Please use a PC Browser to access Register-Tadawul

Top Three Dividend Stocks For Your Portfolio

Scholastic Corporation SCHL | 29.40 | +1.48% |

As the U.S. stock market navigates a period of volatility, with the S&P 500 and Nasdaq recently closing higher despite ongoing tariff concerns, investors are increasingly focused on stable income sources amid economic uncertainty. In this environment, dividend stocks can offer a reliable stream of income and potential for capital appreciation, making them an attractive option for those looking to bolster their portfolios against market fluctuations.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.82% | ★★★★★★ |

| Douglas Dynamics (NYSE:PLOW) | 5.07% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 5.05% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 7.19% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 6.61% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.40% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.98% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.61% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.62% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.75% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

Civista Bancshares (NasdaqCM:CIVB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Civista Bancshares, Inc. is a financial holding company for Civista Bank, offering community banking services in the United States with a market cap of $302.47 million.

Operations: Civista Bancshares, Inc. generates revenue primarily through its banking segment, which amounts to $149.09 million.

Dividend Yield: 3.5%

Civista Bancshares offers a stable dividend history with recent increases, now at US$0.17 per share. Despite being lower than the top 25% of U.S. dividend payers, its payout ratio is sustainable at 31.8%, suggesting dividends are well covered by earnings and forecasted to remain so in three years. Recent earnings showed slight growth, while the stock trades below estimated fair value by 45.2%, offering potential relative value compared to peers and industry averages.

