Please use a PC Browser to access Register-Tadawul

Top Penny Stocks To Consider In October 2025

loanDepot, Inc. Class A LDI | 2.46 | -5.19% |

As of mid-October 2025, U.S. markets have been grappling with renewed trade tensions between the United States and China, which have overshadowed robust earnings from major banks. In such a climate, investors may look beyond established giants to explore opportunities in lesser-known areas of the market. Penny stocks—often representing smaller or newer companies—can offer intriguing prospects for those seeking potential value and growth. Although the term "penny stock" might seem outdated, these investments can still hold significant promise when backed by strong financials and strategic positioning.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.81 | $396.46M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.79 | $650.99M | ✅ 4 ⚠️ 0 View Analysis > |

| LexinFintech Holdings (LX) | $4.95 | $849.73M | ✅ 4 ⚠️ 1 View Analysis > |

| Global Self Storage (SELF) | $4.90 | $55.1M | ✅ 5 ⚠️ 1 View Analysis > |

| Sensus Healthcare (SRTS) | $3.22 | $52.77M | ✅ 4 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $1.89 | $23.75M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.22 | $547.65M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.98 | $6.99M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.41 | $78.39M | ✅ 3 ⚠️ 2 View Analysis > |

Here's a peek at a few of the choices from the screener.

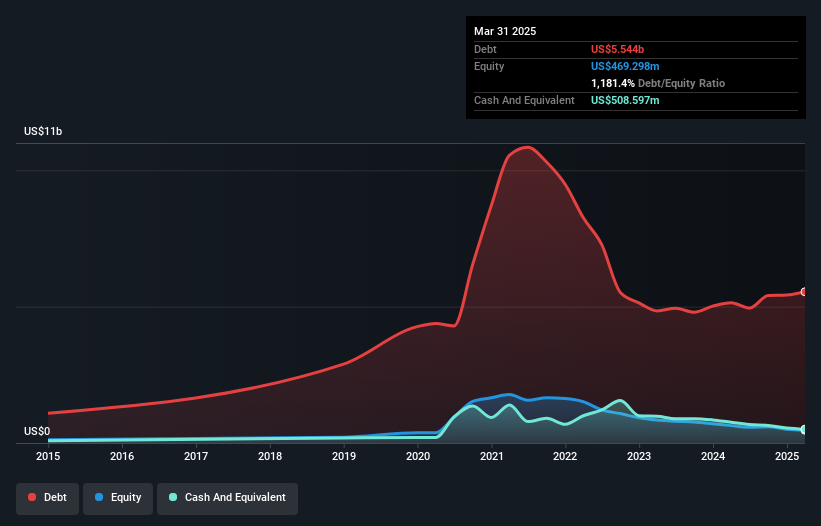

CBAK Energy Technology (CBAT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: CBAK Energy Technology, Inc. and its subsidiaries focus on the manufacture, commercialization, and distribution of standard and customized lithium and sodium batteries across Mainland China, Europe, and other international markets with a market cap of $91.31 million.

Operations: CBAK Energy Technology's revenue is primarily derived from two segments: CBAT, which contributes $97.61 million, and Hitrans, which adds $47.86 million.

Market Cap: $91.31M

CBAK Energy Technology, Inc. faces challenges typical of penny stocks, including a recent notice from Nasdaq for non-compliance with the minimum bid price requirement of US$1.00 per share, risking potential delisting if not resolved by March 2026. The company is currently unprofitable with increasing losses over five years and reported a net loss of US$4.65 million for the first half of 2025 despite generating revenue from lithium and sodium battery segments. While CBAK's debt levels have improved, its short-term assets do not cover liabilities, highlighting financial vulnerabilities amidst volatile trading conditions and market pressures.

