Please use a PC Browser to access Register-Tadawul

Top Growth Companies With Insider Ownership In April 2025

Canaan Inc. CAN | 0.84 | -9.06% |

In April 2025, the U.S. stock market is experiencing significant volatility, with major indices like the Dow Jones Industrial Average and Nasdaq Composite facing steep declines due to escalating trade tensions and newly imposed tariffs. Amidst this turbulent backdrop, investors often seek stability and potential growth by focusing on companies with strong insider ownership, as these firms may demonstrate confidence in their long-term prospects despite current market challenges.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 14.2% | 29.8% |

| Duolingo (NasdaqGS:DUOL) | 14.4% | 37.3% |

| Hims & Hers Health (NYSE:HIMS) | 13.2% | 21.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.4% | 64.8% |

| Astera Labs (NasdaqGS:ALAB) | 15.9% | 61.3% |

| Clene (NasdaqCM:CLNN) | 19.5% | 63.1% |

| BBB Foods (NYSE:TBBB) | 16.2% | 34.6% |

| Niu Technologies (NasdaqGM:NIU) | 36.2% | 82.8% |

| Upstart Holdings (NasdaqGS:UPST) | 12.7% | 100.1% |

| Credit Acceptance (NasdaqGS:CACC) | 14.4% | 33.9% |

We'll examine a selection from our screener results.

Bridgewater Bancshares (NasdaqCM:BWB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bridgewater Bancshares, Inc. is the bank holding company for Bridgewater Bank, offering various banking products and services in the United States, with a market cap of $339.16 million.

Operations: The company's revenue is primarily derived from its banking segment, which generated $106.04 million.

Insider Ownership: 20.3%

Revenue Growth Forecast: 14.9% p.a.

Bridgewater Bancshares demonstrates potential as a growth company with high insider ownership. The firm is trading at 62.5% below its estimated fair value and has earnings projected to grow significantly at 20.1% annually, outpacing the broader US market's growth rate of 13.6%. Despite recent net income declines, analysts agree on a potential stock price increase of 37%. Recent events include a $150 million shelf registration filing and stable preferred dividends, indicating strategic financial planning.

Canaan (NasdaqGM:CAN)

Simply Wall St Growth Rating: ★★★★★☆

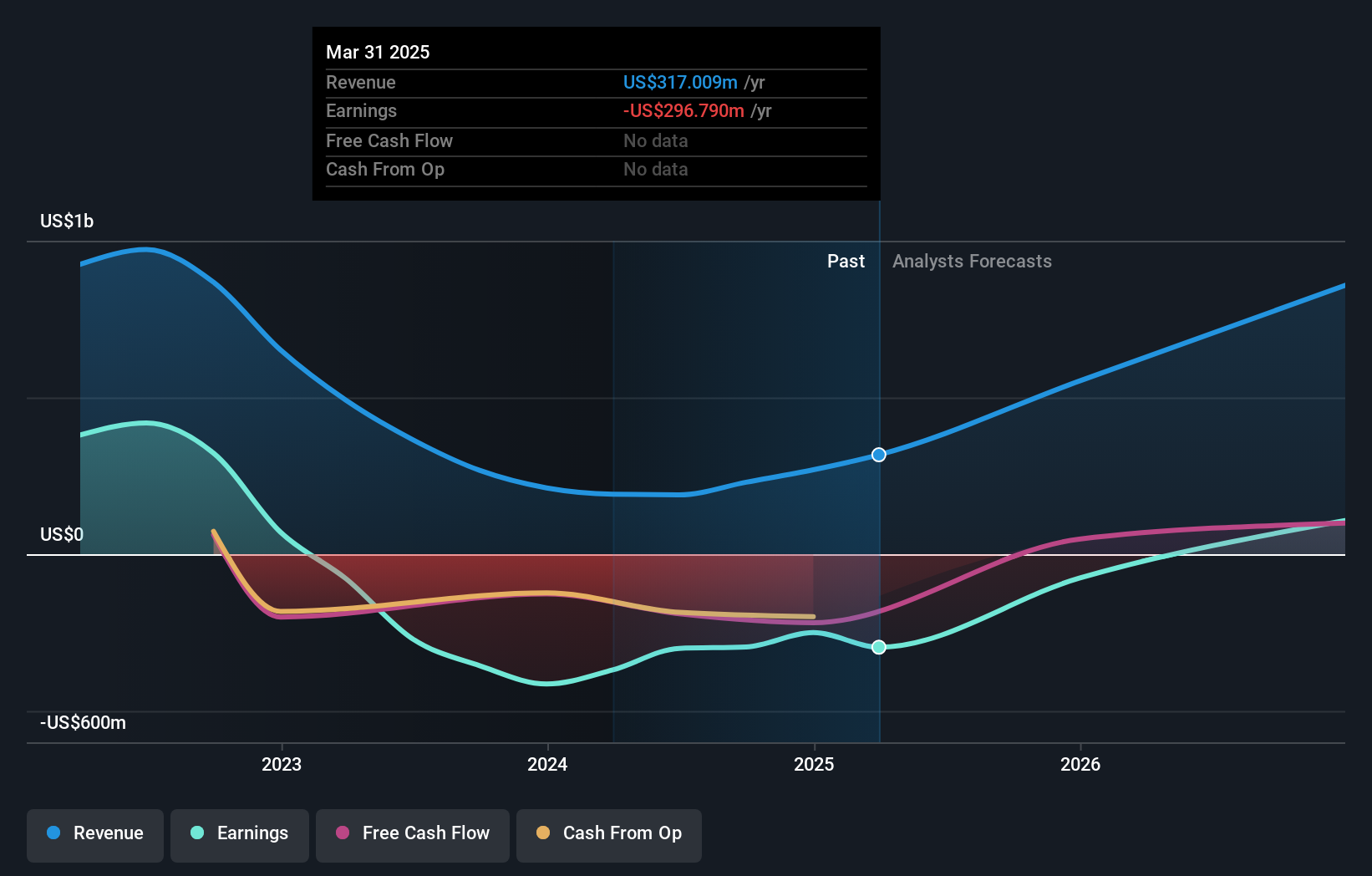

Overview: Canaan Inc. focuses on the research, design, and sale of integrated circuits for bitcoin mining equipment in China, with a market cap of approximately $283.92 million.