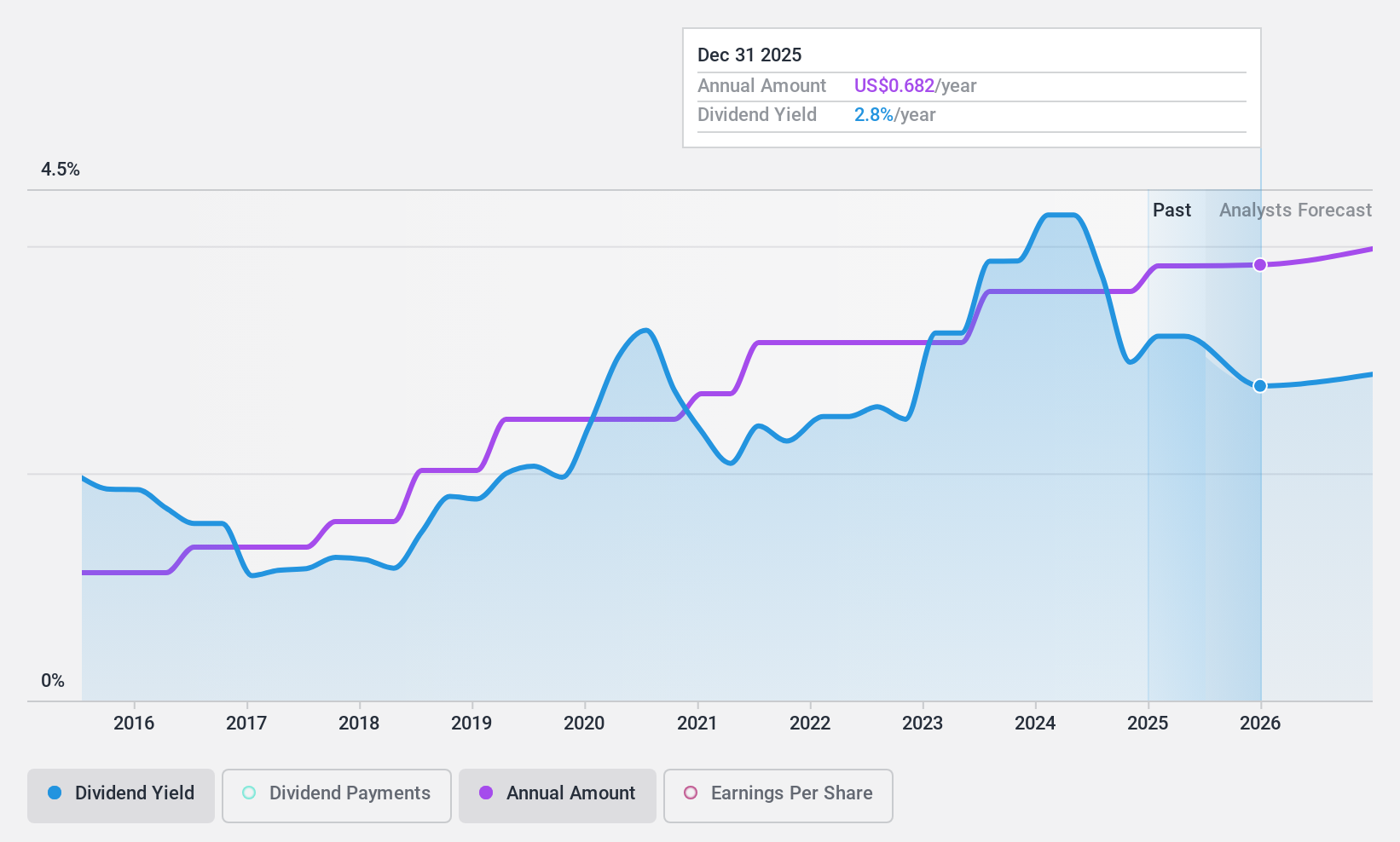

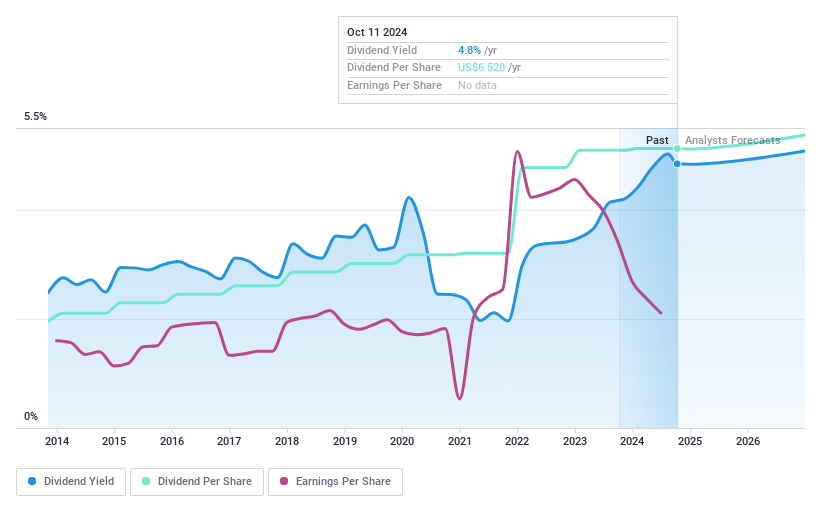

Scholastic (NasdaqGS:SCHL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Scholastic Corporation publishes and distributes children's books worldwide, with a market cap of $503.84 million.

Operations: Scholastic Corporation's revenue is primarily derived from Children's Book Publishing and Distribution ($943 million), Education Solutions ($319.80 million), and International segments ($273.60 million).

Dividend Yield: 4.2%

Scholastic's dividend yield of 4.25% is below the top 25% of U.S. dividend payers, with a high payout ratio of 121.5%, indicating dividends are not well covered by earnings but are supported by cash flows at a 65.3% cash payout ratio. Dividends have been stable and growing over the past decade, though recent profit margins have declined to 1.2%. The company recently completed a significant share buyback, enhancing shareholder value despite trading significantly below its estimated fair value.

