Please use a PC Browser to access Register-Tadawul

Top US Dividend Stocks For October 2024

Dillard's, Inc. Class A DDS | 632.67 | -6.81% |

As the U.S. stock market continues its longest winning streak of the year, with major indices like the S&P 500 and Dow Jones Industrial Average reaching record highs, investors are increasingly turning their attention to stable income sources such as dividend stocks. In this thriving market environment, identifying strong dividend-paying companies can be a strategic way to capitalize on consistent returns while benefiting from potential capital appreciation.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| WesBanco (NasdaqGS:WSBC) | 4.58% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 5.24% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.05% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.36% | ★★★★★★ |

| Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.52% | ★★★★★★ |

| Farmers National Banc (NasdaqCM:FMNB) | 4.51% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.00% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.58% | ★★★★★★ |

| OTC Markets Group (OTCPK:OTCM) | 4.48% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.83% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

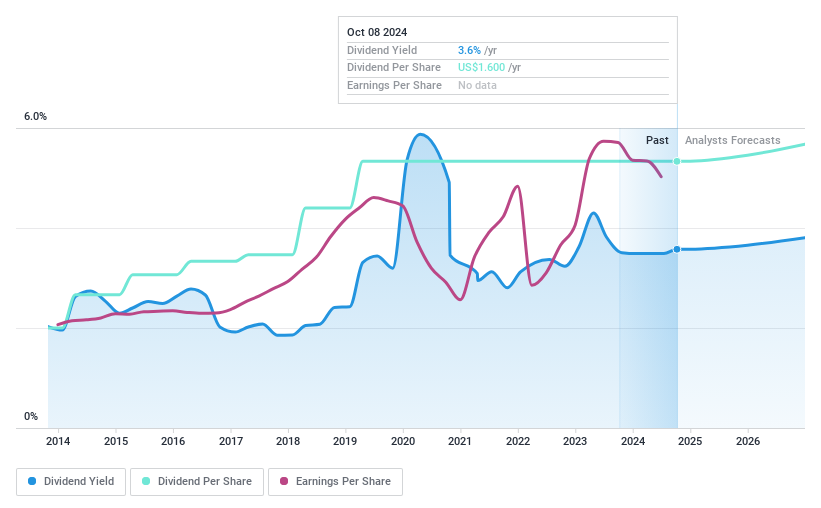

Virginia National Bankshares (NasdaqCM:VABK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Virginia National Bankshares Corporation, with a market cap of $227.24 million, operates as the holding company for Virginia National Bank, offering a variety of commercial and retail banking services.

Operations: Virginia National Bankshares Corporation generates revenue through its comprehensive suite of commercial and retail banking services.

Dividend Yield: 3.1%

Virginia National Bankshares has consistently grown its dividends over the past decade with minimal volatility, maintaining a stable payout. Despite a dividend yield of 3.12%, which is below the top 25% in the US market, its low payout ratio of 45.5% suggests sustainability. Recent earnings show slight declines, but dividends remain affirmed at $0.33 per share quarterly. The stock trades at a significant discount to estimated fair value, enhancing its appeal for value-focused investors.

