Please use a PC Browser to access Register-Tadawul

These Analysts Revise Their Forecasts On Abbott Following Q2 Results

Abbott Laboratories ABT | 125.46 | +1.77% |

Abbott Laboratories (NYSE:ABT) reported better-than-expected sales and profits in the second quarter, but dialed back earnings and growth projections for the rest of the year.

The company reported second-quarter sales of $11.14 billion, beating the consensus of $11.07 billion. The U.S. MedTech giant reported adjusted earnings of $1.26, beating the consensus of $1.25, and within the management guidance of $1.23-$1.27.

"Halfway through the year, we delivered high single-digit organic sales growth, double-digit EPS growth, significantly expanded our margin profiles, and continued to advance key programs through our new product pipeline," said Robert B. Ford, chairman and chief executive officer, Abbott. "We see this momentum carrying into 2026."

Abbott narrowed full-year 2025 adjusted earnings guidance from $5.05-$5.25 per share to $5.10-$5.20 per share compared to the consensus of $5.16. The company expects organic sales growth of 7.5%-8.0% compared to prior guidance of 7.5%-8.5%, or 6.0% to 7.0% when including COVID-19 testing-related sales.

Abbott forecasts an adjusted operating margin of approximately 23.5% of sales, down from prior guidance of 23.5%- 24.0%. Abbott expected third-quarter 2025 adjusted earnings of $1.28-$1.32 per share, compared to the consensus of $1.34 per share.

Abbott shares dipped 8.5% to close at $120.51 on Thursday.

These analysts made changes to their price targets on Abbott following earnings announcement.

- BTIG analyst Marie Thibault maintained Abbott Laboratories with a Buy and lowered the price target from $148 to $145.

- Jefferies analyst Matthew Taylor upgraded Abbott from Hold to Buy and raised the price target from $143 to $145.

- Mizuho analyst Anthony Petrone maintained Abbott with a Neutral and lowered the price target from $140 to $135.

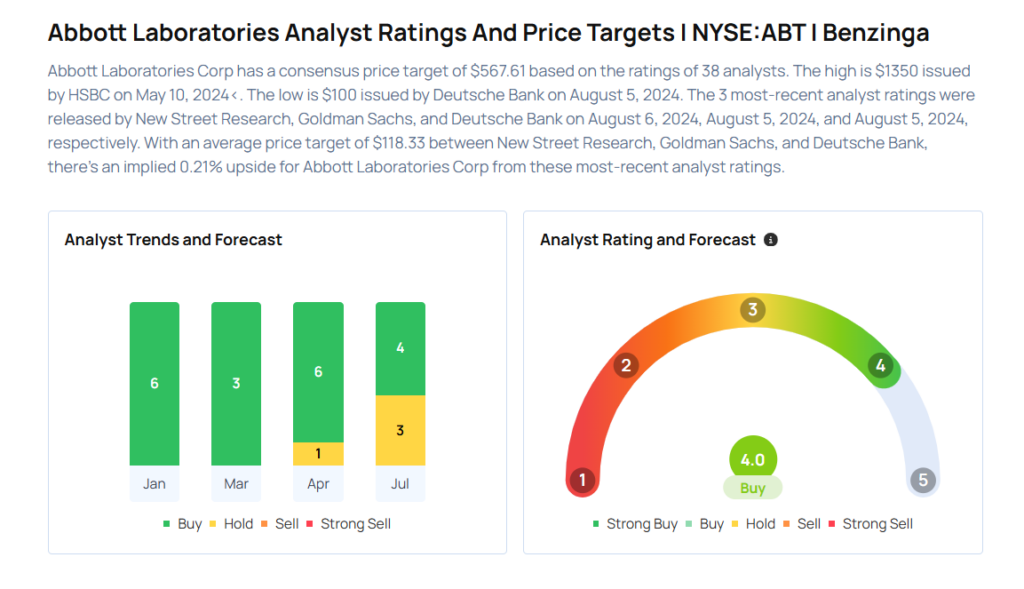

Considering buying ABT stock? Here’s what analysts think:

Read This Next:

- Top 2 Defensive Stocks That Are Ticking Portfolio Bombs

Photo via Shutterstock