Please use a PC Browser to access Register-Tadawul

Tractor Supply Board Shake Up And Dividend Streak Test Earnings Resilience

Tractor Supply Company TSCO | 52.96 | +1.92% |

- Tractor Supply (NasdaqGS:TSCO) appointed Sonia Syngal to its Board of Directors, adding a leader with broad retail and operations experience.

- The Board approved the company’s 17th consecutive annual dividend increase, extending a long-running pattern of higher shareholder payouts.

For investors watching Tractor Supply, the twin updates on governance and capital returns stand out. The stock recently closed at $54.53, and longer term performance has been mixed, with a 21.3% return over 3 years and a 72.1% return over 5 years but a 2.7% decline over the past year. Those figures give context for how the business has rewarded patient holders over different time frames.

The appointment of Syngal brings additional boardroom experience in retail operations, supply chains and large scale execution. This may influence how Tractor Supply positions itself in the coming years. The continued pattern of dividend increases may appeal if you prioritize regular cash returns, although it is still important to consider your own risk profile, time horizon and how NasdaqGS:TSCO fits alongside your other holdings.

Stay updated on the most important news stories for Tractor Supply by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Tractor Supply.

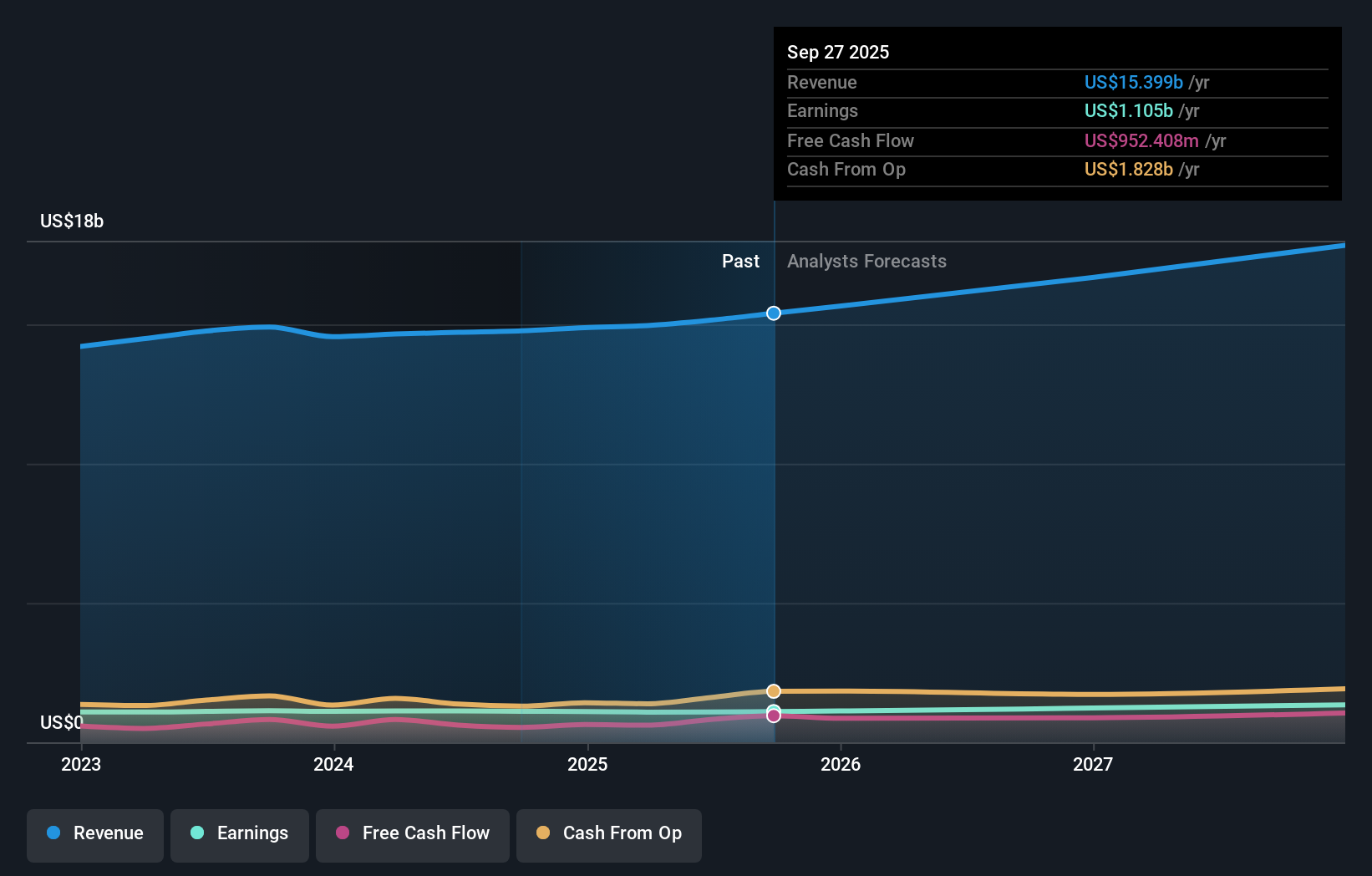

The 4.3% dividend increase to an annualized US$0.96 per share, alongside Tractor Supply’s ongoing share repurchases, points to a Board that is comfortable continuing cash returns even as recent earnings have been fairly flat. For 2025, sales moved to US$15,524.05m from US$14,883.23m, while net income was slightly lower at US$1,096.09m compared to US$1,101.24m. That backdrop suggests the higher dividend is being funded from a business that is still generating substantial profit, rather than rapid earnings growth. For you, the key questions are how the new payout level sits against Tractor Supply’s earnings and cash generation, and whether you are comfortable with a company that is prioritizing a long-running income stream through its 17 year track record of increases.

How This Fits Into The Tractor Supply Narrative

- The appointment of Sonia Syngal, with her background in e-commerce and supply chain at Gap and Old Navy, lines up with themes in the existing narrative around supply chain diversification and customer engagement initiatives.

