Please use a PC Browser to access Register-Tadawul

Timken (TKR) Valuation After 2025 Earnings Miss And New 2026 Guidance

Timken Company TKR | 108.16 | +0.98% |

Timken earnings and guidance catch investor attention

Timken (TKR) has put fresh numbers on the table, reporting fourth quarter and full year 2025 results, alongside new 2026 guidance that outlines expected revenue growth and an earnings per share range.

Timken’s latest earnings, 2026 guidance and ongoing share repurchases have arrived alongside a strong run in the stock. A 30 day share price return of 19.81% and a 1 year total shareholder return of 35.06% indicate building momentum rather than fading interest.

If Timken’s recent move has you thinking about where else capital goods demand and automation trends might show up, it could be worth scanning the market for 30 robotics and automation stocks as potential next ideas.

With Timken trading at US$108.82 after a strong run and management guiding to 2026 EPS of US$4.50 to US$5.00, you have to ask yourself: is there real value left here, or is the market already pricing in future growth?

Most Popular Narrative: 18.2% Overvalued

Timken’s most followed narrative points to a fair value of $92.03 per share, which sits below the current $108.82 price and frames the latest rally in a different light.

The analysts have a consensus price target of $83.952 for Timken based on their expectations of its future earnings growth, profit margins and other risk factors.

In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.9 billion, earnings will come to $474.3 million, and it would be trading on a PE ratio of 15.6x, assuming you use a discount rate of 9.0%.

Want to see what has to happen between now and 2028 for that earnings and margin profile to line up with a higher multiple and discounted cash flow math? The most popular narrative lays out a very specific path for revenue, profitability and valuation that goes well beyond today’s share price and headline guidance.

Result: Fair Value of $92.03 (OVERVALUED)

However, the story can change quickly if industrial demand stays weak or tariffs continue to pressure margins, which would make those 2028 earnings assumptions harder to hit.

Another Angle On Valuation

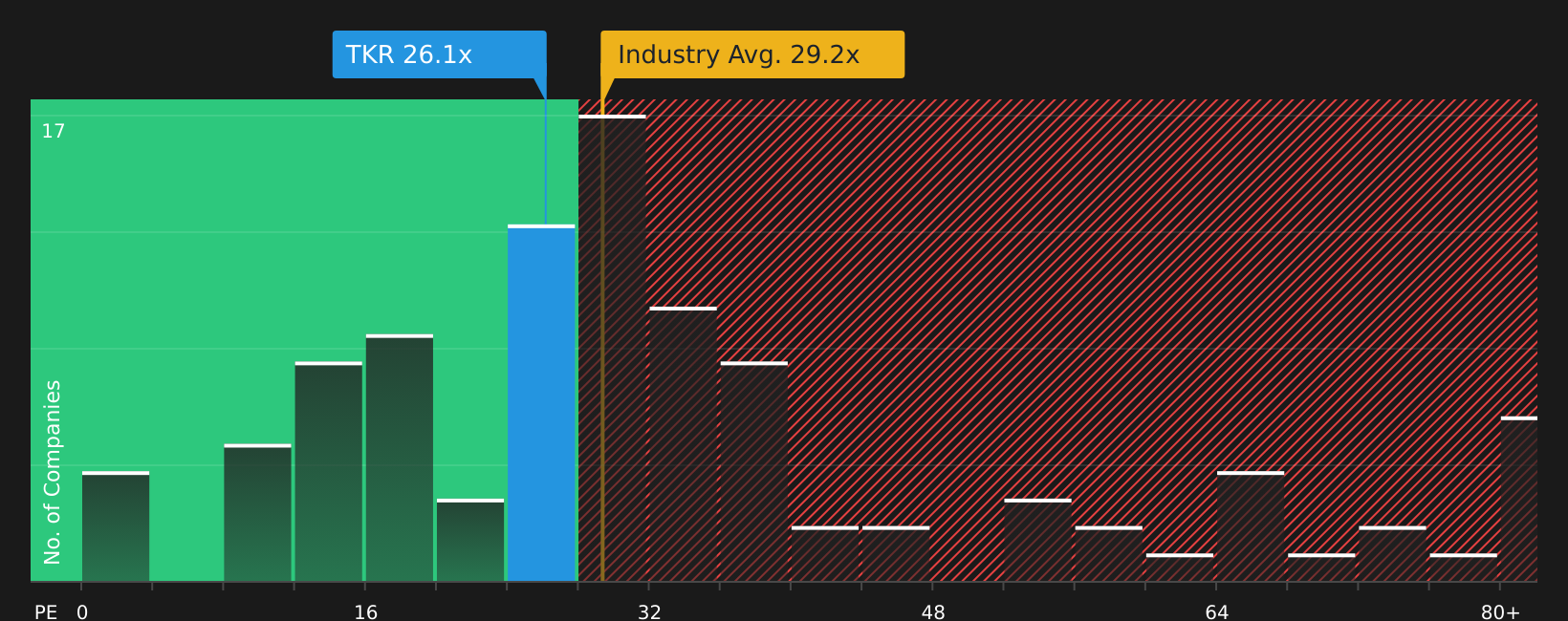

The popular narrative leans on future earnings and a fair value of $92.03, which frames Timken as 18.2% overvalued at $108.82. If you look at today’s P/E of 26.3x though, the picture is different. That multiple sits below the Machinery industry at 29.7x, below a peer average of 46.3x, and very close to a fair ratio of 26.7x our model suggests the market could gravitate toward. So is Timken priced for disappointment on long term cash flows, or simply in line with where similar earnings streams already trade?

Build Your Own Timken Narrative

If you read this and think the assumptions do not quite fit your view, you can stress test the numbers yourself and build a custom thesis in just a few minutes, then Do it your way.

A great starting point for your Timken research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Timken has sharpened your interest, do not stop here. Fresh ideas across sectors could round out your watchlist and help you spot opportunities others miss.

- Zero in on quality by checking companies that screen well on balance sheet strength and fundamentals through our solid balance sheet and fundamentals stocks screener (45 results).

- Hunt for potential mispricings with our list of 52 high quality undervalued stocks that pair solid business profiles with appealing valuations.

- Target reliable income streams with our collection of 13 dividend fortresses that focus on higher yielding, resilient payers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.