Please use a PC Browser to access Register-Tadawul

There's No Escaping Townsquare Media, Inc.'s (NYSE:TSQ) Muted Revenues Despite A 37% Share Price Rise

Townsquare Media, Inc. Class A TSQ | 6.72 | +2.28% |

Townsquare Media, Inc. (NYSE:TSQ) shares have had a really impressive month, gaining 37% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 22% in the last twelve months.

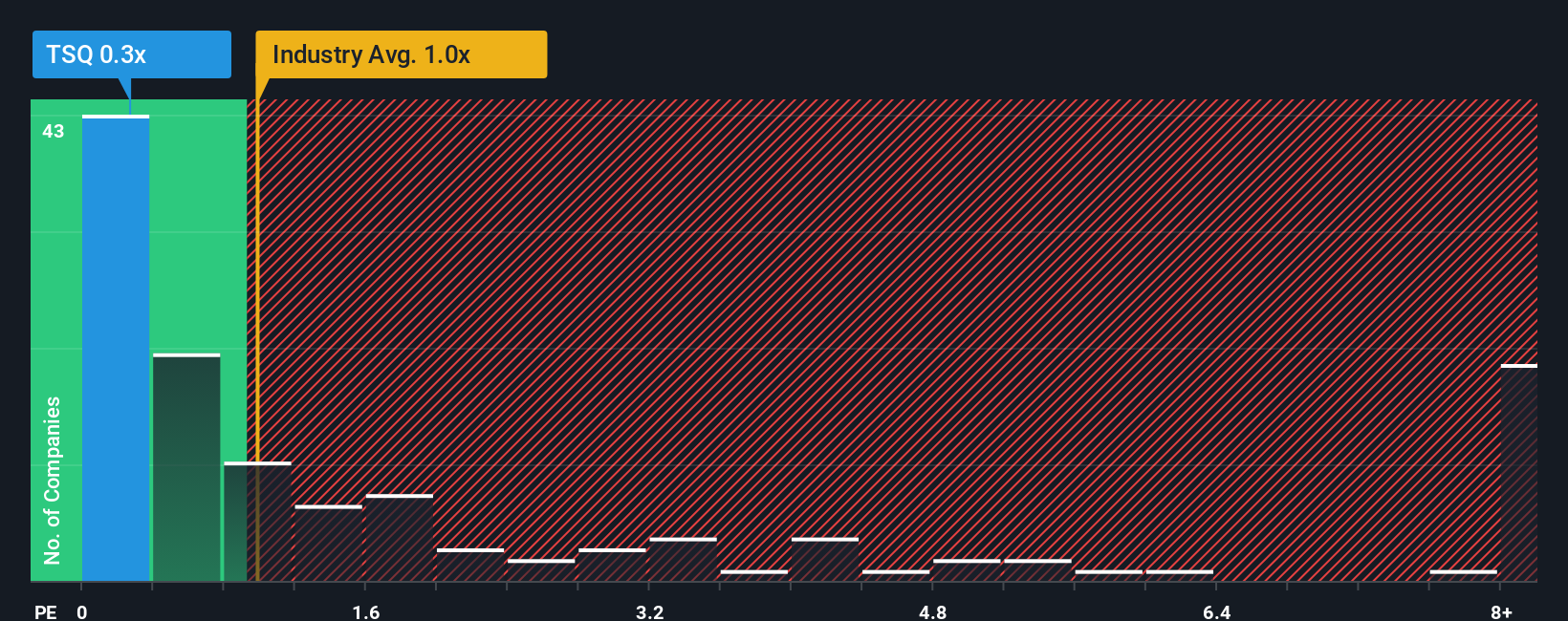

Although its price has surged higher, Townsquare Media may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.3x, since almost half of all companies in the Media industry in the United States have P/S ratios greater than 1x and even P/S higher than 3x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

How Has Townsquare Media Performed Recently?

Townsquare Media hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Townsquare Media will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Townsquare Media?

The only time you'd be truly comfortable seeing a P/S as low as Townsquare Media's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.1%. As a result, revenue from three years ago have also fallen 3.2% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 1.5% as estimated by the two analysts watching the company. With the industry predicted to deliver 7.6% growth, that's a disappointing outcome.

With this in consideration, we find it intriguing that Townsquare Media's P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Townsquare Media's P/S

The latest share price surge wasn't enough to lift Townsquare Media's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Townsquare Media's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

If these risks are making you reconsider your opinion on Townsquare Media, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.