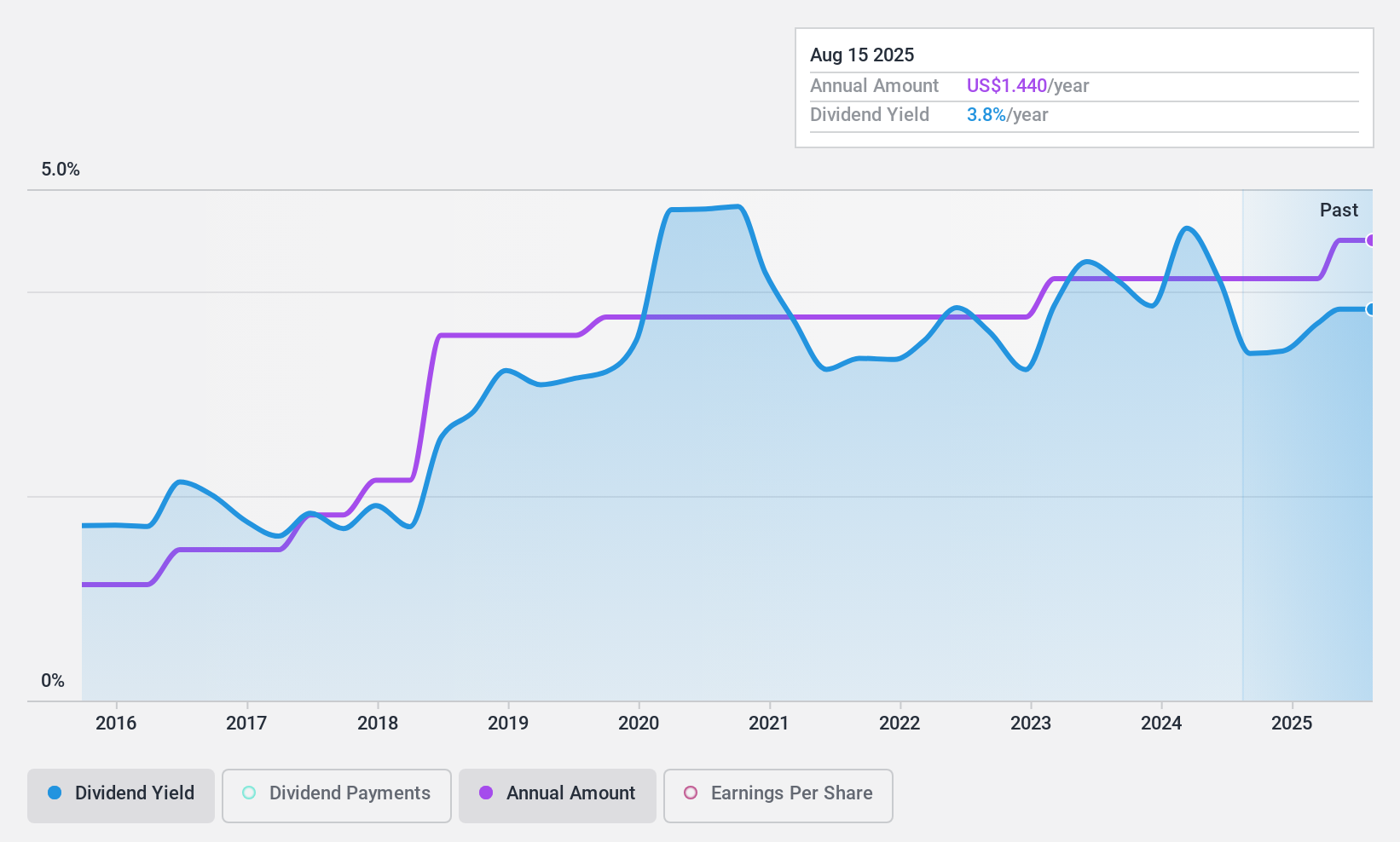

Dillard's (NYSE:DDS)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Dillard's, Inc. operates retail department stores across the southeastern, southwestern, and midwestern United States with a market cap of approximately $6.34 billion.

Operations: Dillard's generates revenue from its retail operations, amounting to $6.50 billion, and construction services, contributing $299.37 million.

Dividend Yield: 5.4%

Dillard's offers a robust dividend profile with a yield of 5.36%, placing it among the top 25% of US dividend payers. The dividends are well-covered by earnings and cash flows, with payout ratios at 2.5% and 63.9%, respectively, indicating sustainability. Despite recent revenue and net income declines, the company has maintained stable dividends over the past decade. Trading below estimated fair value enhances its attractiveness for value investors seeking reliable income streams.

