Please use a PC Browser to access Register-Tadawul

Top Penny Stocks To Watch In February 2025

TDH Holdings, Inc. PETZ | 1.04 | +6.12% |

As of February 2025, U.S. markets are experiencing a downturn, with the S&P 500 and Nasdaq Composite declining for four consecutive days due to a slump in major technology stocks like Tesla. Despite this volatility, investors continue to seek opportunities in smaller or less-established companies that may offer significant potential returns. While the term "penny stock" might seem outdated, it still highlights these promising investment avenues; we will explore three such stocks that combine strong financials with growth potential, offering investors an opportunity to uncover hidden value in emerging companies.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $123.69M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.8998 | $6.27M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.90 | $395.93M | ★★★★☆☆ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| North European Oil Royalty Trust (NYSE:NRT) | $4.55 | $41.08M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.58 | $78.86M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.44 | $46.86M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $4.11 | $149.92M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.32 | $24.12M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8239 | $76.37M | ★★★★★☆ |

Let's dive into some prime choices out of the screener.

TDH Holdings (NasdaqCM:PETZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: TDH Holdings, Inc. operates in the restaurant business within the United States and has a market cap of $12.08 million.

Operations: No revenue segments have been reported for this company.

Market Cap: $12.08M

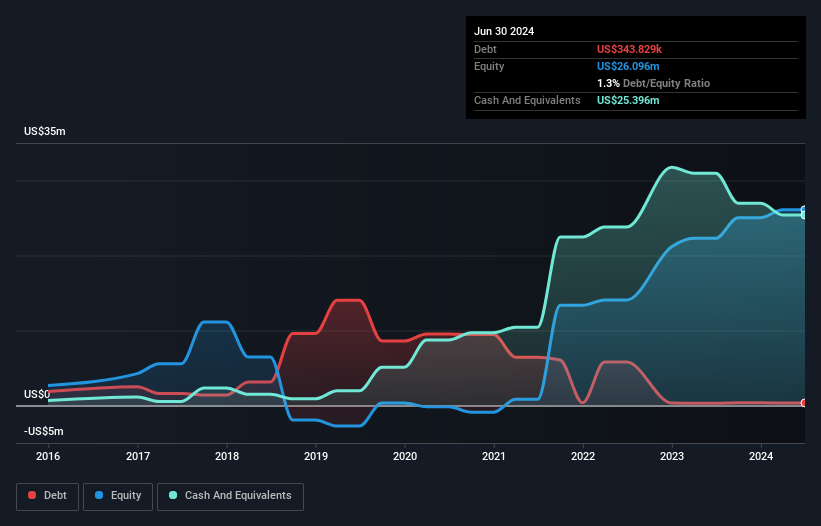

TDH Holdings, Inc., with a market cap of US$12.08 million, reported sales of US$0.103 million for the half year ended June 30, 2024, indicating it is pre-revenue. Despite being unprofitable and having a negative return on equity of -27.26%, the company has managed to reduce losses over five years at an annual rate of 15.6%. Its short-term assets (US$25.6 million) exceed both short-term (US$2.4 million) and long-term liabilities (US$2.2 million), providing financial stability with sufficient cash runway for over three years if free cash flow continues to grow historically.

PharmaCyte Biotech (NasdaqCM:PMCB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PharmaCyte Biotech, Inc. is a biotechnology company focused on developing and commercializing cellular therapies for cancer in the United States, with a market cap of $11.57 million.

Operations: PharmaCyte Biotech, Inc. does not report any specific revenue segments.

Market Cap: $11.57M

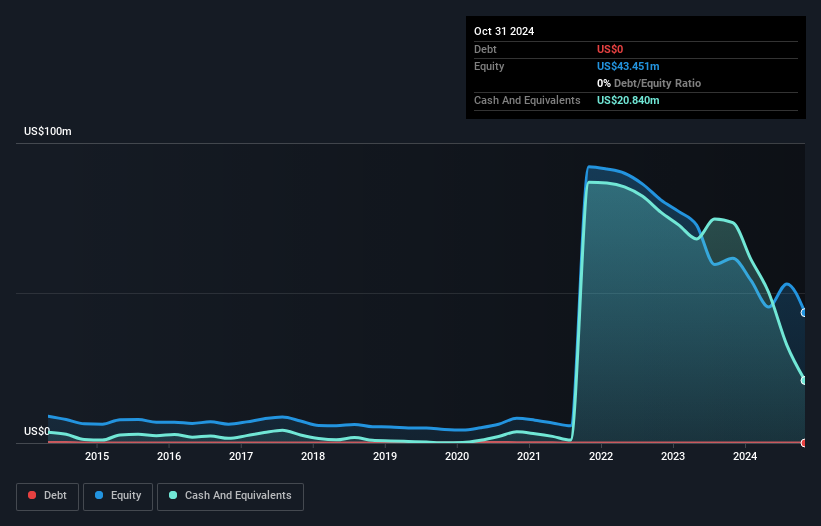

PharmaCyte Biotech, Inc., with a market cap of US$11.57 million, is a pre-revenue biotech firm focusing on cellular therapies for cancer. The company recently reported a significant one-off gain of US$15.9 million, which impacted its financial results for the year ending October 31, 2024. Despite this, it has become profitable over the past year and maintains an outstanding return on equity of 52.2%. With no debt and stable weekly volatility at 8%, PharmaCyte's short-term assets (US$21.3 million) comfortably cover both short-term (US$4.8 million) and long-term liabilities (US$6.9 million).

Vaso (OTCPK:VASO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vaso Corporation, along with its subsidiaries, operates in the healthcare equipment and information technology sectors both domestically and internationally, with a market cap of $22.82 million.

Operations: The company generates revenue from three main segments: IT ($41.62 million), Equipment ($2.26 million), and Professional Sales Service ($37.77 million).

Market Cap: $22.82M

Vaso Corporation, with a market cap of US$22.82 million, operates in the healthcare equipment and IT sectors. Despite being unprofitable, it has significantly reduced its losses over the past five years. The company benefits from a seasoned board with an average tenure of 14 years and an experienced management team. Vaso's financial stability is evident as its short-term assets (US$43 million) exceed both short-term (US$30.2 million) and long-term liabilities (US$18.1 million). Recent executive changes include Edgar Rios as Vice Chairman and Jane Moen as Chief Operating Officer, indicating strategic leadership adjustments for future growth.

Taking Advantage

- Access the full spectrum of 735 US Penny Stocks by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.