Please use a PC Browser to access Register-Tadawul

Tilray (TLRY) Is Down 5.9% After DOJ Nixes Cannabis Rules and Eyes Reverse Stock Split – Has the Bull Case Changed?

Tilray Brands TLRY | 12.15 | +44.13% |

- In recent days, Tilray Brands faced a setback as the Department of Justice canceled pending cannabis rules, causing regulatory uncertainty and prompting the company to consider measures such as a reverse stock split to meet Nasdaq listing standards.

- This development comes as Tilray continues to report sizable net income losses and contends with mounting financial and compliance pressures within the competitive cannabis sector.

- We'll explore how this regulatory reversal could affect Tilray Brands' long-term efforts to stabilize its financial position and global ambitions.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 29 companies in the world exploring or producing it. Find the list for free.

Tilray Brands Investment Narrative Recap

To own Tilray Brands stock, investors generally need to be confident in the global momentum for cannabis legalization and Tilray’s ability to capitalize on these opportunities, even as regulatory slowdowns and financial pressures continue to weigh. The Department of Justice’s cancellation of pending cannabis rules has increased near-term uncertainty around U.S. market access, impacting sentiment but not fundamentally altering the fact that maintaining Nasdaq listing compliance remains the most urgent, short-term catalyst. The primary risk right now is Tilray’s persistent operating losses, which have implications for both solvency and shareholder dilution.

Among the corporate actions, Tilray’s approved reverse stock split is particularly relevant, as it aims to support Nasdaq compliance following the recent regulatory setbacks in the United States. This move follows significant net income losses and is a clear effort to stabilize the company’s market position, helping address short-term listing risks that could affect access to capital and institutional support.

By contrast, investors should be aware that despite the focus on regulatory changes and compliance actions, Tilray’s ongoing inability to achieve profitability leaves open questions on future dilution and financial stability…

Tilray Brands is projected to reach $940.4 million in revenue and $193.4 million in earnings by 2028. This outlook assumes a 4.6% annual revenue growth and a $2.4 billion increase in earnings from current earnings of -$2.2 billion.

Uncover how Tilray Brands' forecasts yield a $0.983 fair value, a 12% downside to its current price.

Exploring Other Perspectives

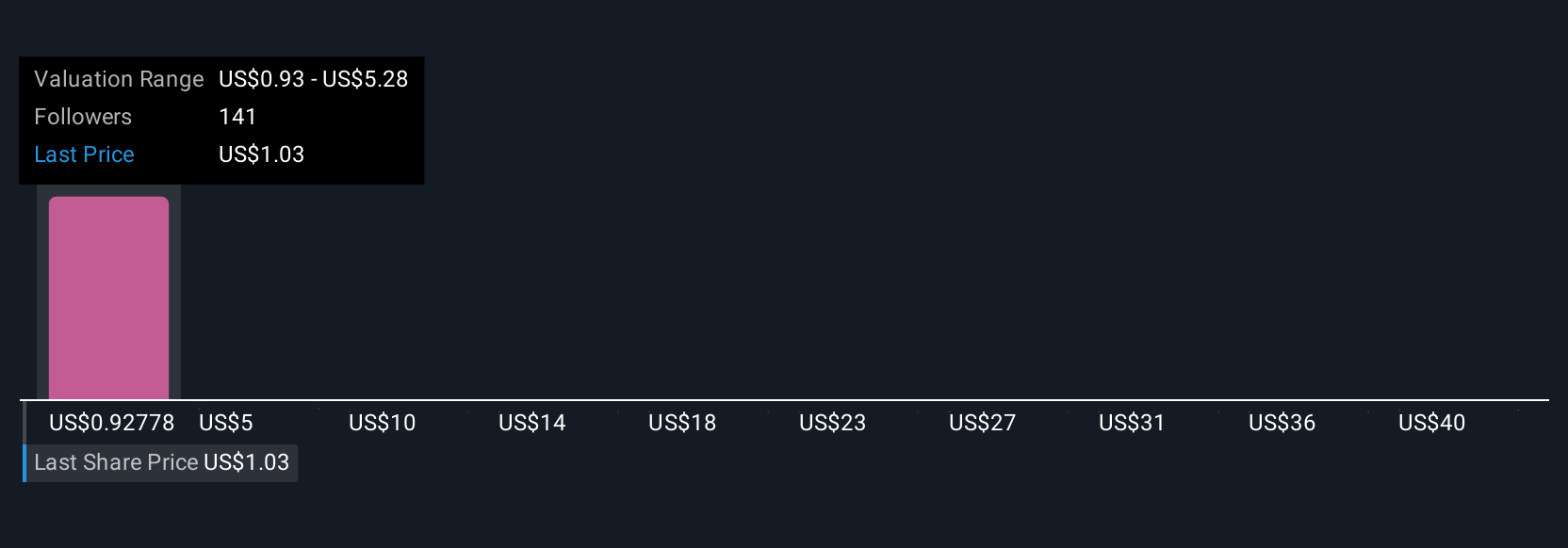

Seventeen Simply Wall St Community members set fair values for Tilray between US$0.98 and US$44.45, revealing sharply diverging outlooks across the board. While many see global legalization trends as a catalyst, persistent net losses may complicate the company’s long-run ambitions, so explore multiple viewpoints before deciding for yourself.

Explore 17 other fair value estimates on Tilray Brands - why the stock might be a potential multi-bagger!

Build Your Own Tilray Brands Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tilray Brands research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Tilray Brands research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tilray Brands' overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 25 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.