- The slight pressure on net income in 2025, alongside continuing dividend increases and buybacks, may challenge assumptions that margins will easily improve if comparable sales stay under pressure.

- The Board’s decision to extend a 17 year dividend streak, and to keep returning cash through buybacks, is a strong capital allocation signal that is not fully captured in the narrative’s focus on store expansion and legal risks.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for Tractor Supply to help decide what it's worth to you.

The Risks and Rewards Investors Should Consider

- ⚠️ Earnings for 2025 were slightly lower at US$1,096.09m versus US$1,101.24m the year before, so a higher dividend puts more pressure on future cash flows if growth stays muted.

- ⚠️ Analysts have flagged 2 key risks, including concerns around comparable store sales and margin pressure, which could make a long-running dividend growth streak harder to maintain if conditions worsen.

- 🎁 The dividend has now been raised for 17 consecutive years, which can appeal if you value consistency in income and view a long history of increases as a sign of disciplined capital returns.

- 🎁 Tractor Supply continues to return cash through both dividends and buybacks, with over 72.9m shares repurchased since 2007, giving you multiple ways of participating in the company’s cash generation.

What To Watch Going Forward

From here, keep an eye on how Tractor Supply’s earnings and cash flows evolve relative to the higher dividend commitment and completed buyback program. The 2026 guidance points to net sales growth and a targeted net income range of US$1.11b to US$1.17b, so you may want to see whether actual results stay within that band and support ongoing dividend growth. It is also worth watching how Sonia Syngal’s supply chain and e-commerce experience is reflected in Tractor Supply’s merchandising, online offering and cost discipline, especially against other rural and farm focused retailers like Rural King and larger big box peers such as Home Depot and Lowe’s.

To ensure you're always in the loop on how the latest news impacts the investment narrative for Tractor Supply, head to the community page for Tractor Supply to never miss an update on the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.