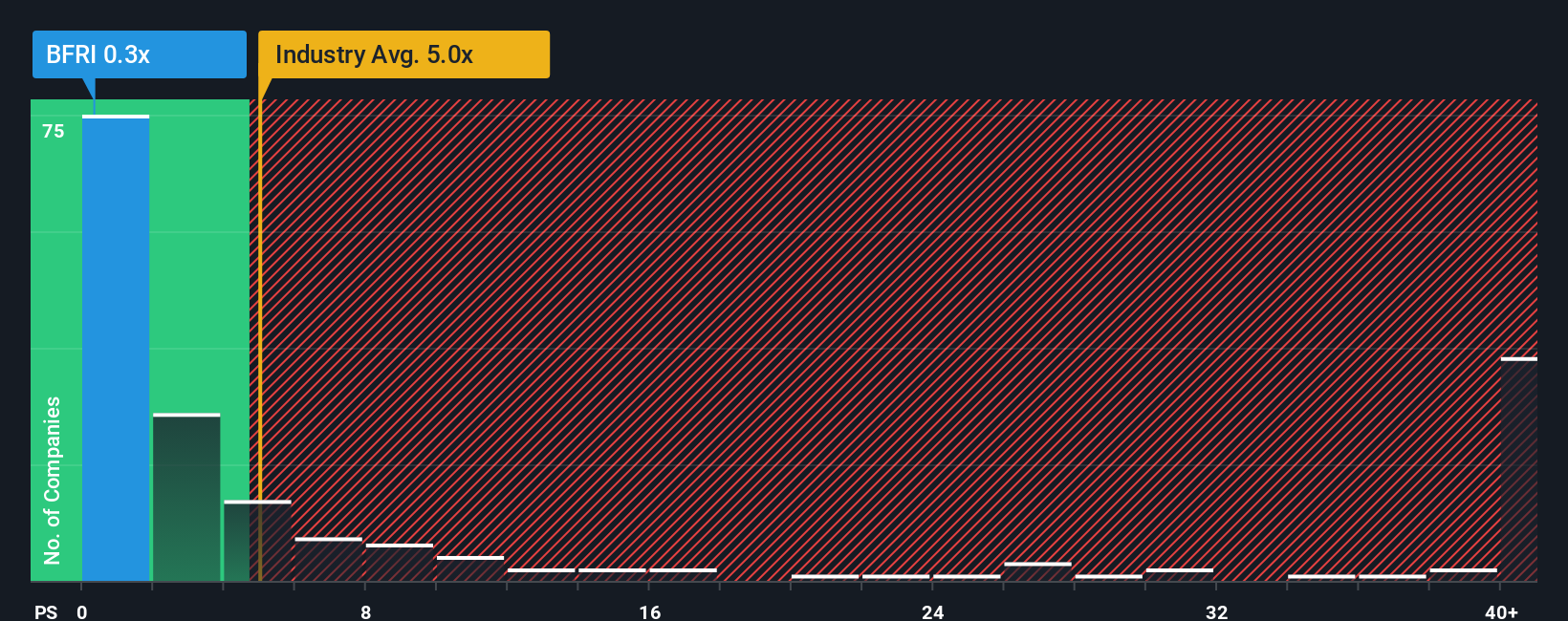

Although its price has surged higher, Biofrontera may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.3x, since almost half of all companies in the Pharmaceuticals industry in the United States have P/S ratios greater than 5.2x and even P/S higher than 29x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

How Biofrontera Has Been Performing

Recent times haven't been great for Biofrontera as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Biofrontera.Is There Any Revenue Growth Forecasted For Biofrontera?

Biofrontera's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered a decent 5.1% gain to the company's revenues. Pleasingly, revenue has also lifted 34% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 17% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 33% each year, which is noticeably more attractive.

In light of this, it's understandable that Biofrontera's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Shares in Biofrontera have risen appreciably however, its P/S is still subdued. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As expected, our analysis of Biofrontera's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Biofrontera (at least 2 which are significant), and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.