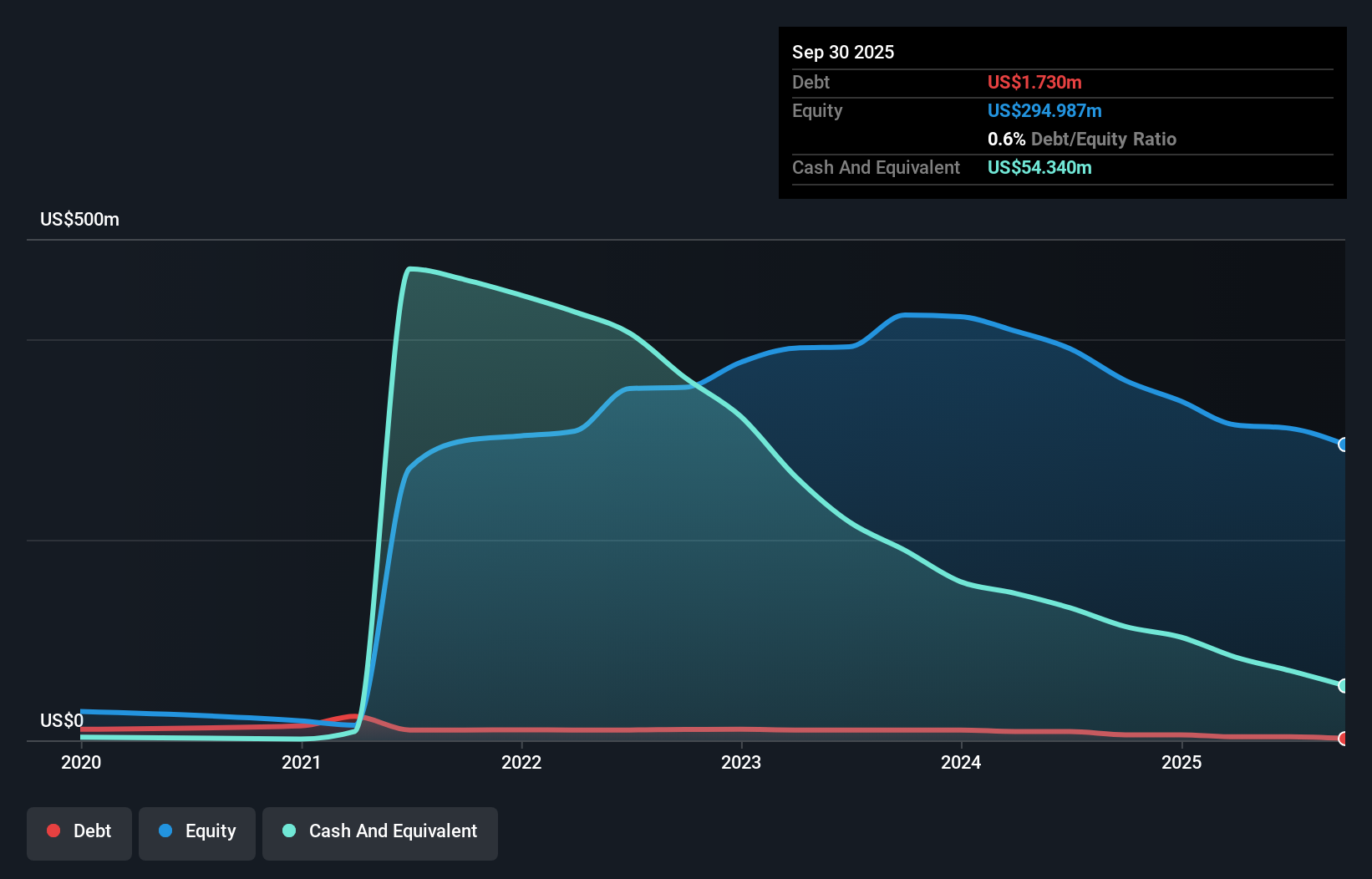

Origin Materials (ORGN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Origin Materials, Inc., along with its subsidiaries, operates as a carbon-negative materials company with a market cap of $83.50 million.

Operations: The company generates revenue through its Specialty Chemicals segment, which reported $28.67 million.

Market Cap: $83.5M

Origin Materials, Inc. is navigating significant challenges typical of penny stocks, including a recent Nasdaq notice for failing to meet the US$1.00 minimum bid price requirement, with a compliance deadline extended to April 2026. The company remains unprofitable with increasing losses over five years and reported a net loss of US$39.19 million for the first half of 2025 despite generating revenue from its Specialty Chemicals segment. While Origin has more cash than debt and sufficient short-term assets to cover liabilities, its share price volatility and declining earnings guidance indicate ongoing financial instability amidst strategic partnerships aiming at sustainable packaging solutions.

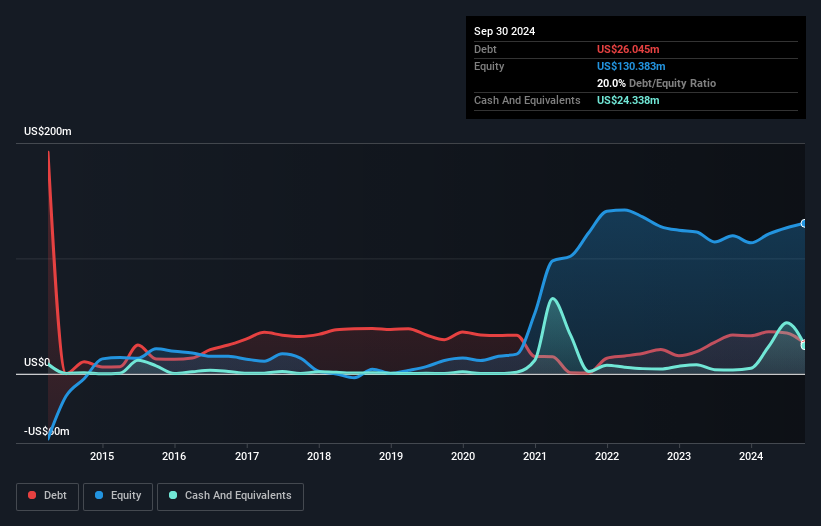

loanDepot (LDI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: loanDepot, Inc. operates in the United States by originating, financing, selling, and servicing residential mortgage loans with a market cap of approximately $969.61 million.

Operations: The company's revenue is primarily derived from its activities in originating, financing, and selling mortgage loans, totaling $1.12 billion.

Market Cap: $969.61M

loanDepot, Inc. faces the challenges typical of penny stocks, with a history of unprofitability and increased losses over the past five years. Despite this, it maintains a robust asset position with US$4.3 billion in short-term assets exceeding both short and long-term liabilities. Recent executive changes aim to leverage emerging technologies like AI for operational efficiency and growth, but high debt levels remain a concern with a net debt to equity ratio considered very high at 1095.6%. The company is focused on returning to profitability through strategic leadership appointments and technology-driven initiatives amidst volatile share prices.

Make It Happen

- Reveal the 363 hidden gems among our US Penny Stocks screener with a single click here.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.