Please use a PC Browser to access Register-Tadawul

ThredUp (TDUP): Assessing Valuation After Bullish Forecast and Strategic Shift Toward AI-Driven U.S. Growth

thredUP, Inc. Class A TDUP | 8.23 | -1.56% |

ThredUp (TDUP) made waves at the Wells Fargo 8th Annual Consumer Conference by rolling out a bullish forecast and unveiling some pivotal strategic shifts. The company’s move to concentrate on its U.S. business while exiting Europe, combined with an increased emphasis on artificial intelligence, sent a clear signal to investors that growth remains firmly on the agenda. With management predicting a 25% jump in third quarter revenue and touting early wins from AI, including an 18% boost in new customer conversions, it is no wonder the stock caught fresh attention.

These upbeat projections and operational changes have already had an impact. ThredUp’s stock posted a 25% gain over the past three months, putting it well ahead of the broader market and showing that investors are responding positively to the renewed growth plan. Year to date, shares are up more than 6%, while a 10% climb in the past year caps a period of clear momentum. ThredUp’s focus on cash flow and tech-driven efficiency stands out alongside its annual revenue and net income growth, but the market appears quick to price in the company’s shifts.

So after this surge of optimism and recent gains, is ThredUp still a bargain for long-term investors, or are expectations already running ahead of reality?

Most Popular Narrative: 19% Undervalued

The prevailing narrative suggests ThredUp remains significantly undervalued, with a fair value estimate well above its current market price.

"The closure of the de minimis loophole and the introduction of new tariffs are making fast fashion and new apparel imports more expensive. This increases the relative value proposition and attractiveness of secondhand platforms like ThredUp, which should support further customer acquisition and drive strong revenue growth.

Rising consumer awareness of sustainability and growing interest in circular fashion models continue to expand the addressable market for online resale. This is creating lasting demand tailwinds that are likely to boost volume growth and top-line revenue for ThredUp."

Curious how bold, long-term projections are fueling this bullish valuation? The narrative hinges on sector-shifting regulatory changes, ambitious growth forecasts, and an industry-defying future profit multiple. Wondering which specific numbers underpin this confidence? Explore the full narrative for the tantalizing details behind ThredUp's supposed discount.

Result: Fair Value of $13.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ThredUp’s path is not without hazards. Rising customer acquisition costs or waning secondhand demand could undermine these optimistic projections.

Find out about the key risks to this ThredUp narrative.Another View: Market Multiples Challenge the Discount

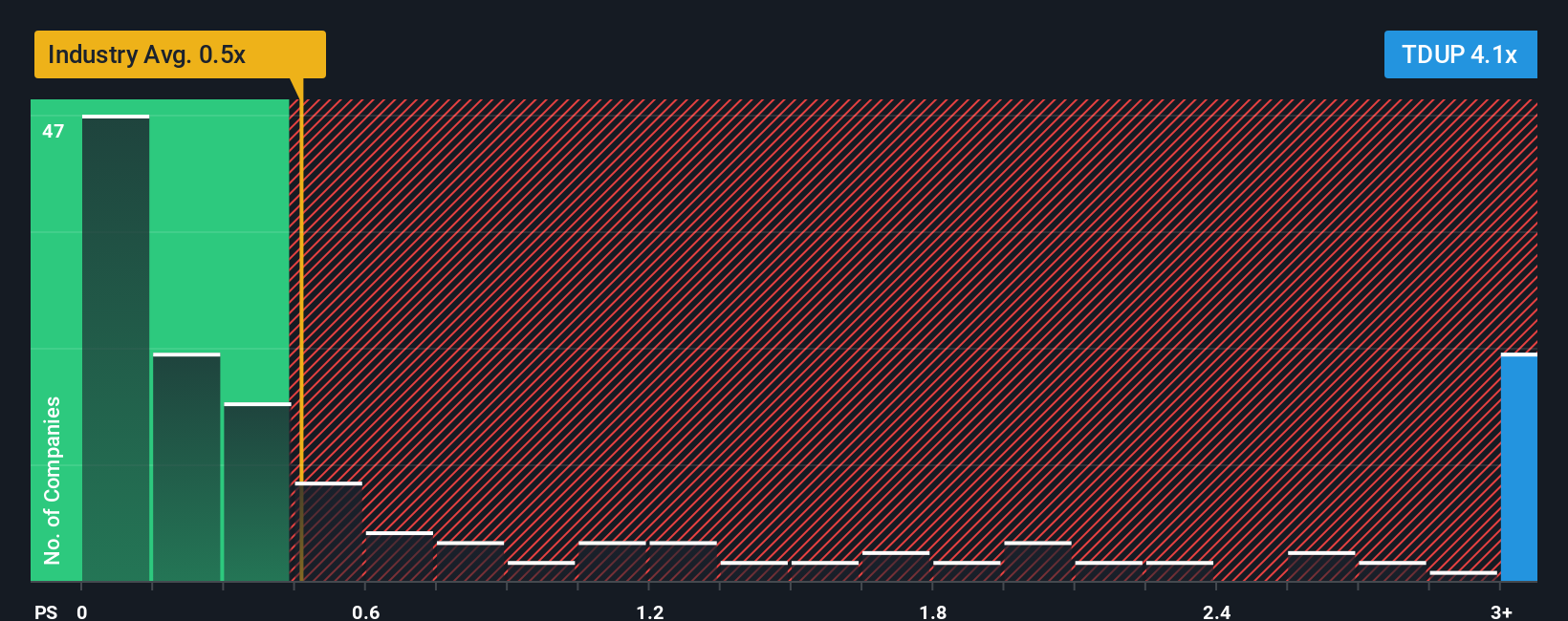

While the consensus and DCF model point to ThredUp as undervalued, a look at its price-to-sales ratio tells a different story. This suggests the stock trades at a premium compared to most industry peers. Which perspective is closer to reality?

Build Your Own ThredUp Narrative

If you are the type of investor who likes to dig into the data or draw your own conclusions, you have the tools at your fingertips. Take just a few minutes to shape your own take on ThredUp’s story. Do it your way.

A great starting point for your ThredUp research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always stay ahead by exploring a variety of market opportunities. Open yourself to new possibilities and stock ideas tailored for different strategies and risk levels with the Simply Wall Street screener suite.

- Uncover tomorrow’s tech disruptors and stay on the cutting edge by checking out AI penny stocks leading the charge in artificial intelligence innovation.

- Tap into stocks with impressive income potential by evaluating companies offering dividend stocks with yields > 3% for portfolios hungry for steady yields above 3%.

- Spot value gems missed by the crowd when you target hidden bargains among undervalued stocks based on cash flows backed by strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.