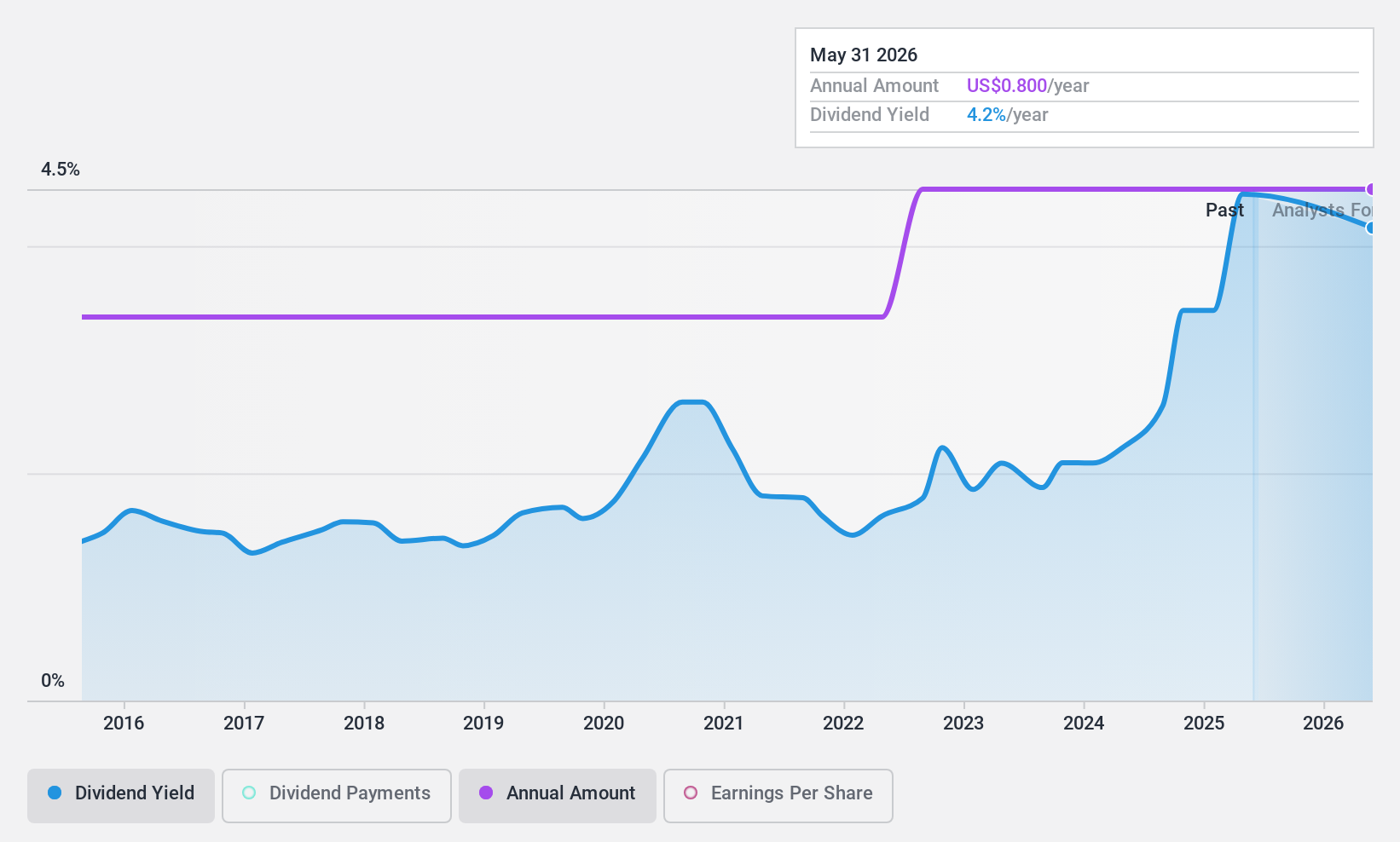

United Parcel Service (NYSE:UPS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: United Parcel Service, Inc. is a package delivery and logistics provider that offers transportation and delivery services, with a market cap of approximately $93.22 billion.

Operations: United Parcel Service, Inc. generates revenue through its key segments: U.S. Domestic at $60.38 billion, International at $17.96 billion, and Supply Chain Solutions at $12.73 billion.

Dividend Yield: 6%

UPS's dividend yield of 5.97% ranks in the top 25% of U.S. dividend payers, but with a high payout ratio of 96.4%, dividends are not well covered by earnings, though cash flows support them at an 88.9% cash payout ratio. Dividends have been stable and growing over the past decade despite a high debt level and recent shareholder activism regarding governance issues, which could impact future policies and decisions on capital allocation.

Where To Now?

- Take a closer look at our Top US Dividend Stocks list of 159 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.