Please use a PC Browser to access Register-Tadawul

TPG Launches Third Wave Insurance As Earnings Mix Evolves

TPG Inc Class A TPG | 44.51 | -0.16% |

- TPG (NasdaqGS:TPG) has launched Third Wave Insurance, a new retail insurance brokerage platform.

- The business is led by industry veteran Brian Bair and formed in partnership with Palmer & Cay.

- The move extends TPG beyond its traditional alternative asset management roots into insurance distribution.

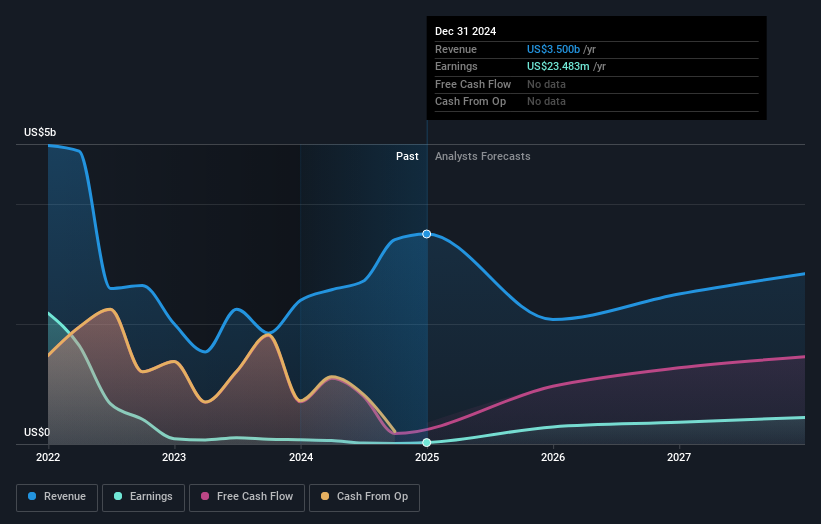

For investors watching TPG at a current share price of $53.54, this new insurance brokerage venture adds another business line alongside its existing funds platform. The stock has seen a 23.1% decline over the past 30 days and an 18.6% decline year to date, while its 3-year return sits at 86.6%. That mix of recent pressure and longer-term gains provides context as the firm broadens into retail insurance.

Third Wave Insurance, with Brian Bair at the helm and support from Palmer & Cay, may influence how TPG allocates capital and develops recurring revenue streams over time. For investors, a key consideration is how this new platform fits into TPG's overall risk profile, earnings mix, and exposure to the insurance sector.

Stay updated on the most important news stories for TPG by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on TPG.

TPG’s move into retail insurance brokerage with Third Wave Insurance gives it another fee-based business alongside its core alternative asset management franchise, putting it closer to diversified peers like Blackstone and KKR that already have meaningful insurance exposure. Partnering with Palmer & Cay provides immediate scale, existing client relationships, and an operating team, which may help Third Wave avoid a slow, purely organic build out.

How Third Wave fits into the TPG Narrative

This launch lines up with both bullish and bearish narratives around TPG, because it extends the firm beyond traditional private equity into another recurring revenue stream while also adding execution complexity. Bulls who focus on TPG’s expansion across asset classes can view insurance distribution as one more way to add long duration, fee based earnings, while more cautious investors may see it as another business where competition and regulation could weigh on profitability over time.

Risks and rewards from this move

- Entry into insurance distribution could broaden TPG’s earnings mix and reduce reliance on private equity and performance fees.

- The Palmer & Cay partnership gives Third Wave an existing footprint and brand, rather than starting from scratch in a crowded brokerage market.

- Scaling a new brokerage platform could require meaningful investment and management attention, with no guarantee it reaches material size relative to TPG’s overall business.

- Insurance brokerage carries its own regulatory and compliance demands, which may add to TPG’s overall risk and cost base.

What to watch next

From here, it is worth watching how quickly Third Wave adds additional partnerships, what management discloses about its financial contribution, and whether TPG links this platform more directly to its investment products over time. If you want to see how this kind of expansion fits into the broader story, check out the community narratives on TPG through our dedicated company page.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.