Please use a PC Browser to access Register-Tadawul

Titan International, Inc.'s (NYSE:TWI) Price Is Right But Growth Is Lacking After Shares Rocket 28%

Titan International, Inc. TWI | 10.81 | +0.37% |

The Titan International, Inc. (NYSE:TWI) share price has done very well over the last month, posting an excellent gain of 28%. Taking a wider view, although not as strong as the last month, the full year gain of 18% is also fairly reasonable.

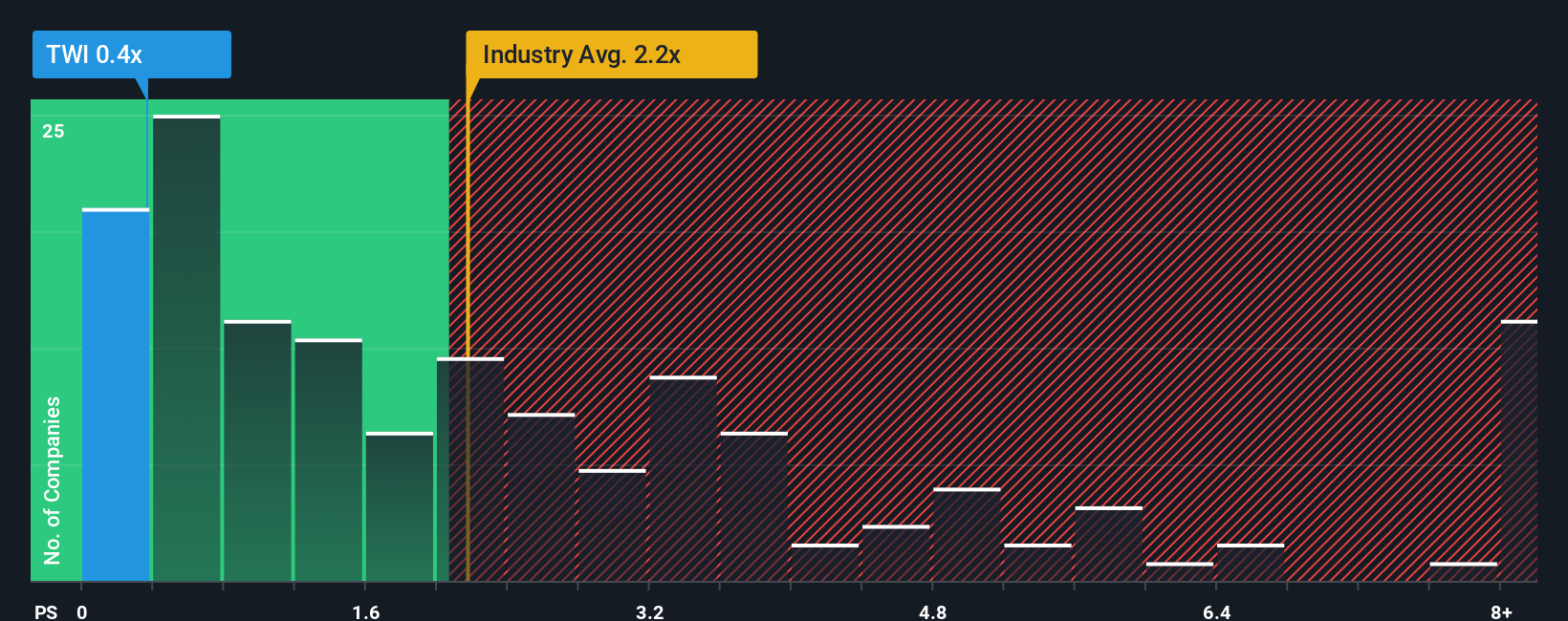

Even after such a large jump in price, it would still be understandable if you think Titan International is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.4x, considering almost half the companies in the United States' Machinery industry have P/S ratios above 2.2x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

What Does Titan International's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Titan International's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Titan International will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Titan International?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Titan International's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 2.8%. As a result, revenue from three years ago have also fallen 16% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 3.8% as estimated by the four analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 22%, which is noticeably more attractive.

In light of this, it's understandable that Titan International's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Titan International's P/S

Despite Titan International's share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Titan International's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Titan International with six simple checks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.