Operations: The company's revenue is primarily derived from its semiconductors segment, which generated $269.32 million.

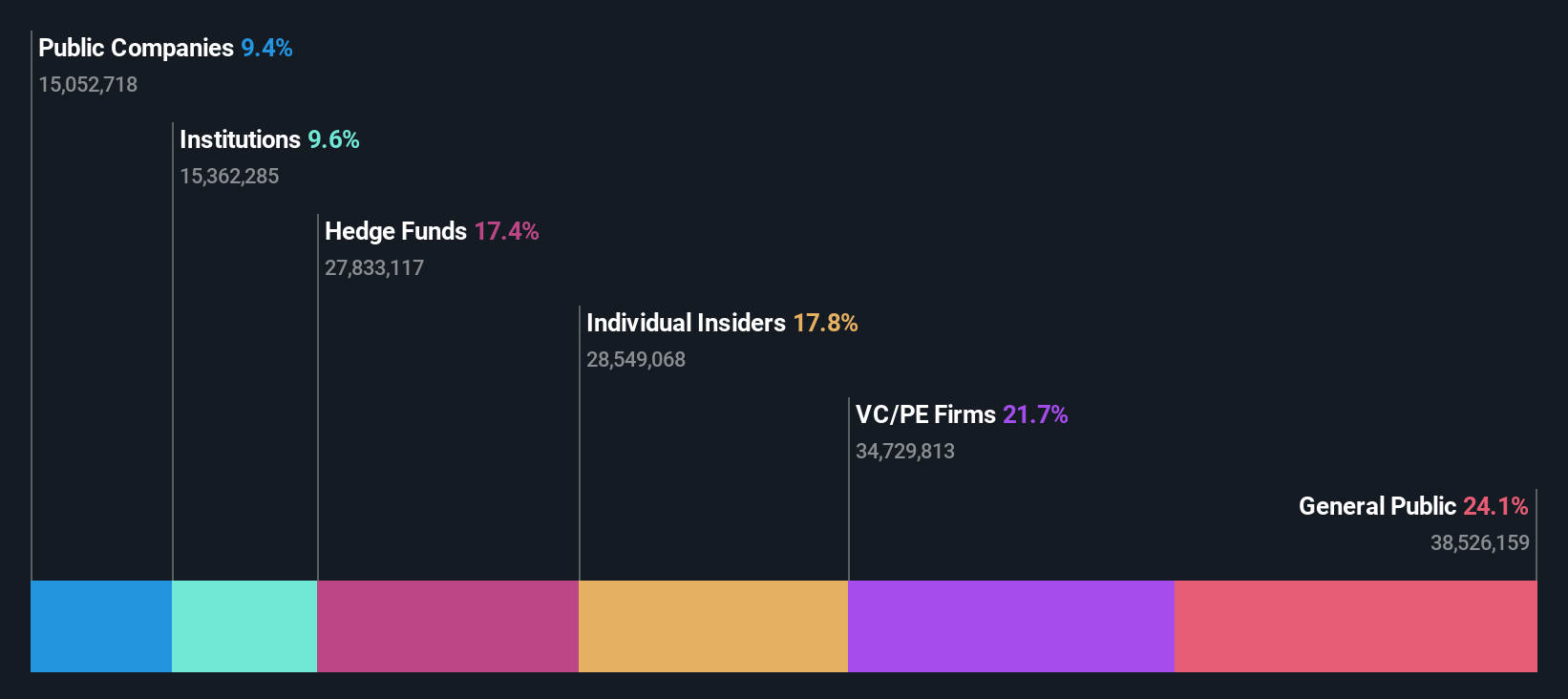

Insider Ownership: 10.1%

Revenue Growth Forecast: 51.5% p.a.

Canaan Inc. illustrates potential as a growth entity with substantial insider ownership, despite recent financial losses. The company has entered a significant digital colocation agreement with Mawson Infrastructure Group, enhancing its operational capacity. Revenue is forecasted to grow significantly at 51.5% annually, outpacing the US market average of 8.2%. Recent earnings show improvement, with revenue reaching US$88.77 million in Q4 2024 and continued expansion into North American mining facilities expected to boost future performance.

ZKH Group (NYSE:ZKH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ZKH Group Limited operates a trading and service platform for maintenance, repair, and operating (MRO) products in China, with a market cap of approximately $0.54 billion.

Operations: The company's revenue segment primarily consists of Business-To-Business Trading and Services of Industrial Products, generating CN¥8.76 billion.

Insider Ownership: 17.7%

Revenue Growth Forecast: 10.7% p.a.

ZKH Group demonstrates growth potential with significant insider ownership, despite recent financial setbacks. The company reported a Q4 2024 net loss of CNY 29.1 million, contrasting last year's profit, yet earnings are forecast to grow over 100% annually. Revenue is expected to increase at a rate faster than the US market average, though below high-growth benchmarks. Analysts agree on a potential stock price rise of 30%, and it trades at good value relative to peers and industry estimates.

Taking Advantage

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 196 more companies for you to explore.Click here to unveil our expertly curated list of 199 Fast Growing US Companies With High Insider Ownership.

- Curious About Other Options? Trump's oil boom is here — pipelines are primed to profit. Discover the 20 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.