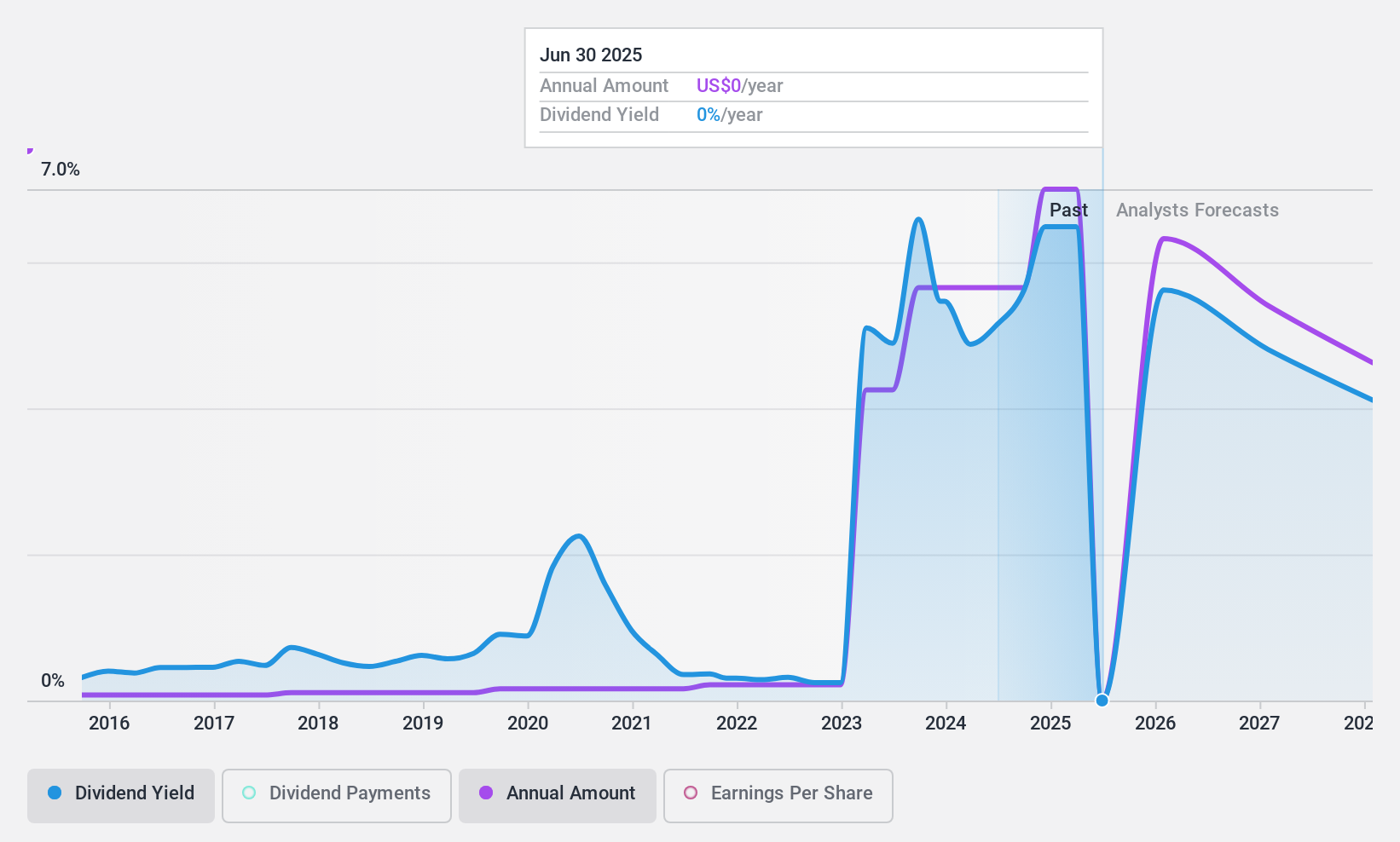

Webster Financial (NYSE:WBS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Webster Financial Corporation, with a market cap of $9.07 billion, operates as the bank holding company for Webster Bank, National Association, offering a variety of financial products and services to individuals, families, and businesses in the United States.

Operations: Webster Financial Corporation generates its revenue through diverse financial products and services tailored for individuals, families, and businesses across the United States.

Dividend Yield: 3%

Webster Financial provides a stable dividend profile with payments consistently increasing over the past decade. The dividends are well-covered by earnings, reflected in a low payout ratio of 36.2%, and are forecast to remain sustainable. Despite recent declines in net income, the company's dividend reliability remains intact. However, its yield of 3.02% is lower than the top US dividend payers, and significant insider selling has been noted recently.

Key Takeaways

- Click this link to deep-dive into the 167 companies within our Top US Dividend Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.